For much of the AI cycle, Amazon (AMZN) has stayed quieter than its rivals, with Alexa mostly limited to smart speakers and home devices. Now, Amazon plans to expand Alexa onto the web through Alexa.com, rolling the service out to “tens of millions” of Early Access users. The move brings Alexa beyond devices and apps, giving users a browser-based way to ask questions and plan tasks.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

That update caught the attention of Wall Street.

Top BofA Securities analyst Justin Post reiterated a Buy rating on Amazon.com and maintained his $303 price target, pointing to the broader role Alexa could play inside Amazon’s ecosystem.

Post noted that Alexa.com brings Amazon’s assistant closer to the experience offered by popular AI tools such as ChatGPT and Google’s (GOOGL) Gemini. Still, he does not see Amazon trying to compete by offering a broad, general chatbot.

Instead, the analyst highlighted Amazon’s focus on practical, everyday use tied to the home. This includes managing smart home devices, adding items to Amazon Fresh or Whole Foods carts, and updating shared family to-do lists.

In Post’s view, this plays directly to Amazon’s strengths. Alexa is already linked to shopping habits, household devices, and customer accounts in ways other AI tools are not.

He also pointed out that many Alexa+ features rely on Amazon’s own services and data, giving the assistant functions that are harder for rivals to copy. By focusing on everyday tasks rather than flashy features, Post believes Alexa can see more regular use over time.

That belief underpins his positive outlook on Amazon and supports his continued Buy rating on the stock.

Is Amazon a Buy, Sell, or Hold?

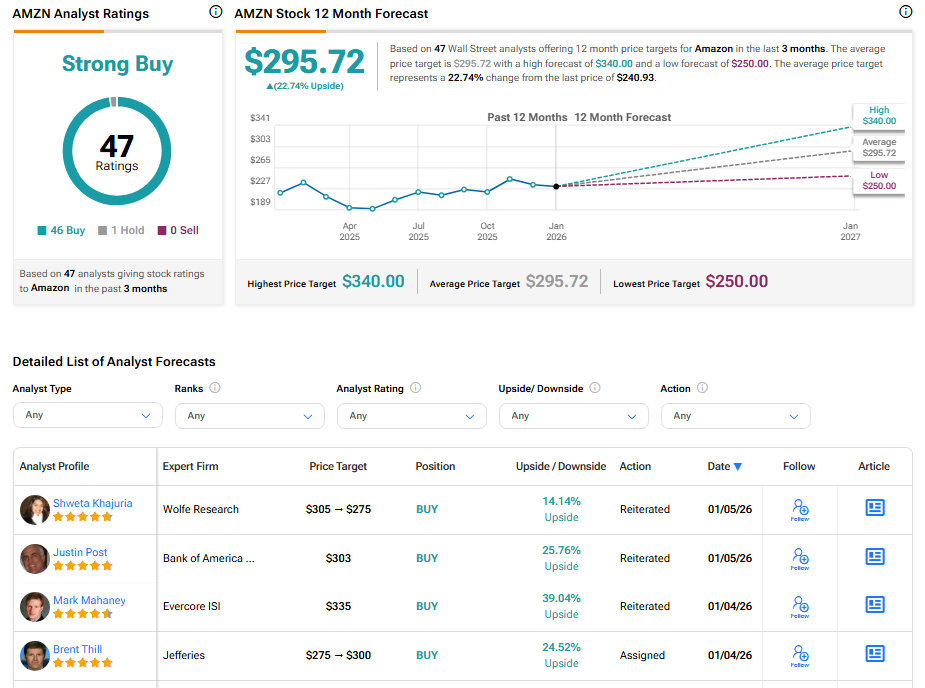

Turning to Wall Street, analysts have a Strong Buy consensus rating on AMZN stock based on 45 Buys and one Hold assigned in the past three months, as indicated by the graphic below. Furthermore, the average AMZN price target of $296.21 per share implies 27.6% upside potential.