Tesla (NASDAQ:TSLA) shares shot higher over the past week, sparked once again by Elon Musk’s magic touch in moving the stock with just a few words.

This time, Musk revealed that he plans to scale back his involvement with the White House and refocus his energy on leading the EV giant. Investors cheered the news, sending Tesla’s stock soaring ~26% in the days following its Q1 earnings call on April 22.

The skyward movement was somewhat ironic, considering the weak earnings numbers the company has reported. Slowing EV delivery figures shared in early April (down 13% year-over-year) gave way to disappointing financials, with automotive revenues dropping by ~20% and an EPS miss by 34%.

One top investor, known by the pseudonym Value Portfolio, believes the “atrocious” quarter is just the tip of the iceberg for TSLA, and is urging investors to stay far, far away.

“With a P/E ratio far exceeding competitors and no clear path to revenue in key areas, Tesla remains our top short pick for 2025,” explains the 5-star investor, who is among the top 2% of TipRanks’ stock pros.

Value Portfolio also pushed back on hopes that Tesla’s growth in energy and services could offset its shrinking automotive business, arguing that both divisions are still too small to meaningfully move the needle.

And then there’s the biggest dream of all: Tesla’s robotaxi ambitions. Here, too, Value Portfolio delivered a reality check, noting that despite all the hype, Tesla “has yet to make a penny” from its self-driving tech. Meanwhile, Waymo has been earning income off of its robotaxi service for over a year.

Adding insult to injury, the anti-Musk sentiment continues to grow, with boycotts a real possibility. Value Portfolio posits that this anger might not even be fully reflected in the Q1 numbers – as Trump only took office a few weeks into the new year. In other words, more Musk-inspired losses could be on the horizon.

In the face of this gloomy financial picture, the investor argues that the company’s P/E multiple of 400x is simply not reasonable. As a reference, Value Portfolio points out that other automobile competitors such as Ford, Toyota, and GM trade at single-digit valuations.

“We don’t see the pain as being over, with a boycott combined with a tough overall economy and the company’s stock starting in an overvalued position,” concludes Value Portfolio, who rates TSLA a Sell. (To watch The Value Portfolio’s track record, click here)

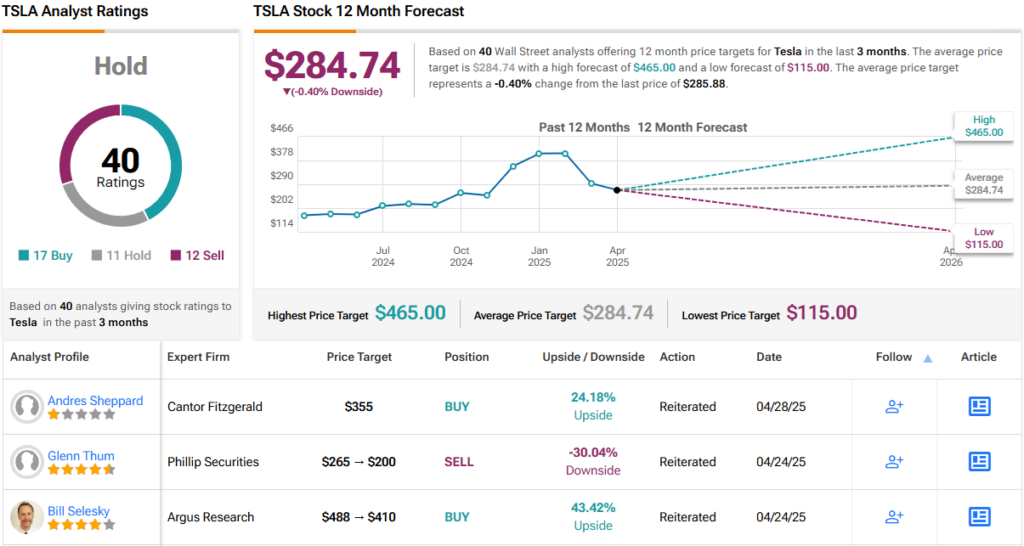

Wall Street is not quite as sour as Value Portfolio, but not exactly brimming with optimism either. With 17 Buy, 11 Hold, and 12 Sell recommendations, TSLA holds a consensus Hold (i.e., Neutral) rating. Its 12-month average price target of $284.74 implies almost no movement in the year ahead. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.