A Director of Freeport-McMoRan Inc. (NYSE:FCX), Ryan M. Lance, has bought the company’s shares worth $988,314.10. According to an SEC filing, the director bought 31,000 shares of the mining company in the range of $31.84-$31.91 per share on August 29.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

FCX stock declined 5.5% in yesterday’s trading session to close at $29.76. Due to this, the total value of the Director’s aforementioned Freeport-McMoRan holdings fell more than 6.5% based on his purchase price.

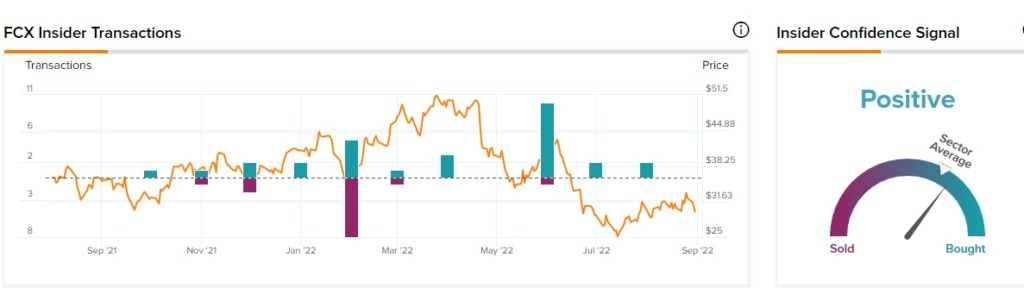

According to TipRanks, which provides a comprehensive list of daily insider transactions, various corporate insiders have bought and sold FCX stock in the last three months.

Insider Confidence Signal is Positive on FCX Stock

TipRanks’ Insider Trading Activity tool shows that insiders are currently bullish on FCX stock, as corporate insiders have bought FCX stock worth $1.1 million in the last three months.

Interestingly, TipRanks also provides a list of hot stocks that boasts of either a Very Positive or Positive insider confidence signal.

Is FCX Stock a Buy?

Freeport-McMoRan stock seems to be a decent investment option. FCX stock scores an eight out of 10 on TipRanks, which implies that it has strong potential to outperform the market.

Further, financial bloggers and retail investors look positively inclined toward the stock. While financial bloggers are 83% Bullish on FCX stock against the sector average of 76%, retail investors have increased their holdings in FCX stock by 2% in the last 30 days.

Contrary to bloggers and retail investors, analysts on TipRanks are cautiously optimistic about FCX stock, which carries a Moderate Buy consensus rating based on seven Buys, six Holds, and one Sell.

Key Takeaways for FCX Investors

As of now, corporate insiders are seen taking advantage of the company’s weak stock price, which has fallen 27.4% so far this year. It could be the right time to gain exposure to the company. This is because Freeport-McMoRan’s average price forecast of $37 implies 24.3% upside potential to current levels.

Read full Disclosure