Bank of America warned that a recent U.S. court ruling creates new risks for Apple’s (AAPL) highly profitable App Store business. Indeed, Judge Yvonne Gonzalez Rogers ruled that Apple broke a previous order that required more competition in how apps are downloaded and paid for. The case will now be referred to federal prosecutors. Interestingly, though, even with this negative news, five-star analyst Wamsi Mohan kept his Buy rating on Apple due to the company’s strong earnings and potential to expand into new markets over time. Still, the firm said that this ruling brings important new risks.

The analysts explained that the decision could let developers direct customers to other app stores or payment options, where Apple would no longer earn a commission. Although this only affects the U.S. for now, BofA noted that if the same rule applies globally in the future, the impact could be much bigger. Indeed, according to SensorTower data, the App Store brings in about $31 billion in yearly revenue. Of that, 35% comes from the U.S., 9% from the EU, 24% from China, and 32% from the rest of the world. Therefore, losing commissions to sales outside of the App Store could have a major effect on Apple’s profits.

In fact, Mohan’s team estimated that for every $1 billion in U.S. App Store revenue lost, Apple’s earnings per share (EPS) would fall by about $0.05. If half of the large developers stop using the App Store, it could mean a $5 billion hit to revenue and a $0.25 hit to EPS, or about 3%. On a global scale, the revenue loss could reach $16 billion, and EPS could drop by $0.80, or 10%. However, the analysts noted that these are aggressive estimates and the outcome could still change, since Apple plans to appeal the ruling. Nevertheless, for now, Apple said it will comply with the court order while continuing the legal process.

Is Apple a Buy or Sell Right Now?

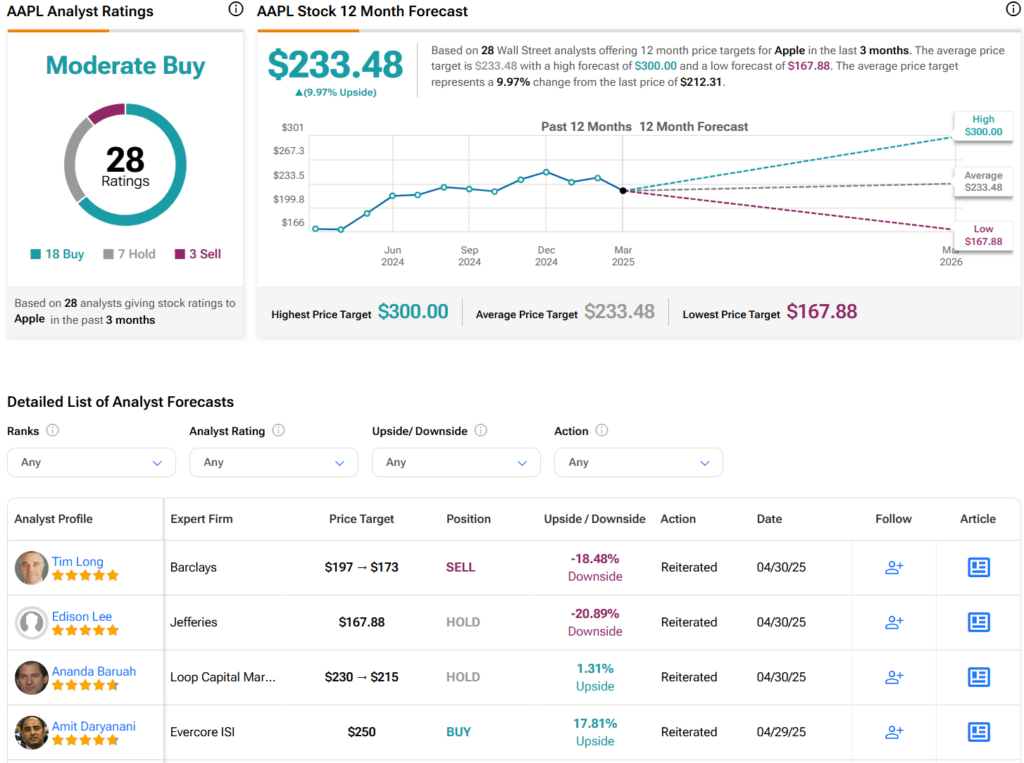

Overall, analysts have a Moderate Buy consensus rating on AAPL stock based on 18 Buys, seven Holds, and three Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average AAPL price target of $233.48 per share implies 10% upside potential.