In the fall of 2022, Third Harmonic Bio (NASDAQ:THRD) raised $180 million through a successful IPO for the clinical development of an inflammation drug. Despite setbacks, including discontinuing initial trials, the company has rebounded with a modified treatment, resulting in a stock surge of over 100% in the past year. This presents an intriguing opportunity for growth investors willing to speculate on an early-stage development opportunity.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Promising Pipeline Candidate

Third Harmonic Bio is a clinical-stage biopharmaceutical company that primarily focuses on developing treatments for allergic and inflammatory diseases. The company’s leading treatment candidate is THB335, an oral small-molecule inhibitor of KIT, which is the primary controller of mast cell function and survival.

The market opportunity for this treatment is vast. One potential use is treating Chronic Spontaneous Urticaria, the market for which is projected to reach approximately $7.5b by 2032, expanding at a CAGR of 14.96%.

Financial Outlook

For Q4 2023, the company reported a net loss of $6.8 million, a notable reduction from the net loss of $11.5 million reported in the same period of 2022. This trend is also reflected in the year-end figures, with net loss for FY2023 reported at $30.8 million, compared to the previous year’s $35.2 million. There was also a considerable decrease in the FY23 earnings per share (EPS), which dropped to -$0.78 from -$2.45.

Third Harmonic Bio reported substantial cash and cash equivalents of $269.1 million as of the end of 2023. Based on the current operating plan, the company’s existing funds are projected to cover operating expenses and capital expenditure requirements up to 2026.

Despite the net loss, the financial momentum indicates a solid footing for the company. Being a biotech startup means facing years of unprofitability before a significant breakthrough. The company’s cash runway implies that it has the financial endurance to navigate the often lengthy and costly drug discovery and development processes for the foreseeable future.

Is THRD a Buy, Hold, or Sell?

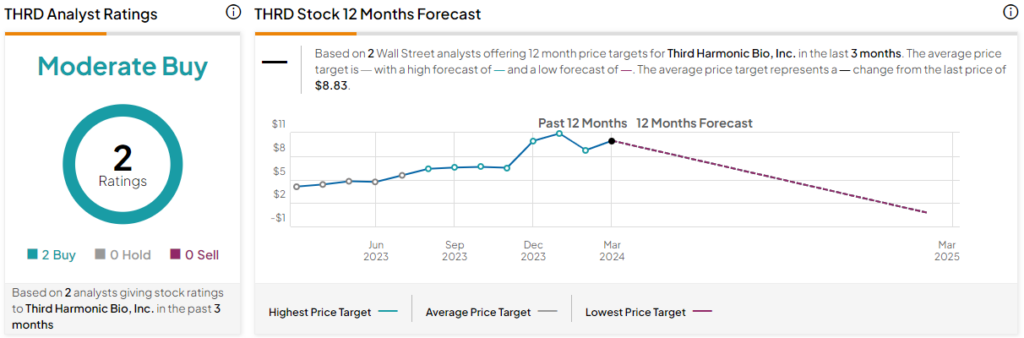

The Third Harmonic Bio stock had been trending up for most of the past year, but it has cooled recently. The stock can demonstrate quite a bit of volatility, so this type of ride is to be expected.

The company is thinly followed by Wall Street, though the analysts who do are bullish on its prospects. For instance, LifeSci Capital analyst Sam Slutsky recently reaffirmed his Buy rating on the stock, citing the company’s continuing progress in its drug development pipeline and the vast market potential of its current treatment candidate.

The THRD stock is rated a Moderate Buy based on the ratings of two analysts in the last three months.

Final Thoughts on THRD

Third Harmonic Bio is an intriguing early-stage player in the biopharmaceutical landscape. Having dusted off the disappointment of its initial Phase 1 trial failure, the company has bounced back with a potentially game-changing treatment for allergic and inflammatory diseases. Growth investors willing to speculate on a promising biotech stock may want to get in early before news of potential early success from clinical trials catalyzes the stock higher.