Social media giant Meta Platforms (META) is looking at new ways to grow its business and stay competitive in the AI space. Indeed, the company is introducing new tools that could boost its revenue. However, it’s also facing real risks that could slow it down. For investors, the direction of the stock will depend on how well Meta can deliver on its AI plans while managing the challenges that come with them.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Catalysts That May Push the Stock Higher

To begin with, the firm is starting to use AI in new ways. Starting December 16, Meta will use the conversations from its AI chatbot to help personalize ads and content across its platforms. This means that users might see ads that match their interests better, which could make advertising more effective and increase revenue for Meta. Interestingly, the company said it will avoid using sensitive topics—like health or political opinions—in this process, but this new layer of data could still make a big difference in ad performance.

Separately, Meta is also expanding to third-party websites. In fact, it recently launched Business AI, a tool that lets other websites use Meta’s AI assistant to chat with their visitors. This creates a new opportunity for Meta to make money outside of its traditional ad business. If businesses find this tool helpful for customer support or sales, it could lead to a new revenue stream.

In addition, in order to make sure it has enough computing power to handle these AI tools, Meta signed a $14.2 billion deal with cloud provider CoreWeave (CRWV). This agreement, which runs through 2031, will help make sure Meta has access to powerful infrastructure to support its AI goals. As a result of these moves, Meta now has multiple ways to grow its sales over the long term.

Risks to Watch Out For

Despite these opportunities, Meta’s plans aren’t without risks. For instance, using AI chatbot conversations to personalize ads could raise privacy concerns, even though Meta says it will avoid sensitive data. If users or regulators push back, it might limit how far Meta can go with this strategy. Furthermore, the deal with CoreWeave is a major financial commitment. If costs rise or if Meta can’t make enough money from its AI efforts, the investment might not pay off.

Also, entering the third-party AI assistant market puts Meta in competition with other big players. If businesses don’t adopt Meta’s tool or prefer other options, this new line of business could underperform. Finally, if excitement around AI cools off and Meta’s results fall short, the stock could lose momentum and trade at a lower multiple.

Is Meta a Buy, Sell, or Hold?

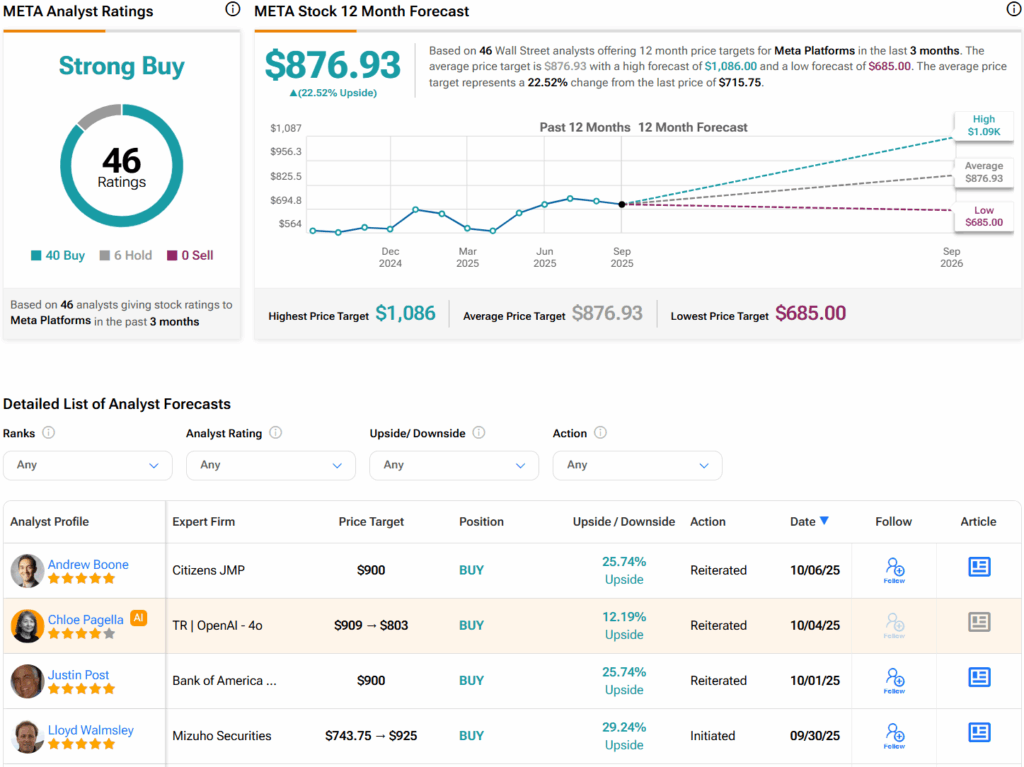

Turning to Wall Street, analysts have a Strong Buy consensus rating on META stock based on 40 Buys, six Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average META price target of $876.93 per share implies 22.5% upside potential.

.