Labor market softness, lingering inflation uncertainty, and growing political pressure could push the Federal Reserve to cut interest rates more aggressively in early 2026, according to Mark Zandi, chief economist at Moody’s Analytics (MCO). While financial markets and Fed officials currently expect only limited easing, Zandi believes that the central bank will move faster with three quarter-point rate cuts before the middle of the year.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

He argues that hiring remains weak and businesses are still hesitant due to changing trade and immigration policies, which is slowing job growth and allowing unemployment to creep higher. It’s worth noting that Zandi’s outlook is notably more aggressive than current expectations. For reference, market pricing, as tracked by the CME (CME) FedWatch tool, points to just two rate cuts in 2026, with the first likely no earlier than April and the second closer to September. Fed policymakers are even more cautious and have signaled only one cut for the entire year in their most recent projections released in December.

However, where Zandi differs most is on politics. He believes that pressure from President Donald Trump, a vocal supporter of lower interest rates, will increasingly influence the Fed’s direction. Trump has already appointed several Fed governors and is positioned to make more changes as leadership terms expire, including Jerome Powell’s role as chair in May. Zandi argues that as midterm elections approach, political pressure to support economic growth will become more intense and reduce Fed independence.

Is SPY Stock a Good Buy?

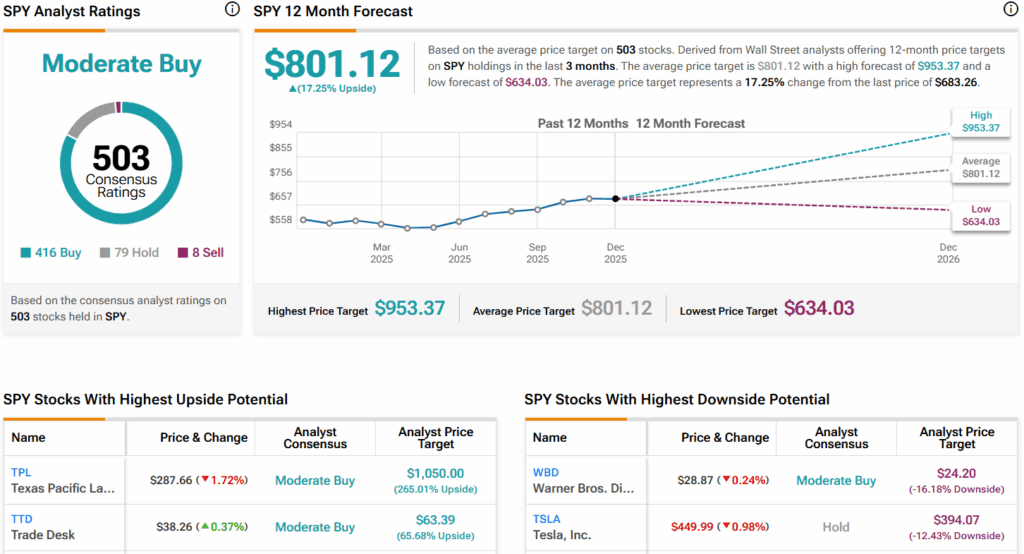

Turning to Wall Street, analysts have a Moderate Buy consensus rating on the SPDR S&P 500 ETF Trust (SPY) based on 416 Buys, 79 Holds, and eight Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average SPY price target of $801.12 per share implies 17.3% upside potential.