Stocks Hold Steady as Metals Surge and an AI Deal Lifts Semis

U.S. markets ended the holiday week mostly unchanged after touching new highs. A broad rally in metals, strength in AI-related chipmakers, and steady economic data helped keep sentiment upbeat. The S&P 500 (SPX) dipped 0.03% to 6,929, the Nasdaq 100 (NDX) lost 0.09%, and the Dow Jones Industrial Average (DJIA) slid 0.04%. However, the S&P 500 posted its 39th record close of the year in the prior session, though it broke a five-day winning streak this week.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

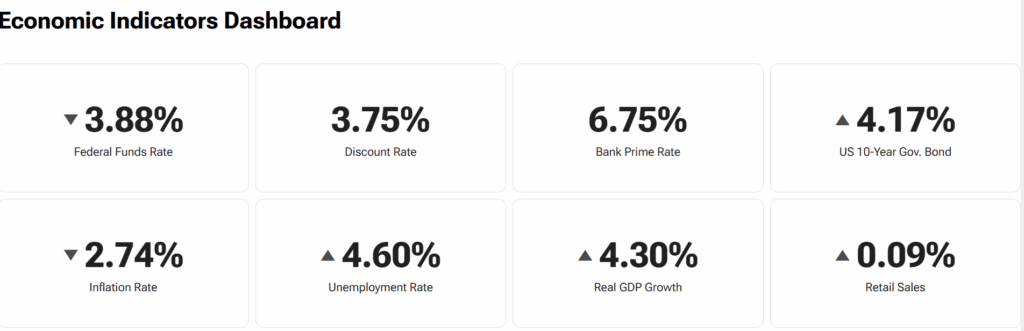

The 10-year Treasury yield rose slightly to 4.17%, while the Federal Funds Rate slipped to 3.88%. Inflation ticked lower to 2.74%, and real GDP growth was last reported at 4.3%. Oil dropped 2.4% to $57.06 per barrel, but gold and silver surged to new records.

Precious Metals Break Out, Commodity Stocks Follow

Metals were the big story this week. Gold (XAUUSD) rose 1.3% to $4,536, and silver (XAGUSD) jumped over 11% to $79.45, both reaching new all-time highs. Copper gained 5%, helped by global supply risks and industrial demand. The move sparked gains in metal producers, including Freeport-McMoRan (FCX) and Southern Copper (SCCO).

Traders pointed to lower rates, a weaker dollar, and rising geopolitical tension as reasons behind the gold rally. Investors also looked for safety amid thin holiday trading and signs that mining supply remains tight heading into 2026.

AI Chips Get a Boost as Nvidia Licenses Groq

AI stocks got fresh attention after Nvidia (NVDA) signed a major licensing agreement with AI chip startup Groq. The deal gives Nvidia access to Groq’s low-latency inference chips and brings key Groq executives into the company. Groq’s chips are optimized for language models and offer faster processing with lower power use compared to traditional GPUs.

The companies did not confirm an acquisition, which may help avoid antitrust scrutiny. However, analysts widely see it as a major acqui-hire. Nvidia plans to add the Groq technology into its AI factory architecture to extend its leadership in inference workloads.

The move came as memory stocks also stayed in focus. Micron Technology (MU) remains near its highs after reports from South Korea showed its competitors are raising prices on high-bandwidth memory chips. Wedbush said server and memory demand are both tracking ahead of seasonal trends.

The Week Ahead

Markets will close out 2025 with light volume and a close watch on catalysts. Eyes will be on follow-up moves from the Nvidia–Groq agreement, possible updates around drug pricing deals, and signals from Fed speakers around early 2026 rate guidance.

Commodities could stay in focus as metals and miners attract new flows, while AI chipmakers and hyperscaler capex trends remain a key driver of sentiment into the new year.

Analysts see potential for a Santa Claus rally to push markets higher into year-end, though gains may depend on data and headlines. Many investors are looking for a positive setup in January, with macro conditions turning more supportive and earnings season just around the corner.

Upcoming Earnings and Dividend Announcements

The calendar remains quiet this week, with a handful of small- and mid-cap earnings due and light dividend activity as markets wrap up the year and move into January.

Earnings Preview

On Wednesday, December 30, AMTD IDEA Group (AMTD) is set to report, though forecasts for earnings per share and revenue have not been issued.

Ex-Dividend Dates This Week

A few notable mega-cap companies will trade ex-dividend this week, starting Monday, December 29:

- Micron Technology (MU) will pay $0.12 in 17 days, with a 0.16% yield and a Smart Score of 9

- GE Aerospace (GE) will return $0.36 in 29 days, yielding 0.43% with a Smart Score of 10

- American Tower (AMT) will distribute $1.70 next month

- Xcel Energy (XEL) is set to pay $0.57 in 23 days, with a 3.03% yield and a perfect Smart Score of 10

On Tuesday, December 30, watch for:

- British American Tobacco (BTI) with a $0.74 dividend and a 5.20% yield

- Franklin Resources (BEN) will pay $0.33 in 12 days with a 5.29% yield

- Telefonica Brasil (VIV) and Zimmer Biomet Holdings (ZBH) also go ex-dividend, though yields remain under 5%

By Wednesday, December 31, several more high-yield names come into focus:

- Realty Income (O) will pay $0.27 in 18 days, yielding 5.67%

- AGNC Investment (AGNC) will return $0.12 in 15 days with a 13.27% yield

- Annaly Capital (NLY) will pay $0.70 next month, yielding 11.88%

- Deere (DE) and Mondelez International (MDLZ) will also distribute in January

And on Thursday, January 2, key names include: