U.S. markets opened the new year with modest gains as investors balanced steady economic data against higher bond yields and mixed performance in technology stocks. The Dow Jones Industrial Average (DJIA) rose 0.66% to 48,382, supported by industrial and financial shares. The S&P 500 (SPX) added 0.19% to 6,858, while the Nasdaq 100 (NDX) slipped 0.17% as several large technology names paused after a strong 2025.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

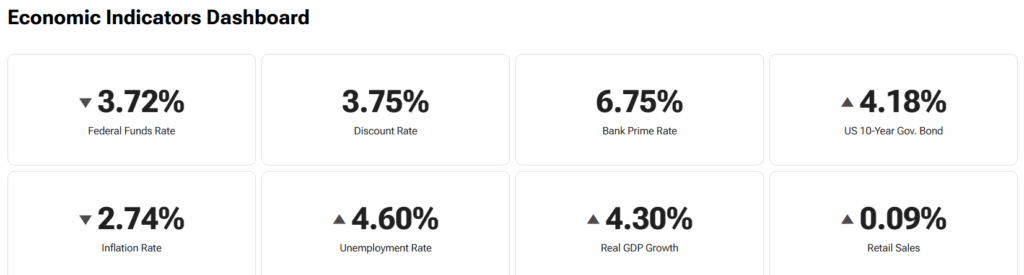

At the same time, the 10-year Treasury yield climbed to about 4.20%, reflecting expectations that interest rates may stay elevated into early 2026. The Federal Funds Rate stood near 3.7%, while inflation was last reported at 2.74%. Real GDP growth remained firm at roughly 4.3%, though markets continue to price in slower momentum ahead. Oil (CL) rose to $57.29 per barrel, gold (XAUUSD) eased to $4,332, and Bitcoin (BTC) traded near $91,000 as risk appetite stayed balanced.

Tesla Deliveries Miss as Demand Shifts

After the market recap, focus turned to Tesla (TSLA), which reported weaker fourth-quarter deliveries. Tesla delivered about 418,000 vehicles during the quarter, down roughly 16% from a year earlier and marking a second straight annual decline. The slowdown followed a strong third quarter, when many buyers rushed to purchase vehicles before a $7,500 U.S. tax credit expired on October 1.

Tesla does not report sales by region, though company filings show the U.S. accounts for close to half of revenue. As a result, softer domestic demand had a meaningful impact on results. Competition also intensified throughout 2025, with pressure from BYD (BYDDF) and traditional automakers, while overall EV growth cooled. In response, Tesla introduced lower-priced versions of the Model 3 and Model Y, though those models offer shorter range and fewer features.

Even so, Tesla shares rose modestly in early trading and finished 2025 up about 18.6%. Investors continue to focus on longer-term initiatives tied to AI, robotaxis, and humanoid robots, despite Tesla’s robotaxi service remaining limited to Austin and San Francisco. Meanwhile, investor Michael Burry said this week that while he still views Tesla as overvalued, he is not currently short the stock.

The Week Ahead

Looking ahead, investors will turn their attention to early January data releases and fresh guidance from economists and company executives. Markets will watch for updates on inflation trends, labor conditions, and interest rate expectations as 2026 begins. Comments from Federal Reserve officials could shape near term sentiment, especially with bond yields near recent highs.

In addition, earnings season will begin to come into focus, with investors looking for confirmation that corporate profits can hold up amid slower growth and higher borrowing costs. AI-related spending trends, memory demand, and capital investment plans remain key areas of interest.

Upcoming Earnings and Dividend Announcements

The calendar becomes more active in the first full week of January, with several well known companies set to report earnings and a steady lineup of ex dividend dates across financials, technology, and defensive sectors.

Earnings Preview

On Wednesday, January 7, earnings are expected from Applied Digital Corporation (APLD), Albertsons Companies Inc. (ACI), Cal Maine Foods Inc. (CALM), and Jefferies Financial Group (JEF). Investors will be watching for updates on consumer spending, food costs, and capital markets activity as the new year begins.

On Thursday, January 8, Constellation Brands Inc. (STZ) is scheduled to report alongside TD SYNNEX Corporation (SNX), RPM International Inc. (RPM), Acuity Brands Inc. (AYI), and Seven and I Holdings Co. (SVNDY). These results should offer insight into enterprise demand, industrial trends, and global consumer activity early in 2026.

Ex Dividend Dates This Week

Several large companies will trade ex dividend starting Monday.

Monday, January 5:

GE Vernova Inc. (GEV) is set to pay $0.50 in 29 days, while HEICO Corporation (HEI) will distribute $0.12 in 16 days. Itaú Unibanco Holding SA (ITUB) also goes ex dividend, though the payout remains minimal, and Globe Life Inc. (GL) will pay $0.27 in 26 days.

Tuesday, January 6:

The list expands to include JPMorgan Chase (JPM), which will pay $1.50 in 27 days, and Dollar General Corporation (DG), set to distribute $0.59 in 16 days. Agilent Technologies Inc. (A), Bank of Nova Scotia (BNS), Banco Bradesco SA (BBD), and The New York Times Company (NYT) also trade ex dividend.

Wednesday, January 7:

Edison International (EIX) stands out with a $0.88 payment due in 27 days. AECOM (ACM) and PT Bank Mandiri Persero Tbk (PPERY) also go ex dividend, with the latter offering a higher yield but a lower Smart Score.

Thursday, January 8:

Experian plc (EXPGF) is scheduled to trade ex dividend, with a $0.21 payment expected next month.

Friday, January 9:

Several mega-cap names come into focus. Oracle Corporation (ORCL) will pay $0.50 in 19 days, Mastercard Incorporated (MA) is set to distribute $0.87 next month, and Marvell Technology Inc. (MRVL) will return $0.06 in 25 days. Intuit Inc. (INTU), General Mills Inc. (GIS), and Toronto Dominion Bank (TD) also round out the week with regular dividend payments.