U.S. stocks ended the week higher as investors balanced softer hiring data with new government support for housing and stronger momentum in energy and AI-linked sectors. The Dow Jones Industrial Average (DJIA) rose 0.48% to 49,504, the S&P 500 (SPX) gained 0.65% to 6,966, and the Nasdaq (NDX) climbed 0.82%.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

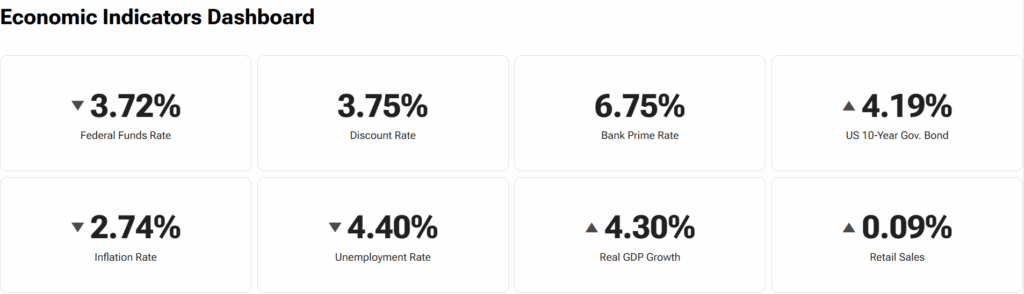

The December jobs report showed that the U.S. economy added only 50,000 jobs while unemployment eased to 4.4%. The slower hiring pace reinforced expectations that the Federal Reserve will keep rates steady later this month. The 10-year Treasury yield ended at 4.17%, and traders continued to expect a possible rate cut later in 2026 if inflation holds near target.

Oil prices (CL) firmed to about $58.81 per barrel, while gold (XAUUSD) slipped 0.38% to $4,516.50. Bitcoin stayed near $90,000 as risk appetite held up.

AI Power Deals and Energy Moves

Meta Platforms (META) reached long-term power agreements with Vistra (VST) and Oklo (OKLO) to secure clean energy for its growing AI data centers. The plan includes building nuclear-powered facilities that could deliver up to 6.6 gigawatts of electricity by 2035. Shares of both energy companies rallied after the announcement. The deal also boosted confidence in small nuclear reactor developers and uranium producers, as investors viewed it as a sign that Big Tech is becoming a key player in clean energy projects.

Meanwhile, Chevron (CVX) gained after analysts at TD Cowen said the company could add between $400 million and $700 million in annual cash flow from higher production in Venezuela. The company’s joint ventures in the country are expected to drive small but steady growth as policy conditions improve. Exxon Mobil (XOM) also advanced on optimism that U.S. producers could regain access to Venezuela’s oil sector under new security guarantees.

Housing Push and Policy Headlines

In other news, President Trump directed Fannie Mae (FNMA) and Freddie Mac (FMCC) to buy $200 billion in mortgage bonds, which helped lower the average 30-year mortgage rate to about 5.99%. The move lifted shares of homebuilders and mortgage lenders such as Rocket Companies (RKT), Lennar (LEN), and D.R. Horton (DHI). Investors welcomed the plan as a sign of broader support for housing affordability.

At the same time, the White House proposed limits on large institutional buyers of single-family homes, sending shares of Blackstone (BX) and Invitation Homes (INVH) lower. The plan aims to free up inventory for individual buyers but raises concerns about government intervention in the housing market.

Tech Scrutiny and Defense Pressure

Elon Musk’s company xAI, which owns the AI chatbot Grok, faced new criticism from U.K. and European regulators after reports of nonconsensual and sexualized images created by users. X restricted Grok’s image generation tool for unpaid users but kept its stand-alone app available. The incident renewed debate about the risks of AI-generated content and platform accountability.

In defense, Raytheon parent RTX (RTX) fell after President Trump warned that contracts could be cut if output does not improve. The president also proposed a $1.5 trillion defense budget for fiscal year 2027. The comments came as the Pentagon pushed for faster delivery of critical systems and tighter oversight of corporate buybacks.

The Week Ahead

Investors will focus on inflation data, retail sales, and new corporate guidance as earnings season approaches. Market attention will also turn to early fourth-quarter results from major banks and technology firms. Traders are looking for signs that corporate profits can hold steady while borrowing costs remain elevated.

So far, steady demand, government spending, and AI-driven investment have helped offset slower hiring and cautious business sentiment. The week ahead should offer new clues about whether that balance can last through the first quarter of 2026.

Upcoming Earnings and Dividend Announcements

The second week of January brings a packed earnings calendar led by major banks and large-cap technology names. Financial stocks will take the spotlight as investors look for early clues on credit trends, consumer spending, and investment activity to start the year.

Earnings Preview

On Monday, January 13, reports are due from JPMorgan Chase (JPM), Delta Air Lines (DAL), and Bank of New York Mellon (BK). Analysts expect earnings per share of about $4.88, $1.53, and $1.91, respectively, with revenue near $46.17 billion for JPMorgan, $14.68 billion for Delta, and $5.14 billion for Bank of New York Mellon. The results will offer a first look at banking and travel demand as the year begins.

On Tuesday, January 14, Bank of America (BAC), Citigroup (C), Wells Fargo (WFC), and Infosys (INFY) are set to report. Forecasts call for $0.96 per share for Bank of America, $1.67 for Citigroup, $1.66 for Wells Fargo, and $0.20 for Infosys. Investors will be watching how higher funding costs and global IT spending shaped the final quarter of 2025.

On Wednesday, January 15, the focus shifts to both finance and technology, with results due from Taiwan Semiconductor Manufacturing Company (TSM), Goldman Sachs Group (GS), BlackRock (BLK), Morgan Stanley (MS), JB Hunt (JBHT), and First Horizon (FHN). Wall Street expects earnings of $2.85 per share for TSMC on $32.74 billion in revenue, $11.64 for Goldman Sachs, $12.30 for BlackRock, and $2.42 for Morgan Stanley. The updates should shed light on semiconductor demand, capital markets, and early freight volumes.

On Thursday, January 16, financial firms will stay in focus, including PNC Financial (PNC), Regions Financial (RF), State Street (STT), M&T Bank (MTB), and Wipro ($WIT). Consensus forecasts see earnings of $4.20, $0.61, $2.79, $4.47, and $0.04 per share, respectively. The group’s commentary will help gauge deposit flows, lending margins, and institutional activity.

Finally, on Friday, January 17, India’s two largest banks, HDFC Bank (HDB) and ICICI Bank (IBN), will report. Analysts expect $0.40 per share for HDFC and $0.39 for ICICI, with revenue of $5.10 billion and $3.34 billion, respectively. Their results will close the week’s earnings round and offer a perspective on growth across emerging markets.

Ex-Dividend Dates This Week

Several large companies will trade ex-dividend starting Monday.

Monday, January 12:

AT&T (T) will pay $0.28 in 22 days, while Verizon (VZ) plans a $0.69 distribution on the same date. Hormel Foods (HRL) goes ex-dividend at $0.29 next month, and real estate group UDR (UDR) will pay $0.43 in 22 days. Luxury retailer Kering (PPRUY) offers $0.08 in 19 days.

Tuesday, January 13:

Accenture (ACN) trades ex-dividend at $1.63 with a payment next month. Quest Diagnostics (DGX) follows with $0.80 in 17 days. GFL Environmental (GFL) offers $0.02 in 19 days, and Repsol (REPYY) pays $0.46 in 10 days. Iberdrola (IBDRY) and Cellnex Telecom (CLNXF) also go ex this day, with payouts of $1.03 and $0.43, respectively.

Wednesday, January 14:

Comcast (CMCSA) will distribute $0.33 in 24 days. EMCOR Group (EME) offers $0.40 in 19 days, and China Merchants Bank (CIHHF) plans a $0.14 payout in 29 days.

Thursday, January 15:

Abbott Laboratories (ABT) trades ex-dividend at $0.63 with a payment next month. Freeport-McMoRan (FCX) pays $0.15 in 22 days, while Mid-America Apartment (MAA) offers $1.53 in 19 days. American Financial Group (AFG) will distribute $0.88 in 16 days, and Fairfax Financial (FRFHF) pays $15.00 in 11 days. Amadeus IT Group (AMADY), China Merchants Bank (CIHKY), and China Everbright Bank (CEBCF) also go ex dividend with payouts of $0.62, $0.58, and $0.02, respectively.

Friday, January 16:

AbbVie (ABBV) trades ex-dividend at $1.73 with a payment next month. General Dynamics (GD) follows at $1.50 in 26 days, and EOG Resources (EOG) pays $1.02 in 19 days. Healthpeak Properties (DOC) offers $0.10 in 19 days, and Williams-Sonoma (WSM) plans $0.66 next month. Ryanair Holdings (RYAAY) will distribute $0.32 in two months. TD SYNNEX (SNX) and RPM International (RPM) also trade ex dividend at $0.48 and $0.54, respectively, while Revvity (RVTY) pays $0.07 in 26 days and Watsco (WSO) offers $3.00 in 19 days.