How is SMH ETF faring? The VanEck Semiconductor ETF has earned about 1.7% over the past five days and nearly 55% over the past year.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Fund Flows and Sentiment

The SMH ETF tracks the performance of the MVIS US Listed Semiconductor 25 index. Recently, it has drawn considerable attention due to high-profile deals being conducted in the AI sector.

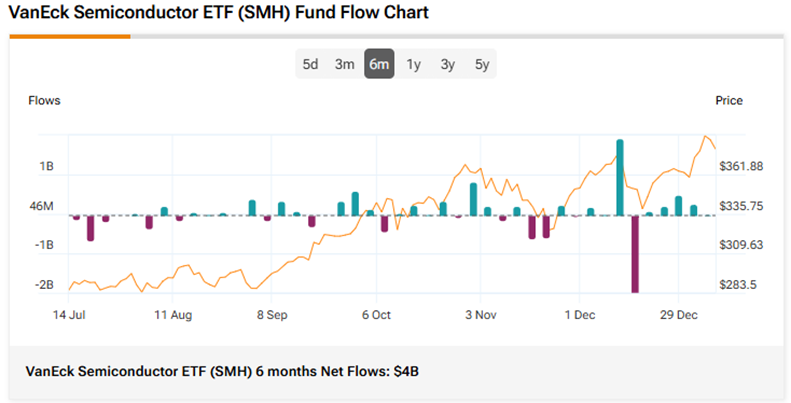

During the last week, the SMH ETF witnessed net inflows of $39 million, while it has reported net inflows of about $4 billion over the past six months.

Today’s SMH ETF Performance

According to TipRanks’ unique ETF analyst consensus, which is based on a weighted average of analyst ratings on its holdings, SMH is a Strong Buy. The Street’s average price target of $431.13 implies an upside of nearly 11%.

Currently, SMH’s five holdings with the highest upside potential are:

- Marvell Technology (MRVL)

- Nvidia (NVDA)

- Advanced Micro Devices (AMD)

- Universal Display (OLED)

- Skyworks Solutions (SWKS)

Meanwhile, SMH’s top holdings with the highest downside potential are:

Revealingly, SMH’s ETF Smart Score is Eight, implying that this ETF is likely to outperform market expectations.

Power up your ETF investing with TipRanks. Discover the Best AI ETFs, carefully curated based on TipRanks’ analysis.