Shares of The TJX Companies (NYSE:TJX) are trending lower today after a tepid outlook for the fourth quarter overshadowed the off-price retailer’s better-than-anticipated third-quarter results. During the quarter, revenue increased by 9.3% year-over-year to $13.3 billion. This figure outperformed estimates by about $210 million. EPS of $1.03 also outpaced expectations by $0.04.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Driven by customer traffic, comparable store sales increased by 7% at Marmaxx, and by 9% at HomeGoods. Similarly, overall comparable store sales increased by 6%. The quarter was marked by strength in apparel, as well as, home sales.

Buoyed by this performance and a robust start to the current quarter, the company raised its outlook for the full year. TJX expects overall comparable store sales for the fourth quarter to rise by 3% to 4%, while EPS is anticipated to be between $0.97 and $1.

For Fiscal Year 2024, TJX expects overall comparable store sales to increase by 4% to 5%. EPS for the year is expected to land between $3.61 and $3.64. With the addition of 50 new stores, the company ended the third quarter with a total of 4,934 stores.

Moreover, TJX generated operating cash flow of $1.2 billion in Q3. It also repurchased $650 million worth of shares and doled out $380 million in dividends. Total share repurchases for the full year are anticipated to be between $2.25 billion and $2.5 billion.

Is TJX a Good Stock to Buy Now?

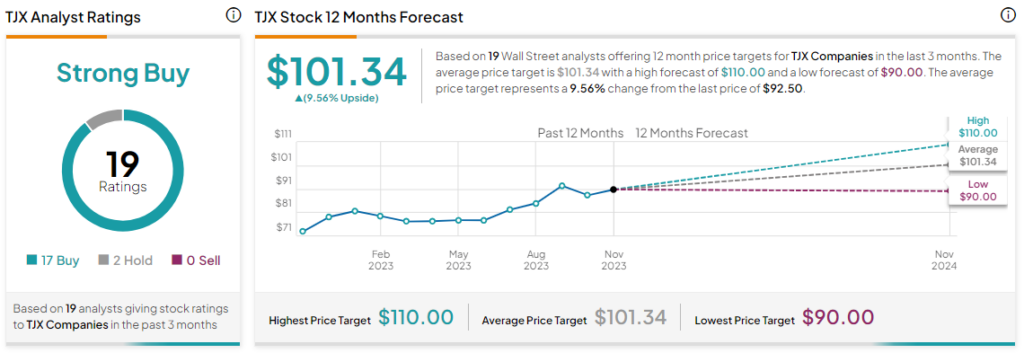

Overall, the Street has a Strong Buy consensus rating on The TJX Companies. Following a nearly 17% rally in the company’s shares over the past six months, the average TJX price target of $101.34 points to a modest 9.6% potential upside.

Read full Disclosure