As geopolitical tensions escalate, aerospace and defense contractor RTX Corp. (RTX) has emerged as an interesting investment opportunity. I see mounting evidence that its stock could be significantly undervalued at the current price, even after a healthy 53% rally over the past year (see chart below). A closer examination of recent contract awards, financial performance, and market dynamics reveals a company poised for continued growth. As such, I am bullish on RTX stock.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

New Contracts

One reason to be bullish on RTX is the impressive array of defense contracts it has recently signed in the defense sector. The U.S. Army has awarded a major contract to Raytheon’s advanced defense systems unit, while the Collins Aerospace division captured a strategic $19 million Department of Defense contract. These victories were complemented by Navy contract modifications worth $118.45 million in the last month, underscoring RTX’s entrenched position within America’s defense infrastructure.

This recent success builds on an already remarkable number of new business acquisitions in 2024. During the third quarter alone, RTX secured over $36 billion in new awards, achieving an exceptional book-to-bill ratio of 1.80. This surge in new business has propelled the company’s backlog to an unprecedented $221 billion, providing exceptional visibility into future revenue streams and highlighting the growing demand for RTX’s sophisticated products and services.

Growing Strength

The company’s financial performance in the third quarter of 2024 further strengthens the bull case for RTX stock. The company delivered organic sales growth of 8%, driven by robust performance across multiple segments. Commercial aftermarket revenue surged by 11%, while defense revenue grew by 10%. Perhaps most impressive, the company achieved 100-basis points of adjusted segment margin expansion while generating $2 billion in free cash flow, demonstrating both strong top-line growth and operational efficiency.

The broader market environment appears increasingly favorable for RTX’s growth prospects. Escalating global tensions and growing security concerns have prompted nations worldwide to significantly boost their defense budgets. This trend has benefited RTX’s Raytheon segment, which has accumulated a $60 billion backlog. Within this backlog is the sophisticated LTAMDS radar system that represents $1.9 billion, while the Standard Missile III program accounts for $1.3 billion. International partnerships continue to flourish, as evidenced by Germany’s $1.2 billion Patriot system contract with RTX.

The commercial aviation sector’s ongoing recovery presents another growth avenue for RTX. The company’s Collins Aerospace and Pratt & Whitney divisions have capitalized on increasing air traffic and growing demand for maintenance, repair, and overhaul services, as reflected in the 11% growth in commercial aftermarket sales. As global airlines continue to modernize their fleets and aircraft production climbs, RTX stands to benefit from its strong market positions in both aircraft systems and engines.

RTX’s Technical Innovations

Innovation remains a cornerstone of RTX’s strategy, with the company continuously pushing technological boundaries. Current initiatives include the development of cutting-edge carbon composite brake technology for hypersonic applications and revolutionary hybrid-electric propulsion systems for helicopters. These investments in next-generation technologies not only enhance the company’s competitive position but also help ensure its long-term market leadership.

In the commercial aviation sector, RTX’s Collins Aerospace unit has opened new facilities to expand its military engine sustainment capacity, while Pratt & Whitney has secured a $1.3 billion contract to advance the F135 Engine Core Upgrade. These developments showcase the company’s commitment to maintaining its technological edge while expanding its operational capabilities.

Risks and Valuation

Despite my bullish outlook for RTX, there are several challenges facing the company that investors should consider. Production issues have severely impacted Collins Aerospace, with narrow body production disruptions stemming from industry-wide supply chain constraints and the ripple effects of labor disputes at Boeing Co. (BA). The company is also addressing a rare condition in powder metal used in certain Pratt & Whitney engine parts, necessitating costly inspections and additional maintenance.

The broader economic environment presents its own set of challenges. Persistent inflation pressures, evolving interest rates, and ongoing supply chain disruptions require careful navigation. While geopolitical tensions drive defense spending higher, they also create operational complexities and potential risks to international business relationships.

As for its valuation, with a market capitalization of $157 billion, RTX stock currently trades at approximately 33.9 times future earnings estimates. While this valuation isn’t historically cheap it’s not cause for a great deal of concern either.

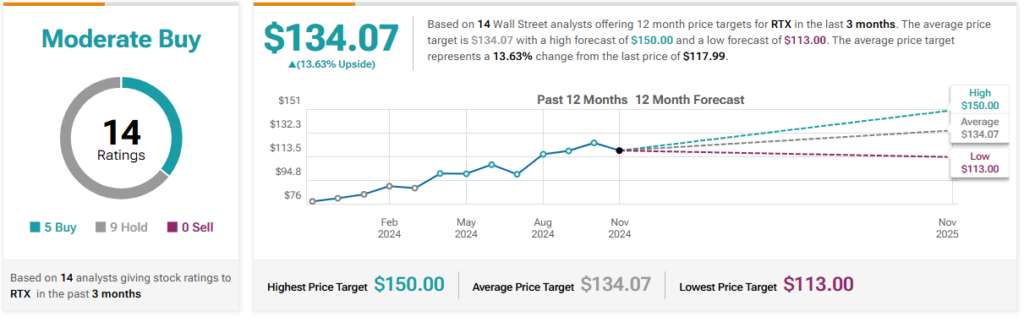

Wall Street’s View of RTX

Despite the challenges, Wall Street analysts maintain a generally positive outlook on RTX. Analysts see significant upside potential, with an average price target of $134.07, suggesting nearly 14% upside from current levels. The stock currently has a consensus Moderate Buy rating among 14 Wall Street analysts.

The company’s commitment to shareholder returns adds another attractive dimension to the investment case. RTX offers a solid 2.05% dividend yield and has completed a substantial $10 billion share repurchase program. This commitment to returning capital to shareholders demonstrates management’s confidence in the company’s financial strength and future.

Looking ahead, RTX has increased its 2024 outlook, projecting adjusted sales of $79.25 to $79.75 billion and adjusted earnings per share of $5.50 to $5.58. This upward revision reflects management’s confidence in the company’s growth trajectory and operational execution.

Conclusion

For investors seeking exposure to both defense and commercial aerospace sectors, RTX presents a compelling opportunity. The company’s record backlog provides strong future revenue, while its technological leadership and diverse portfolio offer solid growth potential. Though near-term challenges exist, RTX’s strong market position, robust cash generation, and growth drivers suggest significant potential for long-term value creation.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue