The promise of electric future sales propelled Oracle (NYSE:ORCL) to astounding heights a few months ago. Since then, however, AI bubble worries and concerns over future margins have combined to help push its share price down and out.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

All told, ORCL’s share price has lost close to 40% of its value since hitting a September peak. Even its most recent earnings report earlier this month, in which it reported $523 billion in remaining performance obligations (RPO), didn’t stop the slide.

However, last week, ORCL received another boost, as news broke that the company will be one of the co-leads for TikTok’s U.S. operations. Not only will the company be the “trusted security partner” of the new joint venture, but it will also enjoy an ownership stake.

As the new year beckons, ORCL’s share price is once again climbing upward. Will this represent its trajectory in the year to come? Investor Manali Pradhan thinks so.

“Oracle stock seems reasonably valued, given its multiyear revenue visibility, disciplined growth strategy, and rising focus on debt management,” explains the 5-star investor.

Pradhan points to Oracle’s more than half-a-trillion dollars in RPO as solid evidence that the company is sitting pretty. She further notes that even a “modest conversion” of these future sales could have a strong impact on Oracle’s earnings.

The investor acknowledges the debt worries, but Pradhan also argues that the company is pursuing growth in a responsible manner. In its last earnings call, Chairman and CTO Larry Ellison shared that Oracle is committed to a policy of chip neutrality, ready and willing to work with multiple CPU and GPU suppliers.

Pradhan is confident that this “beaten-down tech giant” is on the cusp of a pleasant recovery. And with ORCL trading at forward earnings of some ~25x, she believes the price is certainly right.

“The company’s shares appear well-positioned to soar in the coming months,” concludes Pradhan. (To watch Manali Pradhan’s track record, click here)

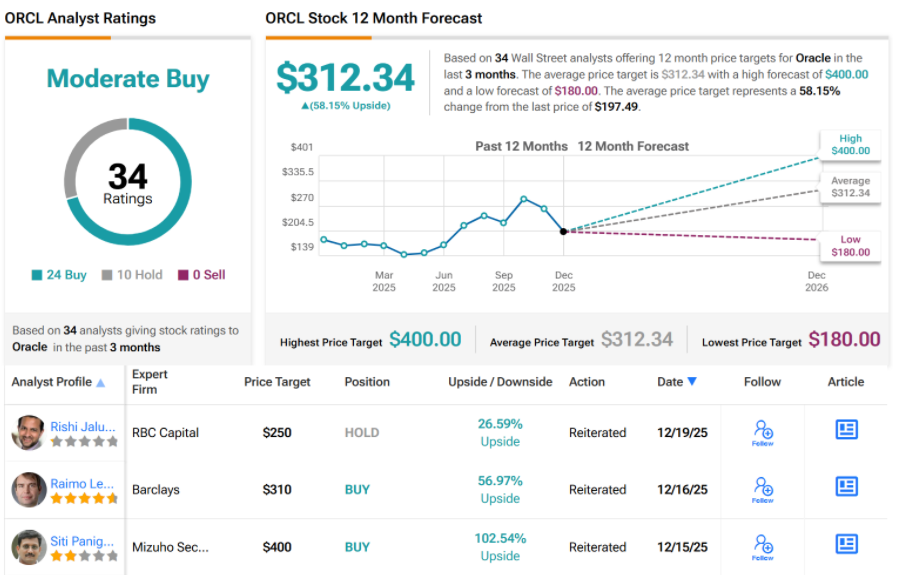

Wall Street is also feeling pretty optimistic that ORCL will be soaring in 2026. With 24 Buys and 10 Holds, ORCL enjoys a Moderate Buy consensus rating. Its 12-month average price target of $312.34 would translate into gains just shy of 60%. (See ORCL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.