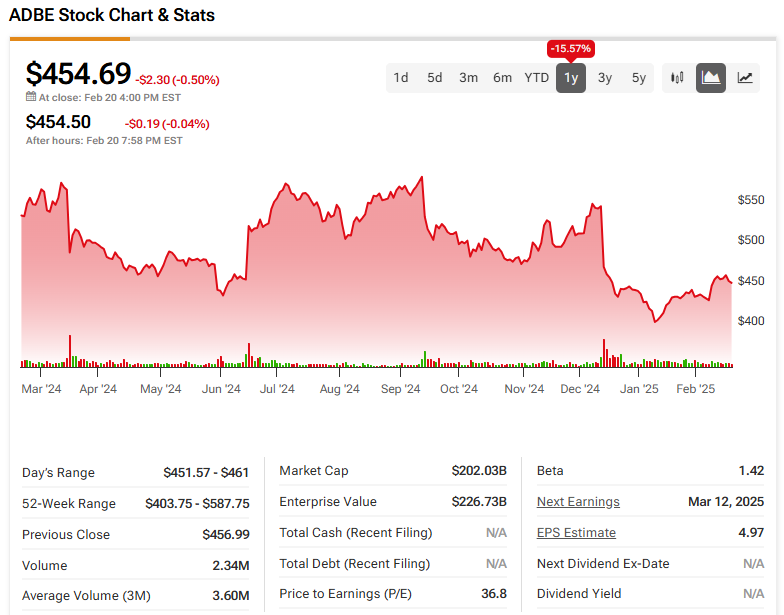

Adobe (ADBE) investors must be feeling motion sickness. In early 2023, the stock was the darling of Wall Street as upbeat earnings beats helped the stock from lows below $300 to as high as $600 in January 2024. The past year has been the exact opposite as the stock has trended lower, losing 16% as tougher competition in the creative software market and a delay in AI monetization have taken their toll. However, while I acknowledge the potential of AI to disrupt creative software, I believe the risks to Adobe are far overblown by market bears.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The creative software kingpin continues posting resilient results while reveling in some of the strongest brand loyalty in tech market history. This helps to support the user base numbers and, ultimately, ADBE’s bottom line. The Street needs some patience to tease out value from the stock and for the overarching AI story to unfold.

I remain an ADBE bull as the digital and media solutions giant prepares to launch a slew of innovative products while AI monetization awaits. Given the relatively lower entry price, building a long-term position becomes alluring as the stock sinks lower. While ADBE may not monetize AI sooner than expected, investors must take a long-term view to capitalize on ADBE stock.

Adobe is Still the Kingpin in Creative Software

Adobe is known for its flagship Creative Suite products, which millions of professionals use daily. However, alternatives such as Canva and Davinci Resolve seek to poach Adobe’s market share. Nevertheless, Adobe is still considered the industry standard for creative software simply because of its rich suite of products and the Adobe ecosystem. According to data compiled by Bloomberg Intelligence and IDC, Adobe dominates the $15 billion creative software market with a 71% market share.

The company’s market dominance allows it to charge premium prices and generate higher margins. Brand loyalty also ensures the company can charge more while maintaining the same user base. ADBE’s trailing twelve-month gross margin is 89%, which is extremely impressive considering that the average profit margin among top U.S. companies is in the low teens.

ADBE is Unloved, But Can it Become a Darling Again?

Adobe faces increased competition from Canva, OpenAI, MidJourney, and newer unicorns foraying into the world of AI-powered design tools. It is also struggling to monetize its offerings because it is focused on an adopt-first, monetize-later strategy, and the Street isn’t a fan of it.

To make matters worse, Adobe undercooked its FY2025 revenue forecasts, stating that it expects to deliver around $23 billion in sales. Meanwhile, analysts polled by Visible Alpha expected revenues to be a touch higher at $23.77 billion. The stock fell dramatically after earnings and has been down 17% since. Was that warranted?

Probably not. The ~$300 million under projection relates to a new pricing strategy and foreign exchange headwinds. Despite the undershoot, it’s not a reason to dump ADBE stock.

I believe Adobe is playing the long game, and the bears are overestimating the threat AI poses. I acknowledge that consumers will be enthralled with adopting AI. However, it’s not so simple for enterprises, especially the larger variety. This is directly reflected in Adobe’s revenue, which is 80% recurring as of the most recent year. Adobe’s Digital Media annual recurring revenue in 2024 was $17.33 billion–something ADBE bears tend to overlook. When I look at Adobe, I do not see a fundamentally troubled enterprise. I see a strong brand with a solid ecosystem that’s maintained its leadership position in the industry for decades.

While I am bullish on Adobe, I am also a pragmatist and do not have unrealistic expectations about future AI-generated revenue as quickly as some investors do. Adobe knows it has to work extremely hard to stay competitive. So far in 2025, Adobe has launched beta versions of the new Firefly image generation and video generation tools to compete with market peers. Shortly after its video model was made public, as a direct competitor to OpenAI’s Sora, Morgan Stanley analyst Keith Weiss reiterated his $660 price target on ADBE shares. Weiss is optimistic about adopting and monetizing the new Firefly Video model and likes the company’s move towards tiered pricing, offering both a Standard and a Pro version. Similarly, I also view the tiered plans as a benefit for Adobe because they offer something for every budget, and that’s the recipe for increasing adoption.

Is ADBE Stock Undervalued?

Despite a monumental sell-off during 2024, ADBE stock is up 2.2% year-to-date, and its shares are priced at 22.4x forward earnings, which is reasonably cheap, in my opinion. That’s actually a 35% discount to its 5-year average P/E of 34x, and we didn’t even have any AI potential back then. Adobe is growing both sales and profits at ~10% per year, and I believe it is fairly valued at its current multiple. For patient and long-term investors, this presents an attractive entry point.

Is Adobe a Good Stock to Buy Right Now?

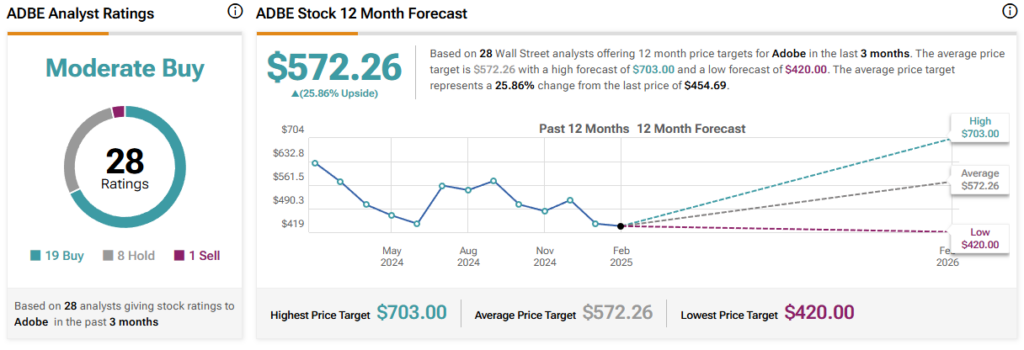

On Wall Street, ADBE stock carries a Moderate Buy consensus rating based on 19 Buy, eight Hold, and one Sell ratings over the past three months. ADBE’s average price target of $572.26 per share implies almost 26% upside potential over the next twelve months.

Resilient Loyalty Makes ADBE a Smart Long-Term Play

Adobe is an established company that has maintained its leadership position in the creative software industry through persistent innovation and doing what other companies only dream of: fostering indomitable brand loyalty over decades of superb product development. Although there is a risk of competition to the company, its product suite has a solid position to fight off new entrants because of its all-inclusive ecosystem and reliability among enterprise clients. The sellers should not discount the fact that Adobe is one of the most high-margin companies in the world and has a stronger distribution network than most tech firms.

Moreover, the company is making gradual progress with its AI-powered products, and its new pricing approach has the potential to monetize AI sooner than most bears think. It’s probably better to monetize AI at a late stage but do it effectively rather than rush out to monetize AI early and do so without thinking ahead. The stock is currently trading at a fair price and is presenting an attractive entry point for investors with a long-term time horizon. If investors are looking for a neat tech play to add to their portfolios, ADBE is worthy of consideration.