It seems quaint at this point, but not too long ago there was some real worry about the ability of Alphabet (NASDAQ:GOOGL) to compete with AI chatbots in the battle for Internet searches. After all, the thinking went, these LLMs could formulate summarized answers to online queries and place Alphabet’s search engine primacy in peril.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Recent history seems to have turned that narrative on its head. Thus far, Alphabet has become one of the bigger AI winners, and Google Search revenues are expanding – growing by 11.7% in Q2 2025 to reach $54.2 billion.

A recent U.S. court decision further sweetened the pot, as Alphabet will not be forced to part ways with its Chrome web browser. All told, GOOGL’s share price has now grown by over 50% in the past three months, sending the company’s market cap north of $3 trillion.

The investor known by the pseudonym Undercovered Deep Insights believes that more growth is coming up on the horizon.

“Alphabet’s strategy of embedding AI everywhere and scaling infrastructure positions it as a long-term winner, with risks offset by financial strength and execution,” asserts the investor.

Undercovered further details that the company combines “unmatched” scale and innovation. This has enabled the company to integrate its AI tools throughout its wide suite of products, including Google Search and YouTube, to drive its growing ad revenues.

However, the company has expanded beyond ads, with Google Cloud growing 32% year-over-year to reach $13.6 billion in revenues. Google Cloud also possesses a $106 billion backlog, notes the investor, meaning that this growth driver is definitely heating up.

“Google is shifting from ads toward full-stack AI infrastructure, and that transition is fueling a multi-year growth cycle,” adds Undercovered.

The company is spending heavily on AI, with a planned $85 billion for 2025. However, the investor is fairly sanguine about this spending, noting that Alphabet’s margins are in the low 30s while net income is up ~20% year-over-year.

“Alphabet’s playbook is crystal clear, which revolves around leveraging Google’s tremendous distribution to push AI everywhere,” sums up Undercovered Deep Insights, who rates GOOGL a Buy. (To watch Undercovered Deep Insights’ track record, click here)

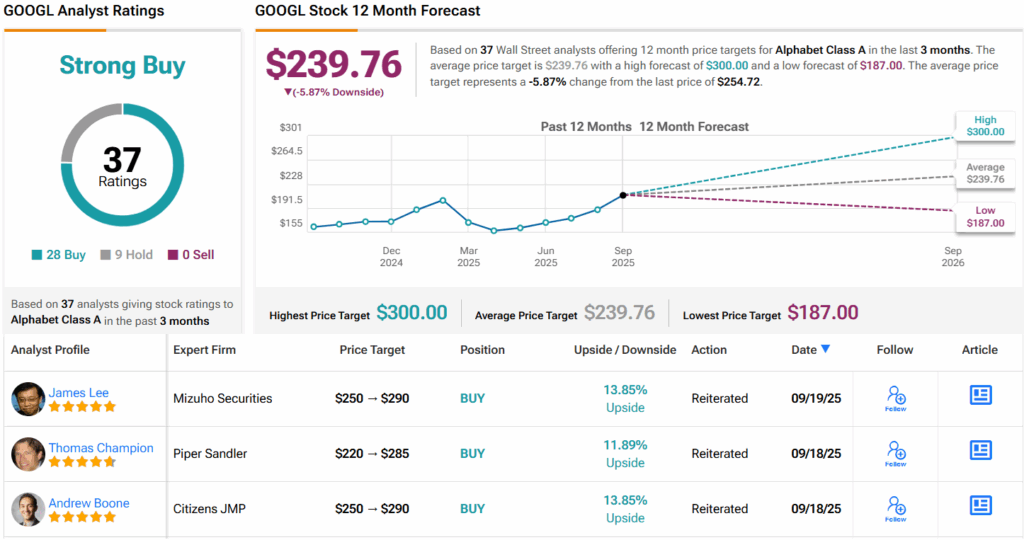

That’s just about where the rest of Wall Street finds itself as well. With 28 Buys and 9 Holds, GOOGL coasts to a Strong Buy consensus rating. Its 12-month average price target of $239.76 implies losses of ~6%. (See GOOGL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.