Markets have been in freefall since Trump put into action his global “reciprocal” tariff scheme. Last week culminated in the biggest two-day wipeout in the stock market’s history. Investors watched in disbelief as stocks around the world tumbled, while Trump stood firm, vowing not to back down.

“I don’t want anything to go down,” Trump was quoted as saying. “But sometimes you have to take medicine to fix something.”

That would make sense if the patient was sick. But for Wedbush analyst Daniel Ives, a market veteran and a tech bull, the patient didn’t even look ill to begin with.

“As someone that has covered tech stocks for 25 years, I have seen everything from the Dot.com bubble/burst, financial crisis, Europe debt crisis, Covid days, and everything in between,” Ives noted. “The reason I believe this is the biggest debacle ever seen in the markets is because its purely self-inflicted by Trump and the logic about ‘near-term pain’ is being way miscalculated which speaks to our concern.”

“If US tech companies are faced with this reality, it will negatively change the tech landscape for decades to come. The cost structure of the US tech world would make it impossible to compete with China and this would be a lotto ticket for the China tech landscape: BYD, Huawei, Alibaba, Tencent and thousands of other China tech players to gain more global market share over the years,” Ives added.

China is at the forefront of Ives’ mind when considering the prospects of two of the world’s biggest companies whose business seriously depends on the world’s second-biggest economy. Tesla (NASDAQ:TSLA) and Apple (NASDAQ:AAPL) both stand to be negatively affected by an escalating trade war and Ives has now seen enough reason to slash his price targets for both.

Let’s see what’s behind the reduced outlook and with help from the TipRanks database, we can find out if the Street agrees with the Wedbush view.

Tesla

Many companies are indelibly tied to a charismatic leader and none more so than Tesla. Led by CEO Elon Musk, it’s likely that EVs would have never become a mainstream concern without his crusade to make them so. Tesla spearheaded the EV revolution and is now the biggest car brand in the world (albeit not by sales but by market cap), but whether it remains a global EV colossus from hereon in is now debatable.

Because these days Musk is on an entirely different crusade. Having thrown his full weight behind Trump, Musk’s increasingly polarizing statements and political activity have made Tesla – a company that was already struggling with waning demand and intensifying competition – a toxic brand for many who not long ago would be its natural customer base.

The result of his involvement in the new administration as the head of DOGE (department of government efficiency) has been a wave of global protests and attacks on Tesla dealerships. More importantly, it has led to crashing vehicle sales. The recently released Q1 deliveries showed they fell to their lowest amount in 3 years, sliding by 13% year-over-year to 336,681 units, way below the Street’s forecast of 377,000 vehicles.

Ives, who has regularly sung Tesla’s praises and has stuck with the Musk-led firm even as protests heated up around the world, has decided enough is enough. This disastrous display has prompted him to reassess his stance, and there’s one area that is particularly concerning.

“The bigger worry in our opinion is Tesla’s success in China as this key region is the linchpin to the future success of Tesla,” Ives says. “The backlash from Trump tariff policies in China and Musk’s association will be hard to understate and this will further drive Chinese consumers to buy domestic such as BYD, Nio, Xpeng, and others. Tesla has essentially become a political symbol globally….and that is a very bad thing for the future of this disruptive tech stalwart and the brand crisis tornado that has now turned into an F5 tornado.”

“Our long standing bull view of Tesla remains, but there is no denying this is a pivotal moment of truth for Musk to turn things around…or darker days are ahead,” Ives further said. “We have been one of the biggest supporters of Musk and Tesla over the last decade….but this situation is not sustainable and the brand of Tesla is suffering by the day as a political symbol. Musk has been with his back against the wall many times and every time Tesla came out of it and was stronger on the other side…this may be one of his biggest challenges yet to turn around.”

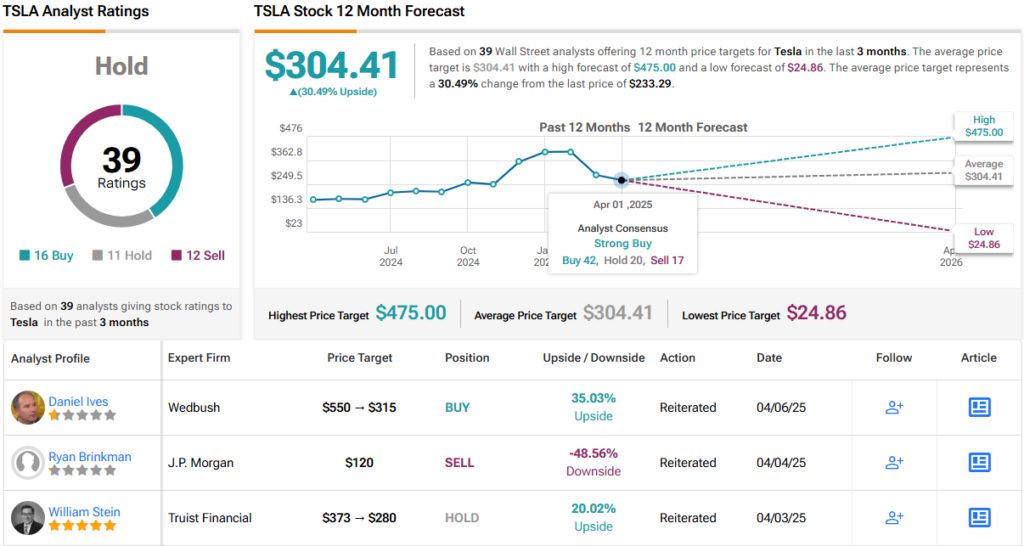

For now, Ives assigns TSLA stock an Outperform (i.e., Buy) rating, but his price target goes from $550 to $315. Nevertheless, there’s still an upside of 35% from current levels. (To watch Ives’ track record, click here)

Even with that lowered target, Ives remains one of the Street’s biggest TSLA bulls. 15 other analysts join him in the bull camp, yet with an additional 11 Holds and 12 Sells, the stock only claims a Hold (i.e., Neutral) consensus rating. Still, at $304.41, the average price target offers a one-year upside of ~30%. (See TSLA stock forecast)

Apple

From one market stalwart to the biggest of them all. Apple, remember, also had a mercurial leader at the helm once; the tech giant had a visionary of its own in co-founder and CEO Steve Jobs. A guru-like figure, he regularly hogged the headlines with his unconventional and demanding leadership style, but his notoriety was nothing even near that of Musk’s.

These days, compared to all the drama going on with Tesla, Apple appears to be a sea of relative calm. Led by the more low-key Tim Cook – or as Trump has called him, Tim Apple – the tech giant has maintained its standing at the top of the market cap pile, its business boasting a huge global fanbase participating in an ever-expanding self-contained ecosystem.

Yet, Apple has faced headwinds of its own in recent times. For one, while its Big Tech peers were riding the AI wave in one way or another, Apple was late to the game. It has now waded in with its own AI Apple Intelligence, a growing ecosystem of AI and machine learning features being introduced across its devices and services.

Meanwhile, it has struggled with sales of its flagship product, the iPhone. In the most recently reported quarter, for F1Q25, iPhone sales fell -0.8% year-over-year to $69.14 billion, coming in below the $71.03 billion expected on Wall Street. The sales decline in major hub China was even more acute, showing an 11% drop vs. the same period last year with Apple facing increasingly strong competition from local rivals such as Huawei and Vivo.

With the company already under pressure, China is front and center for Ives when considering the implications of Trump’s tariffs mania on Apple’s business.

“The tariff economic Armageddon unleashed by Trump is a complete disaster for Apple given its massive China production exposure,” Ives said. “In our view, no US tech company is more negatively impacted by these tariffs than Apple with 90% of iPhones produced and assembled in China. We have seen Apple navigate very uncertain times… This tariff situation is dramatically different and a very scary prospect as the current tariff slate with China at 54% and Taiwan at 32% would be devastating to Apple, its cost structure, and ultimately consumer demand…”

“We stay bullish for the long-term view on Apple as the Services business and strong FCF support a base case valuation of $250,” the analyst summed up.

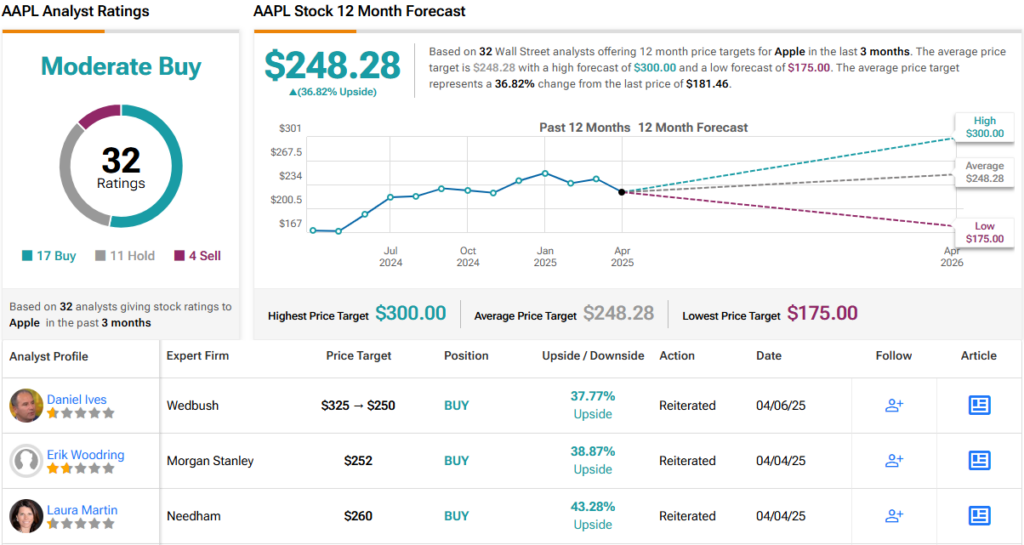

That case valuation, however, is a new one, lowered from $325, yet still offering one-year upside of ~38%. Ives’ rating remains an Outperform (i.e., Buy).

Most analysts remain AAPL bulls but not conclusively so; based on 17 Buys, 11 Holds and 4 Sells, the consensus view is that this stock is a Moderate Buy. At $248.28, the average price target closely matches Ives’ objective. (See AAPL stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.