Tesla (NASDAQ:TSLA) CEO Elon Musk may be on the verge of rewriting the record books once again. Already the world’s richest man with a fortune of around $491 billion, Musk could soon see his net worth soar past the trillion-dollar mark, a milestone no one has ever reached.

Meet Your ETF AI Analyst

- Discover how TipRanks' ETF AI Analyst can help you make smarter investment decisions

- Explore ETFs TipRanks' users love and see what insights the ETF AI Analyst reveals about the ones you follow.

At its annual shareholder meeting, retail and institutional investors voted on several proposals, including a plan granting Musk 25% control of Tesla through a trillion-dollar compensation package designed to incentivize him to stay in his current role and lead the EV firm into an AI-hued future. Despite some opposition from certain shareholders and ISS, the package was approved overwhelmingly, with more than 75% of shareholders voting in support.

It was the outcome Wedbush analyst Daniel Ives expected, one that, in his view, reaffirms Musk’s status as a “wartime CEO as the AI Revolution takes hold.” The approval gives Ives even “greater confidence in the TSLA story moving forward.”

Tesla also said its Robotaxi service will make its next move into Miami, Dallas, Phoenix, and Las Vegas, with plans to remove safety drivers from its Austin operations by year-end.

Although a majority of shareholders supported the proposal to invest in xAI, Tesla noted that no final decision has been made and that it will continue evaluating the potential investment before reaching a conclusion.

With the pay package now approved and Tesla having secured its most valuable asset, Musk, as leader for the foreseeable future, Ives thinks that the “AI valuation is getting unlocked.” The analyst, who ranks among the top 4% on Wall Street, believes the path toward an AI-based valuation for Tesla over the next six to nine months has begun, supported by FSD and autonomous adoption across its installed base.

Pocketing that $1 trillion won’t be easy to do, however, with aggressive milestones still needed to be reached in order to unlock all that goodness. These include delivering 20 million vehicles, reaching 10 million active FSD subscriptions, completing 1 million Optimus robot deliveries, and operating 1 million Robotaxis commercially. As Tesla expands into robotics and AI, it must also scale operations profitably, with Musk and his team needing to achieve $50 billion in adj. EBITDA as an initial target, ultimately reaching $400 billion of adj. EBITDA over four consecutive quarters. This must be accomplished while making significant R&D investments to advance its robotics and AI strategy, requiring a careful balance between aggressive growth investment and margin expansion.

“We have always viewed Musk and Tesla as a leading disruptive technology global player and the first part of this grand strategic vision has taken shape over the past 5 years,” the 5-star analyst summed up. “Now it’s about driving the most important chapter in Tesla’s history with an autonomous future ahead.”

Bottom line, Ives assigns Tesla shares an Outperform (i.e., Buy) rating, backed by a $600 price target. Should the figure be met, investors will be sitting on returns of ~40% a year from now. (To watch Ives’ track record, click here)

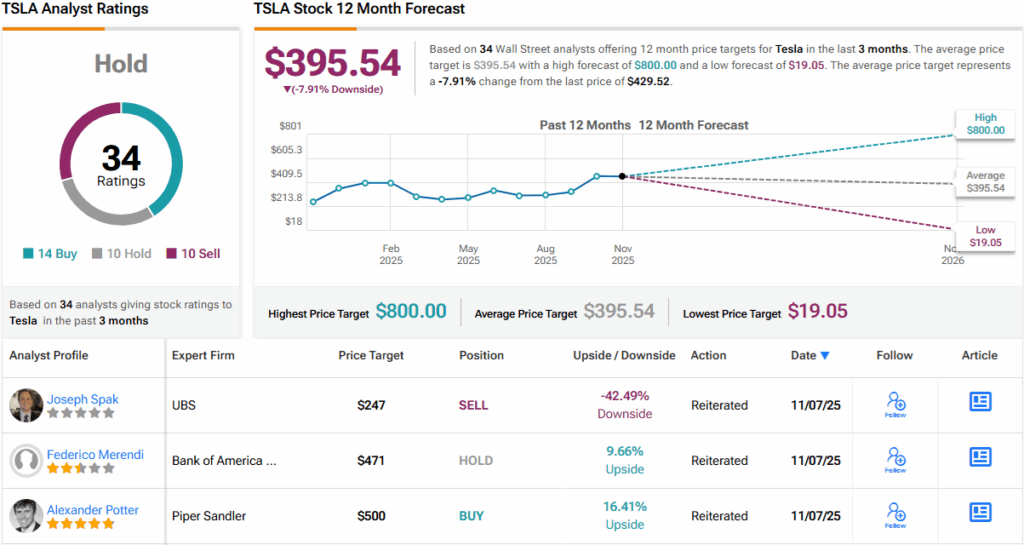

13 other analysts are also TSLA bulls, yet with an additional 10 Holds and Sells, each, the consensus view is that Tesla stock is a Hold (i.e., Neutral). The average price target stands at $395.54, a figure that factors in an 8% downside. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.