Can one put a price on leadership? Investors in Tesla, Inc. (NASDAQ:TSLA) appear to have quantified the value of CEO Elon Musk, at just beneath $1 trillion.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

That’s the (potential) price tag of his historic compensation package, which relies on meeting numerous benchmarks in the fields of robotaxis and humanoid androids – along with other metrics – in the decade to come.

Tesla’s current share price largely rests on Musk’s ability to meet these moonshots, since its EV business hasn’t been doing so well of late.

After a bump in Q3 (thanks in no small part to an expiring $7,500 EV tax credit), Tesla’s EV deliveries dipped again in Q4. Its 418,227 delivered vehicles for the quarter represented a 15.6% year-over-year decline, while 2025 marked the second year in a row that the company suffered from slowing deliveries.

Count the investor known by the pseudonym Cash Flow Venue among those bears who aren’t convinced that Tesla represents a compelling opportunity in the year ahead. That’s even with a fully-engaged Elon Musk firmly on board.

“It will take a lot of time before investors see any meaningful financial results related to Tesla’s ‘hottest’ initiatives – I’d like you to keep in mind that Elon has a history of not following through with his bold claims,” asserts the 5-star investor.

Cash Flow Venue points out that while Tesla talks a good game with the robotaxis, so far Alphabet’s Waymo is progressing faster. Moreover, the company’s energy business – while growing – only accounted for 12.2% of Tesla’s revenues in Q3 2025.

That leaves EVs to supply the lion’s share of the company’s revenues for the time being. The slipping Q4 numbers could be a harbinger of more bad tidings up ahead, according to Cash Flow Venue.

“I’m sorry to disappoint you if you expect a shift in Tesla’s EV business – I don’t think it’s coming,” explains the investor.

The investor points to BYD, the surging Chinese EV company, which has recently overtaken Tesla as the largest EV seller in the world, slipping sales in Europe, and weaker demand in the U.S. following the expiration of the EV tax credit.

That makes the company’s Forward Price-to-Earnings multiple of ~340x way too risky, according to Cash Flow Venue.

“For me, Tesla is a Strong Sell – I believe it will crash in 2026,” concludes Cash Flow Venue. “Cash out or trim your positions while you still can.” (To watch Cash Flow Venue’s track record, click here)

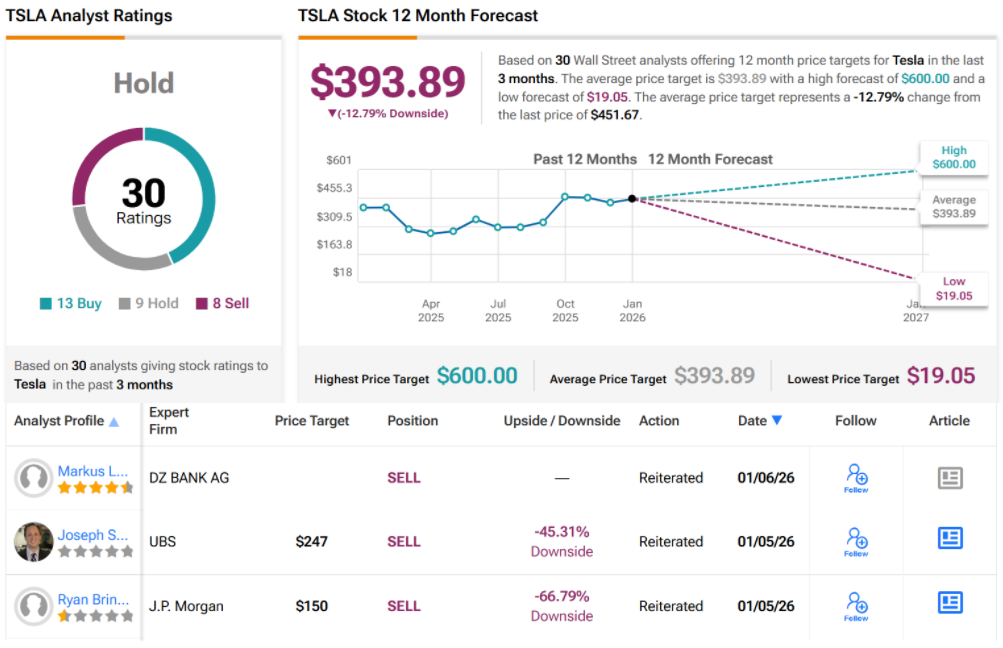

Some on Wall Street feel that way, some are ambivalent, while others still are hopeful that things are looking up in 2026. With 13 Buys, 9 Holds, and 8 Sells, TSLA carries a consensus Hold (i.e., Neutral) rating. Its 12-month average price target of $393.89 would translate into losses of ~13% in 2026. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.