Shares of The Children’s Place (NASDAQ:PLCE) tanked nearly 16% in the early session today after the children’s apparel retailer delivered a mixed set of third-quarter results. Indeed, its EPS of $3.22 lagged expectations by $0.27, while its revenue of $480.2 million came in ahead of estimates by $14.5 million.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The quarter was marked by a double-digit increase in eCommerce traffic and gains in the company’s wholesale channel. However, higher distribution costs and labor costs impacted the company’s bottom line adversely. Interestingly, the higher costs also stemmed from the gains in eCommerce sales, as the higher volumes were accompanied by lower transaction sizes and an outsized increase in packages for PLCE.

eCommerce sales now make up nearly 57% of PLCE’s retail sales. However, the company’s comparable store sales declined by 7.3% in Q3, as the current macroeconomic environment aggravated the slowdown in consumer demand.

Looking ahead to Fiscal Year 2023, PLCE expects net sales to be in the range of $1.605 billion to $1.610 billion, with EPS anticipated to land between -$0.59 and -$0.39. For the upcoming quarter, PLCE expects net sales to hover between $460 million and $465 million, while EPS is anticipated to be between $0.25 and $0.45.

What is the Target Price for PLCE?

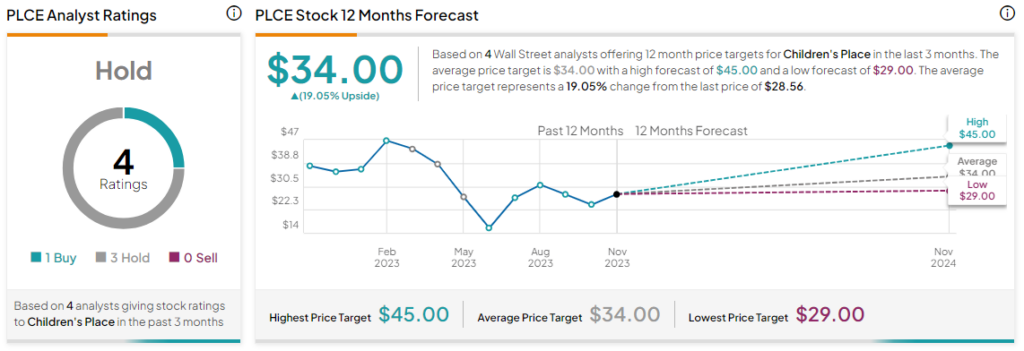

Today’s price decline further adds to the nearly 20% drop in PLCE shares so far this year. Overall, the Street has a Hold consensus rating on The Children’s Place, and the average PLCE price target of $34 points to a 19% potential upside in the stock.

Read full Disclosure