For aerospace stock watchers, there are really only two games in town: Boeing (BA) and Airbus (EADSY). There are other aircraft makers, of course, including companies like Embraer (EMBJ) and China’s puzzling entrant, the Commercial Aircraft Corporation of China (COMAC). But neither of these even approach the level of business that Boeing and Airbus do, so for most, this market is a two-horse race. And this year, as it turns out, Boeing came out ahead in terms of orders.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

By the Numbers

Airbus got its start in 1970, and ever since, has taken aim at Boeing as a company to beat in the field. Sometimes, Airbus even succeeds. In fact, back in October, Airbus brought out word that its A320 was the most-delivered aircraft in the market, beating out the Boeing 737.

While this was a major milestone for Airbus, it was also not the only point to consider in this sector. Going back to the early 2010s reveals that Airbus was already overtaking Boeing in terms of “actual aircraft movements,” one report noted.

A look at numbers from September 2025 found that the Airbus A320 family made 1,414,516 total flights. The Boeing 737 family, meanwhile, could only eke out 1,102,536 total flights.

Yet it was quite clear Boeing would not go quietly. Buoyed by the efforts of President Donald Trump, who spent a large portion of 2025 making trade deals with the rest of the world and shoring up trade deficits, countries all over the world narrowed the gap by buying planes from Boeing.

Airbus managed to win in the “small narrowbody” class, mostly because Boeing does not offer an aircraft equivalent to the A220, an Airbus make that it picked up from Bombardier (BDRBF). And Airbus also narrowly won in the “large narrowbody” class, with Airbus picking up 504 orders here for the A320neo class against Boeing’s 461 in the 737 MAX family.

Medium widebody aircraft, though, proved different. The A330neo had one of its best years ever, pulling in 96 orders. This figure was devastated by the 787 Dreamliner’s order book, which weighed in at 351 total. So, once all sales were tallied, Airbus reportedly sold 640 commercial aircraft, while Boeing sold 812, putting Boeing on top in overall orders for 2025. While Trump’s work played a significant hand in this, Boeing’s status as a global supplier of aircraft could not be ignored. This status had been somewhat tarnished in recent years thanks to several 737 MAX crashes and similar incidents.

Then There’s the Military to Consider

This news comes on top of another big win at Boeing. The United States military offered up a $2.7 billion contract to Boeing for “post-production support services” connected to the Apache helicopter lineup. This is on top of an earlier contract issued about a month ago for the Apache AH-64E attack helicopter, which included Longbow crew trainers and related implements valued at $4.7 billion.

While this does not leave Airbus out of the running—just days ago, Airbus sold Spain 18 C-295 military transport aircraft—Airbus generally receives less income from military operations than Boeing thanks mainly to Airbus primarily contracting as a European vendor as opposed to a United States vendor. European Union military spending has been on the rise recently as the impact of the post-Cold War “peace dividend” has declined. But with the United States spending 2.9% of its gross domestic product on defense spending in 2023 against the 2.1% spent by the United Kingdom, the EU’s attempt to reach 2% in 2024 is still clearly lagging.

Is Boeing or Airbus the Better Stock to Buy Right Now?

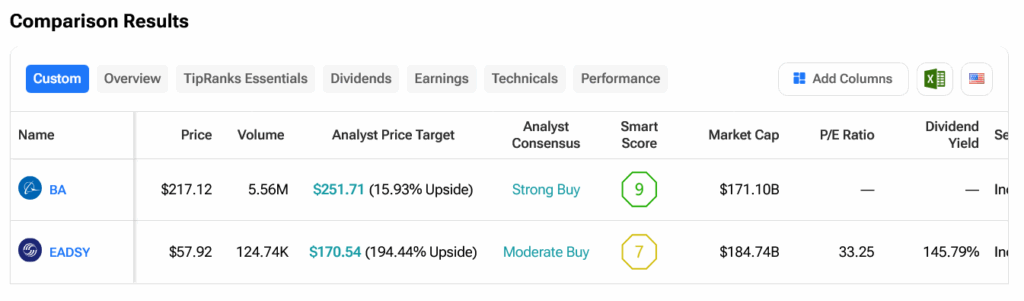

Turning to Wall Street, Boeing is rated a Strong Buy by analyst consensus with an average analyst price target of $251.71 per share, giving it a 15.93% upside potential over last-traded value. Airbus, meanwhile, is rated a Moderate Buy, but with an analyst price target of $170.54 per share, offers investors a 194.44% upside potential.