Is entertainment giant Comcast (CMCSA) looking to make a play for Warner Bros. Discovery (WBD)? If it is, it would become part of a growing field of potential candidates that would spawn a bidding war going forward. And new word from Comcast CEO Mike Cavanagh is that Comcast may be considering, but considering and offering are two different things. Investors did not take this aloof stance very well, though, as shares plunged over 3% in Thursday morning’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

A key point that Cavanagh pointed out was that finding ways to add value is part of the job at Comcast, so if it did make a deal for Warner, it would be particularly interested in streaming and studio assets, especially with the Versant spinoff coming. That is reasonable enough, of course; some of Warner’s biggest assets are streaming and studio assets, leaving aside the Discovery Global content that is likely to get spun off either way.

But Cavanagh also pointed out that Comcast is busily adding value regardless of any Warner deal. It has the NBA on its side now. It has been expanding Peacock, though Peacock is a shadow of HBO Max. The new theme park does not hurt matters. Oh, and then, Cavanagh pointed out almost smugly, there’s the matter of Taylor Sheridan.

The Matter of Taylor Sheridan

In case you had not heard about this, the guy who made Yellowstone happen, as well as its various spin-offs, is now part of the Comcast ecosystem. Taylor Sheridan jumped ship, at least in part; his current contract with Paramount Skydance (PSKY) keeps him in the fold until 2028, when he can also move his television skills over to Comcast.

For now, though, Comcast has a film deal in the works with Sheridan. While Paramount plans to extract as much value out of Sheridan as possible before he can completely leave, Comcast will still be in line for plenty of content. Paramount will keep a ton of properties, including The Dutton Ranch, The Madison, and several others.

Is Comcast Stock a Good Buy Right Now?

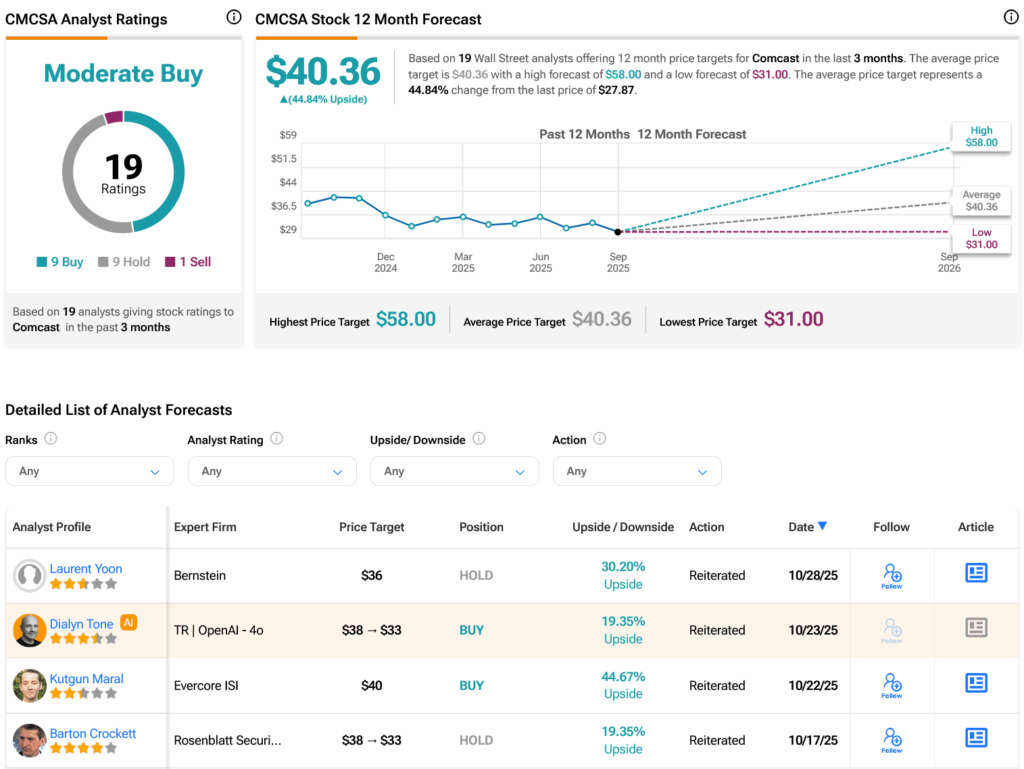

Turning to Wall Street, analysts have a Moderate Buy consensus rating on CMCSA stock based on nine Buys, nine Holds and one Sell assigned in the past three months, as indicated by the graphic below. After a 34.67% loss in its share price over the past year, the average CMCSA price target of $40.36 per share implies 44.84% upside potential.