Tech giant Microsoft (MSFT) is no stranger to big movement, and a point recently emerged that could be a huge win for Microsoft, if it can capitalize on it effectively. The news did not seem to have much impact for shareholders, though, as they sent shares down modestly in Wednesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

One of the biggest points from Microsoft’s recent earnings announcement that probably did not get the attention it should have was Microsoft’s cloud computing backlog. The reports value that figure at a whopping $392 billion, which opens up a major opportunity. The only question remaining to answer is if Microsoft can actually convert that backlog and turn it into revenue. If it can, then it is in line for a massive new revenue stream, even by Microsoft’s standards.

The problem right now is that Microsoft does not have the cloud capacity to meet that backlog. It may be rapidly pushing to change that, but for now, it simply cannot meet the demand. Yesterday, we got a look at just how complex the problem was; while Microsoft had sufficient chips to pursue more development in artificial intelligence, it did not have the necessary electricity to do the job. Throw in cloud computing demand on top of that and the issue of sheer bandwidth becomes clearer.

A PC Hybrid More Likely

Meanwhile, another executive at Microsoft seems to have broken cover about the next Xbox, and the likelihood that it will not be like any of its predecessors at all. Microsoft has been actively promoting the ROG Ally line for some time now, with some pointing out that the handheld was intended as a “tease” for next-generation plans.

That led to Satya Nadella talking about the next Xbox, noting, “We’re going to be everywhere, on every platform. We want to make sure, whether it’s consoles, whether it’s the PC, whether it’s mobile, whether it’s cloud gaming, or the TV, so we just want to make sure the games are being enjoyed by gamers everywhere.” So the idea of a PC hybrid makes that much more sense, keeping that quote in mind.

Is Microsoft a Buy, Hold or Sell?

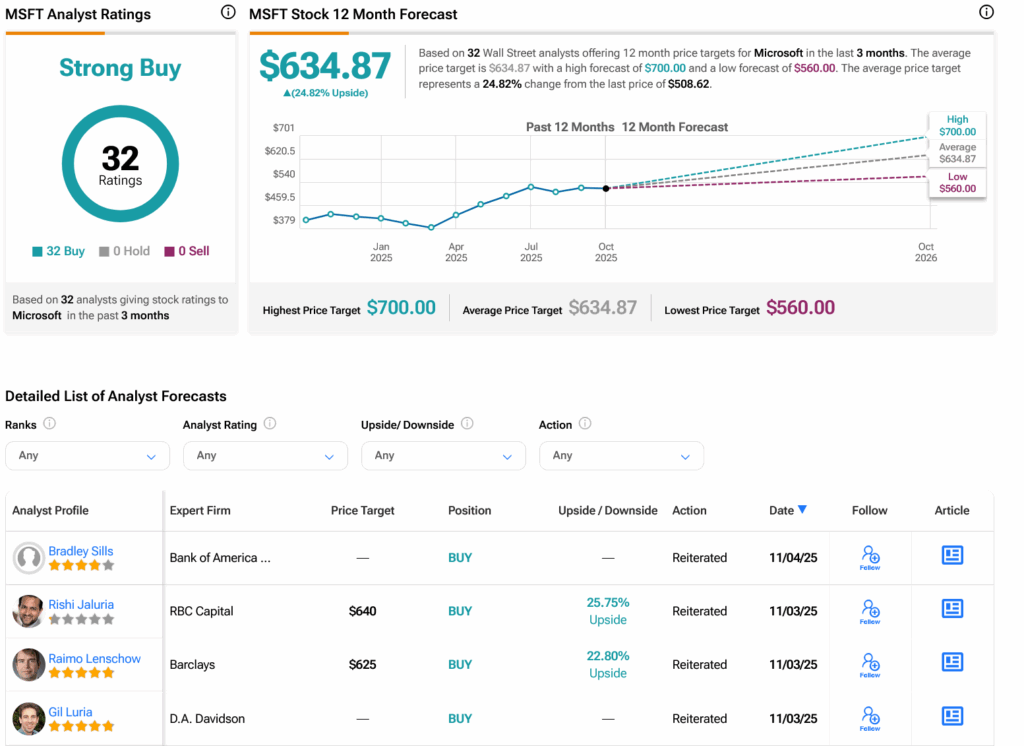

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 32 Buys assigned in the past three months, as indicated by the graphic below. After a 22.41% rally in its share price over the past year, the average MSFT price target of $634.87 per share implies 24.82% upside potential.