Frontier Airlines (ULCC) CEO Barry Biffle pushed back after United Airlines (UAL) CEO Scott Kirby claimed that budget airlines are no longer a viable business model in the U.S. At a travel conference in New York, Biffle called Kirby’s comments “cute” and said that the real problem is that there are too many flights in the U.S., not that the low-cost model is broken. He was responding to Kirby’s earlier statement that Spirit Airlines, the largest budget airline, would likely shut down. Indeed, Spirit recently filed for bankruptcy for the second time in a year.

TipRanks Black Friday Sale

- Claim 60% off TipRanks Premium for the data-backed insights and research tools you need to invest with confidence.

- Subscribe to TipRanks' Smart Investor Picks and see our data in action through our high-performing model portfolio - now also 60% off

Furthermore, Kirby said that if Biffle wants Frontier to be the top budget airline, he’ll end up being the “last man standing on a sinking ship.” In response, Biffle highlighted that Frontier’s operating costs are cheaper at $7.50 per seat mile compared to United’s $12.36. He also said that Frontier reaches customers who wouldn’t normally fly or who want to save money on flights so they can spend more on things like luxury hotels. When asked if Frontier depends on United’s leftover flight capacity, Biffle dismissed the idea.

Still, budget airlines have been struggling due to rising costs and tough competition from larger airlines that now offer cheaper basic economy seats. In fact, Kirby told CNBC that customers don’t see enough value in ultra-low-cost carriers anymore. In response, airlines like Frontier are starting to bundle more services together by offering upgrades that used to cost extra. As a result, Frontier believes the airline could return to profitability by 2026.

Which Airline Stock Is the Better Buy?

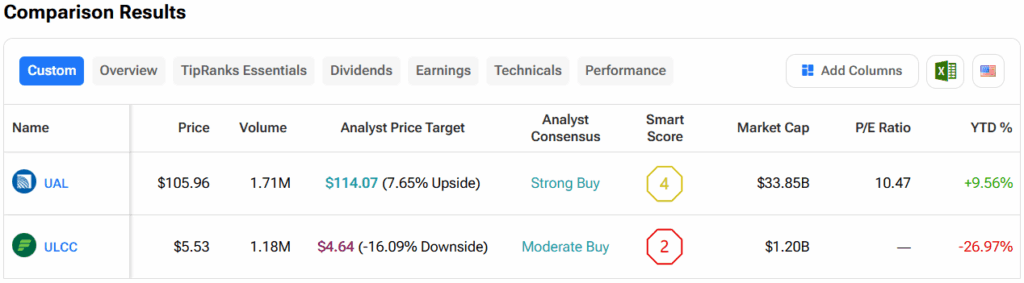

Turning to Wall Street, out of the two stocks mentioned above, analysts think that UAL stock has more room to run than ULCC. In fact, UAL’s price target of $114.07 per share implies 7.7% upside versus ULCC’s 16.1% downside risk.