Worries about the health of American consumers ratcheted up a notch on Tuesday as Target (TGT) warned February sales were soft and it expects a rough first quarter. The retailer beat Wall Street forecasts on the top and bottom lines in its Fiscal fourth quarter but said it expects a “meaningful” drop in 2025 first quarter profits.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Target’s warning on “ongoing consumer uncertainty” amid concerns about tariffs comes after Walmart (WMT) raised concerns last month about the state of U.S. consumers as its full-year sales guidance was softer than anticipated. Home Depot (HD) also cautioned about consumers as it guided for anemic growth of just 1% this year.

At the same time, consumer sentiment surveys from the Conference Board and University of Michigan (UoM) have painted a picture of declining confidence and heightened fears about inflation.

Last month the Conference Board reported the largest monthly drop in its consumer confidence survey since August 2021. The UoM sentiment index fell to its weakest since July while inflation expectations rose to the highest in 30 years. Adding to the sense of gloom, the Atlanta Fed revised its Q1 2025 GDP growth estimate lower again, from -1.5% on February 28th to -2.8%.

TGT Beats but Guides Lower

Total comparable sales increased 1.5% in the fourth quarter, with in-store sales down 0.5% and digital sales increasing 8.7%. After a strong holiday shopping season, the big-box retailer raised its Q4 sales guidance in January but stuck to profit guidance, reflecting a reliance on discounts. This proved accurate as gross margin fell about 0.4 percentage points due partly to “higher promotional and clearance markdown rates.”

Net sales of $30.9 billion were 3.1% lower in the fourth quarter compared with 2023, which included an additional week. Operating income was $1.5 billion in fourth quarter 2024, down by 21.3% from $1.9 billion in 2023.

Nevertheless, earnings per share of $2.41 defied the $2.26 expected by analysts, while revenue came in a fraction above estimates. But a weak performance in February is weighing on the outlook this year as the company anticipates seeing meaningful year-over-year profit pressure in its first quarter relative to the remainder of the year.

“Our topline performance for the month was soft, as uncharacteristically cold weather across the U.S. affected apparel sales, and declining consumer confidence impacted our discretionary assortment overall,” said Jim Lee, chief financial officer.

Is TGT a Good Stock to Buy?

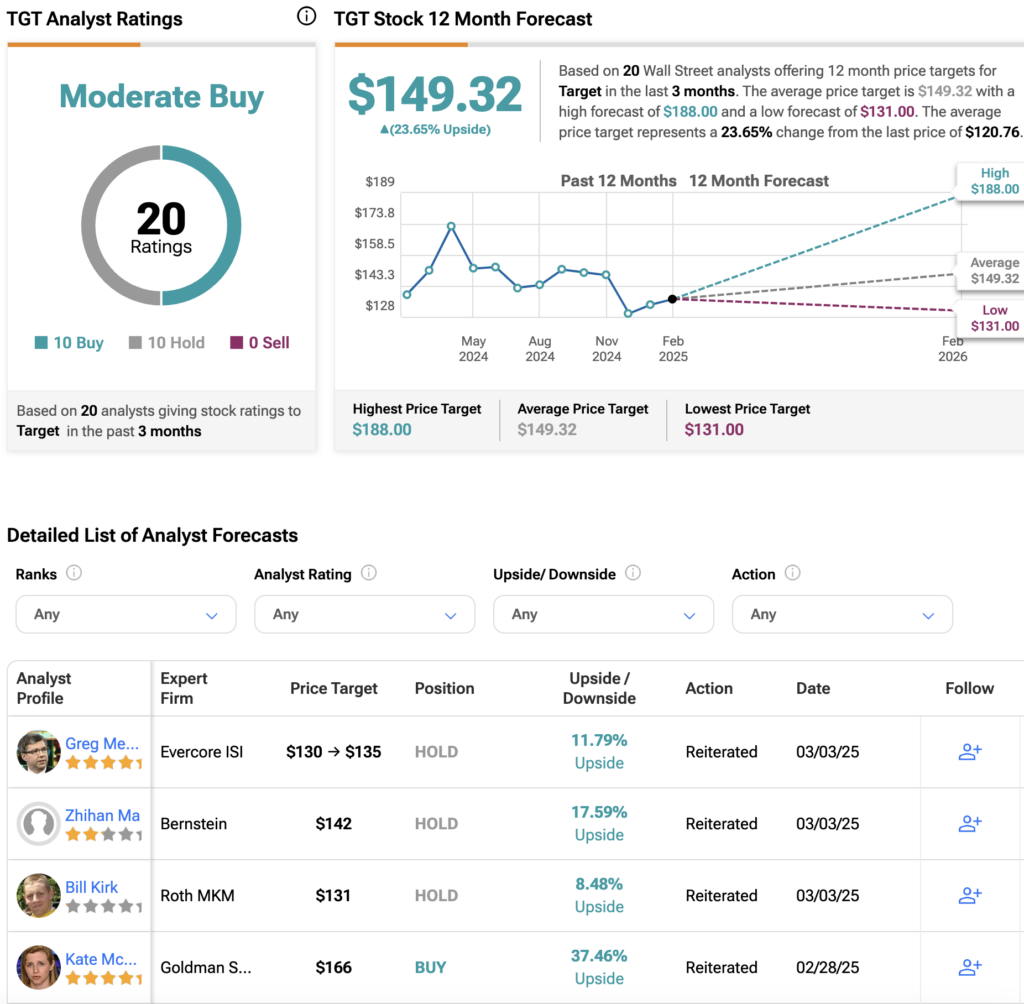

Wall Street has a Moderate Buy consensus rating on TGT stock, based on ten Buys and ten Holds. The average TGT price target of $149.32 implies about 23% upside though figures are liable to be revised following the earnings update.