Shares of Target (TGT) plunged in pre-market trading after the company slashed its Q4 forecast and reported disappointing Q3 results. The retailing giant’s adjusted earnings plummeted by 11.9% year-over-year to $1.85 per share, below consensus estimates of $2.30 per share.

TGT’s Sales Expand through the Digital Channel

Furthermore, the company’s revenues inched higher by 1.1% year-over-year to $25.6 billion in the third quarter. This fell short of Street estimates of $25.87 billion. In addition, the retailer’s comparable sales increased by 0.3% in the third quarter.

Interestingly, more than 80% of the retailer’s sales originated through its stores while 18.5% of sales originated through its digital channels. In comparison, 16.8% of its sales had originated through the digital channel in the same period last year.

Target Announces Dividends and Stock Buyback

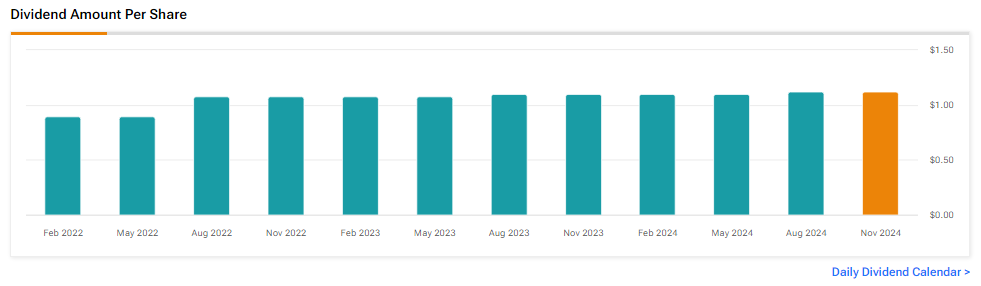

TGT has announced a quarterly dividend of $1.12 per common share for the fourth quarter payable on December 10 to shareholders of record at the close of business on November 20, 2024. Furthermore, the company bought back stock worth $354 million in the third quarter, buying back 2.4 million shares of common stock at an average price of $147.43.

TGT Lowers FY24 Outlook

Looking ahead, the company expects comparable sales to be flat in the fourth quarter while adjusted earnings are likely to be in the range of $1.85 to $2.45 per share. In addition, TGT lowered its FY24 adjusted earnings forecast to between $8.30 to $8.90 per share, compared to its prior estimates in the range of $9 to $9.70 per share. For reference, analysts expect the company to report earnings of $2.65 and $9.57 per share, in the fourth quarter and FY24, respectively.

What Is the Future of TGT Stock?

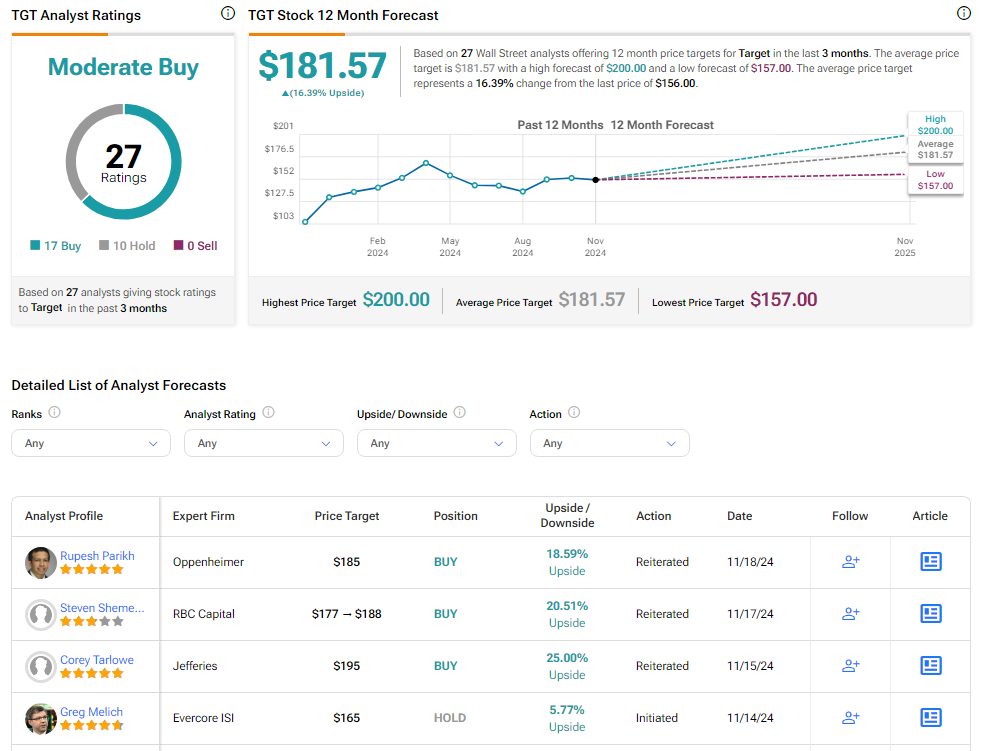

Analysts remain cautiously optimistic about TGT stock, with a Moderate Buy consensus rating based on 17 Buys and 10 Holds. Over the past year, TGT has increased by more than 20%, and the average TGT price target of $181.57 implies an upside potential of 16.4% from current levels. These analyst ratings are likely to change following TGT’s results today.