Tether, the company behind the world’s largest stablecoin USDT (USDT-USD), just made another big bet on Bitcoin. Blockchain data shows the firm added about $1 billion worth of BTC to its reserves, pushing its holdings to nearly $9.7 billion at a time when USDT supply is closing in on a record $175 billion.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The move reinforces Tether’s strategy of quietly expanding its Bitcoin and gold positions at the end of each quarter, a pattern analysts say reflects confidence in BTC as both a treasury and a hedge asset.

Tether Adds 8,889 BTC to Reserves

Arkham Intelligence data revealed that a wallet tagged “Tether: Bitcoin Reserves” received 8,889 BTC this week from a Bitfinex-linked wallet. At current prices near $113,000, the stash is worth $9.7 billion.

The latest addition continues a series of quarterly transfers. Similar moves occurred last September, in December, and in March, as Tether steadily bolsters its Bitcoin position. In June, the firm also seeded more than $1.4 billion in BTC to Twenty One Capital, the treasury firm led by Strike CEO Jack Mallers, where Tether is a lead investor.

CEO Paolo Ardoino has dismissed rumors that the company was rotating Bitcoin into gold. Instead, Tether is doubling down on BTC while still diversifying some reserves into precious metals.

Stablecoin Supply Climbs to $175B

Alongside its Bitcoin accumulation, Tether’s flagship USDT stablecoin continues to dominate the market. Supply has jumped 10.7% in the last quarter alone, now standing at $174.6 billion, according to CoinGecko data.

The growth showcases USDT’s central role in global crypto liquidity, with Tether now serving both offshore and U.S. domestic markets. Earlier this year, the company launched a U.S.-regulated arm led by former White House crypto advisor Bo Hines and introduced a separate stablecoin called USAT, designed to meet federal compliance standards.

What to Look Out for Next

Tether’s second-quarter attestation reported $8.9 billion in BTC reserves as of June. Its next report, expected in late October, will provide updated numbers and more detail on reserve composition.

Analysts say the combination of swelling USDT supply and aggressive Bitcoin accumulation cements Tether’s influence in both the stablecoin and crypto reserve markets. But it also raises recurring questions about concentration risk and how Tether’s balance sheet could affect Bitcoin’s price cycles.

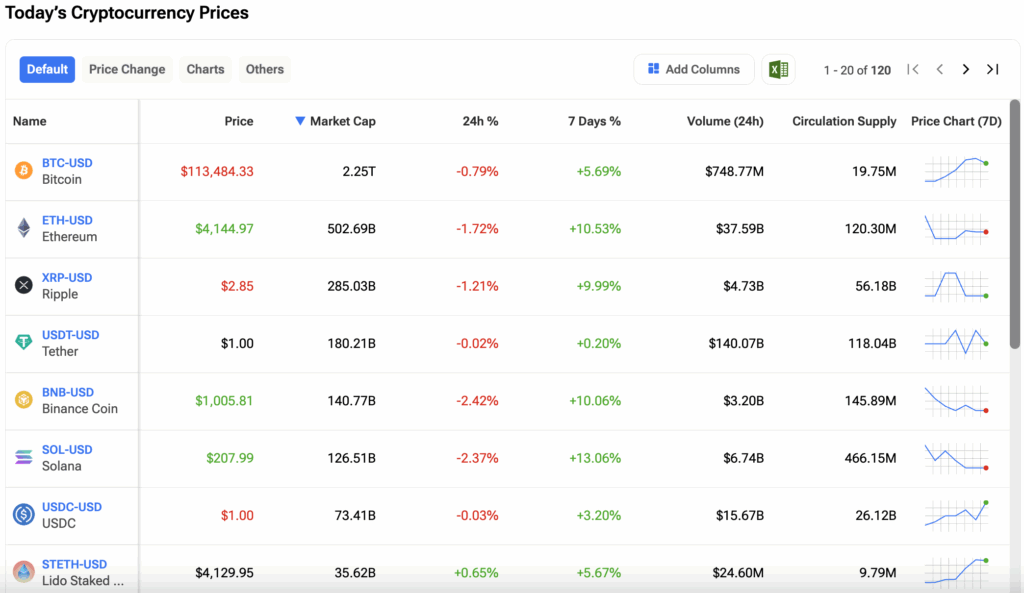

Investors can track the prices of their favorite cryptos on the TipRanks Cryptocurrency Center. Click on the image below to find out more.