Tether (USDT-USD) is weighing a U.S.-specific stablecoin for the first time — a big shift for the world’s most traded crypto token, which hasn’t historically accepted American customers. The rethink comes as the Trump administration signals it’s ready to open the floodgates for new crypto players.

Tether Responds to Trump’s Regulatory Pivot

In an exclusive interview by The Financial Times, Tether CEO Paolo Ardoino said the company is actively engaged in U.S. stablecoin discussions. He said Trump’s team sees stablecoins as “an important instrument for the United States” and wants draft rules ready by August.

“If the new rules make U.S. domestic stablecoins competitive, there could be an interest from Tether to create a domestic stablecoin in the U.S.,” Ardoino said. It would serve as “basically a settlement currency.”

Tether currently has $144 billion in tokens circulating globally but doesn’t onboard U.S. users.

Tether Claims Deep Ties With U.S. Law Enforcement

In the same FT interview, Ardoino pushed back on Tether’s longstanding reputation as a go-to tool for illicit finance. He claimed the company works directly with U.S. agencies, including the FBI and Secret Service.

“We don’t wait for court orders to act,” he said. “We actually have a direct connection with law enforcement.”

High Rates Fueled $13B in Profits

Despite lacking audited financials, Tether reported a record $13 billion in net profit last year, mostly from interest on U.S. Treasuries backing its reserves. Ardoino confirmed to the FT that Tether is in talks with Big Four firms for its long-promised audit.

“It’s just two months,” he said, referring to Trump’s time back in office. “But it’s crazy.”

Circle Watches Closely as Stablecoin War Brews

Tether’s potential move puts pressure on rival Circle (USDC-USD), which just filed for an IPO. According to company disclosures, Circle made $1.66 billion in revenue last year — but net income fell to $156 million. Meanwhile, costs tied to partners like Coinbase jumped sharply.

If Trump’s regulatory U-turn holds, the U.S. stablecoin market could become the next heavyweight fight. Tether looks ready to step in the ring.

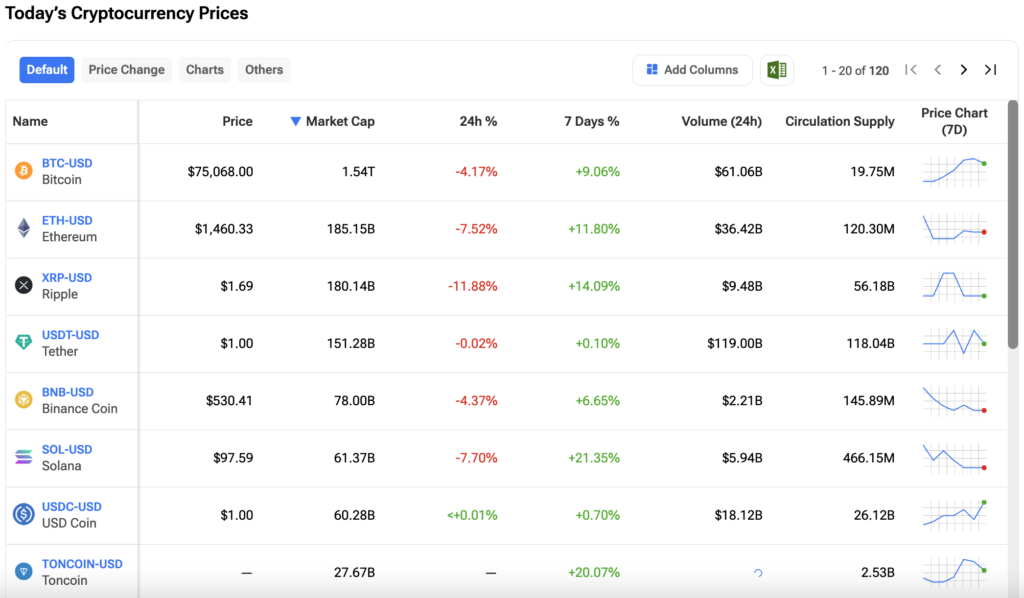

Investors can keep abreast of how these events impact market sentiments and track their favorite cryptocurrencies on TipRanks. Click on the image below to find out more.