Tesla’s (TSLA) self-driving tech is the backbone of the company’s ambitious $1.3 trillion market cap target. Piper Sandler analyst Alexander Potter puts it bluntly: “Tesla’s full self-driving (FSD) software is the largest contributor to our price target,” which is set at $400 per share. While TSLA’s stock has been surging, the tech behind it isn’t quite ready for the fully autonomous future investors are hoping for. As the stock climbs, the real question is whether Tesla can deliver on its robotaxi dreams, or if its self-driving tech will remain just that—dreams.

Tesla’s Falling Car Sales Fuel Investor Confidence in TSLA’s Self-Driving Future

Tesla’s first-quarter numbers were far from stellar, with only 337,000 cars delivered—a 13% drop from the previous year, marking the worst quarterly performance in the company’s history. Yet, despite these setbacks, TSLA’s stock has soared nearly 50% in the last 12 months, driven largely by belief in the potential of Tesla’s self-driving future. As Potter highlighted, Tesla’s full self-driving (FSD) software is the key driver behind the company’s bold $400 price target, a testament to investor faith that the technology will ultimately be huge in the automotive world.

However, the reality of that future is still a ways off. FSD currently requires human intervention in around 6% of rides, highlighting the gap between the promise of autonomous vehicles and what the technology can actually deliver. Tesla’s FSD v13, released in December, has yet to receive major updates, leading some analysts to question whether the company’s self-driving ambitions can meet the high expectations fueling its stock price.

Will Tesla’s Robotaxi Dream Turn Into a Reality?

Tesla is aiming for a robotaxi launch in Austin this summer, but the road to full autonomy is still unclear. The company has been working on mapping systems to help its cars handle tricky features like hidden stop signs, but FSD still can’t complete a ride without needing a human hand on the wheel. As Potter noted, “The current version of FSD isn’t ready for prime time.”

As the summer launch nears, it’s clear that Tesla’s self-driving future may take longer to materialize than anticipated.

Is Tesla a Buy, Hold, or Sell?

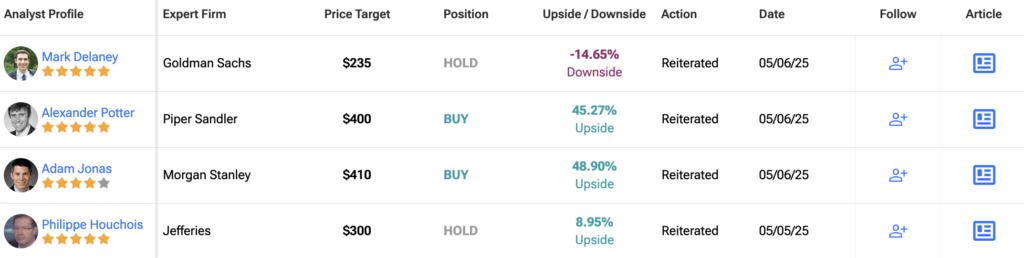

Right now, Tesla is in the “Hold” zone, according to the latest analyst ratings. With 37 analysts weighing in over the past three months, the breakdown is 16 “Buy” ratings, 10 “Hold,” and 11 “Sell.” The average 12-month price target for TSLA sits at $284.23, giving it a modest upside of 3.22% from its current price of $275.35. On the optimistic end, analysts have a high target of $450, while the more cautious predictions dip as low as $115.

So, what does this all mean for investors? Well, it’s not a strong recommendation to jump in, but it’s not time to bail either. The range of ratings suggests a wait-and-see approach. With its stock holding steady and a mixed outlook, analysts aren’t convinced it’s the perfect moment for a bold buy or sell decision. For now, it’s a “Hold.”