Tesla, Inc. (TSLA), the leading EV maker in the U.S., has lost 7% of its market value this year amid challenging industry conditions, inflationary pressures, and the phasing out of EV subsidies in key markets such as China. Amid these challenges, the company’s AI division released its product roadmap yesterday, boosting its investment appeal as it aggressively invests in Full Self-Driving technology, commonly referred to as FSD. I am bullish on the prospects for Tesla stock as I believe the company’s technological investments will lead to robust earnings growth in the long term.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Tesla Unveils an Exciting Release Roadmap

A key component of my bullish stance for Tesla is the company’s AI investments focused on Full Self-Driving. In yesterday’s roadmap, Tesla made several big announcements, including the launch of FSD in Cybertrucks later this month and upgrading the technology in October to include park and reverse features. Perhaps the most important announcement yesterday was the release of global FSD launch timelines. Tesla plans to introduce FSD in Europe and China in the first quarter of 2025, marking a new business phase for the company.

Tesla’s Aim for Margin Expansion

Tesla slashed the price of its FSD software from $12,000 to $8,000 last April, and Tesla owners can also subscribe to FSD software on a monthly basis for $99/month. The new features are expected to be rolled out this month, and the global launch of FSD in Q1 2025 is likely to boost FSD software sales and subscriptions, paving the way for higher gross profits and margins, as these products carry high margins.

The aforementioned margin expansion potential becomes clearer after evaluating the profit margins of Tesla cars. In 2023, Tesla’s average gross profit per vehicle was $8,431. Since software sales will directly trickle to the bottom line, Tesla is poised to book a profit of around $8,000 from direct sales of FSD software, almost as much as the profit the company generates by selling a car.

According to Deepwater Asset Management, Tesla is on track to earn $102 billion in annual operating profits by selling FSD software and subscriptions by 2032, compared to total operating profits of just $8.8 billion in 2023. This massive profitability potential highlights the importance of a global launch of FSD to capture market share before competitors, such as its Chinese rivals BYD Company Limited (BYDDF), establish themselves in this market.

The Robotaxi’s Expected Market Growth

In addition to the exciting FSD features scheduled to be launched soon, my bullish stance for Tesla is also buoyed by the upcoming robotaxi launch on Oct. 10 in Los Angeles. The company initially planned to introduce its first robotaxi prototype last month. Still, CEO Elon Musk had to delay the launch, citing additional work required to bring more prototypes to the market.

Robotaxi are expected to be a major growth driver for Tesla in the long run. According to research firm Markets and Markets, the global robotaxi industry, valued at a meager $400 million in 2023, is expected to grow at a stellar CAGR of 91.8% until 2030, boosting the market value to almost $46 billion. Frost & Sullivan also believes the robotaxi industry will grow in leaps and bounds in the next decade, with the fleet of robotaxis expected to eclipse 724,000 by 2035.

Robotaxi’s Influence on Tesla’s Margins

This massive growth of the robotaxi market will reflect the increasing safety features of fully autonomous driving technologies, with Tesla being the frontrunner in this space. Growing regulatory support will also play a key role in adopting robotaxis. Examples include passing the UK Automated and Electric Vehicles Act, pilot robotaxi programs launched in Beijing with government support, and the robotaxi trials announced in Dubai.

Tesla, as a leading technology company in the autonomous driving market, is well-positioned to benefit from the expected adoption of robotaxis. Cathie Wood’s Ark Invest, in a research note published last July, predicted Tesla stock to hit a high of $2,600 by 2029 with 90% of Tesla’s enterprise value and earnings expected to consist of the robotaxi business. According to Ark, 63% of Tesla’s revenue in 2029 will be attributable to the robotaxi business.

These rosy predictions for Tesla’s stock hinge on the success of its robotaxi business, which makes the upcoming prototype launch next month an important milestone for the company and its shareholders.

Tesla Faces Stiff Competition in China

Although I am bullish on the long-term prospects for Tesla at a time when the company is gearing up to launch FSD features in global markets, I am wary of the increasing competition Tesla faces in China, the largest market for EVs in the world. According to the South China Morning Post, XPeng Inc. (XPEV) is the current market leader in China for autonomous driving, with the company offering semi-autonomous driving nationwide since July. In addition, XPeng is offering its Navigation Guided Pilot system, comparable with Tesla’s FSD system, free of charge to car buyers, unlike Tesla, which requires a subscription or a lump sum payment to access FSD.

Is Tesla a Buy, According to Wall Street Analysts?

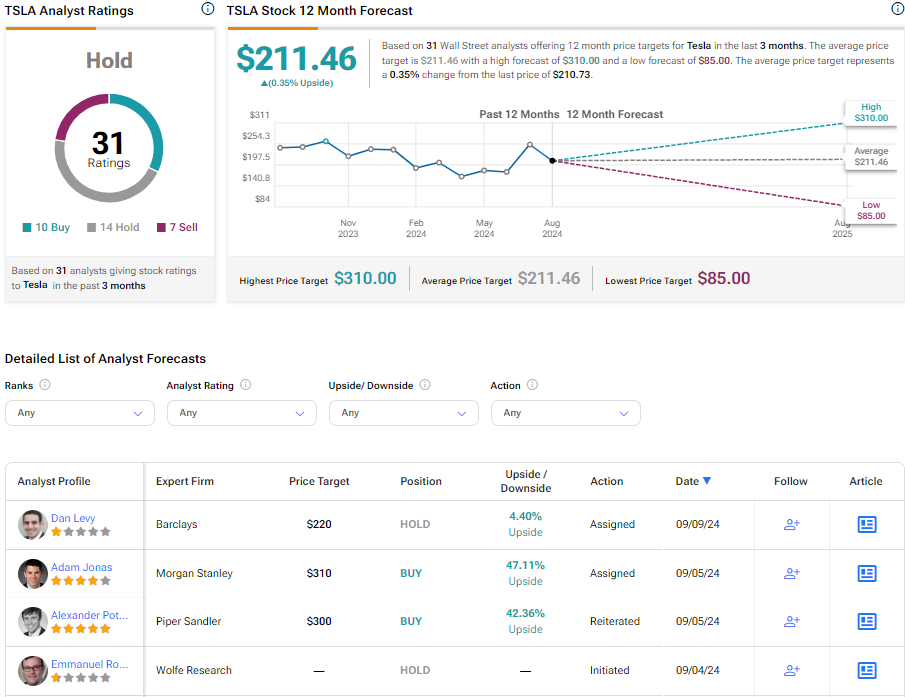

Although Tesla’s competitive positioning in China needs to be monitored carefully, many Wall Street analysts share my positive sentiment toward Tesla, including Morgan Stanley (MS) analyst Adam Jonas, who reiterated Tesla as his top pick among U.S. automakers after digesting the company’s AI product release roadmap yesterday. The analyst has a Tesla price target of $310. In addition, Wedbush Securities analyst Dan Ives believes Tesla is the most undervalued AI player in the market, with the potential to reach a $1 trillion valuation in the foreseeable future.

Based on the ratings of 31 Wall Street analysts, the average Tesla price target is $211.46, which implies an upside of 0.35% from the current market price.

I believe the company, in the long run, is likely to trade at much higher stock prices once its investments in FSD and robotaxis start yielding results.

Takeaway

Tesla’s updated product release roadmap reveals the company is on track to expand its FSD features globally in the first quarter of 2025, marking a major milestone for adopting autonomous driving. This announcement is critical for the company as it prepares to launch the first robotaxi prototype in early October. These new product launches will position Tesla as a leading player in the global AI sector, not just an EV maker. The company seems to enjoy a long runway to grow, aided by the rollout of these new technologies as they open the doors for Tesla to gain exposure to new end markets.