Tesla Inc. (TSLA) is once again under scrutiny after the U.S. National Highway Traffic Safety Administration (NHTSA) received new complaints about faulty door handles on some of its vehicles. According to Bloomberg, the complaints surfaced shortly after NHTSA opened an investigation in mid-September into possible defects affecting Tesla’s 2021 Model Y SUVs.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

In a letter dated October 27, NHTSA told Tesla that more owners had reported door handles not working due to faults in the car’s low-voltage battery. In some cases, the issue kept people, including children, from getting out of the car, raising safety concerns.

NHTSA Widens Its Tesla Investigation

The agency has now widened the probe to include other vehicles, such as the 2017–2022 Model 3 sedans and 2020–2022 Model Y SUVs. NHTSA has asked Tesla for data on customer complaints and any reports of crashes, fires, injuries, or deaths linked to door problems.

The regulator also requested information about any lawsuits or legal cases related to faulty doors or locks. The investigation began on September 15 after nine owners filed complaints, and seven more were added soon after.

Safety Concerns Add to Regulatory Pressure

The investigation comes as NHTSA increases its scrutiny of Tesla’s safety systems, following earlier probes into Autopilot and braking performance. The new complaints about door handle failures add to the list of safety issues that regulators are watching closely.

Tesla has not yet responded to the latest inquiry. However, the investigation could increase regulatory pressure at a time when the company is working to grow its electric vehicle production and maintain investor confidence.

Is Tesla a Good Stock to Buy?

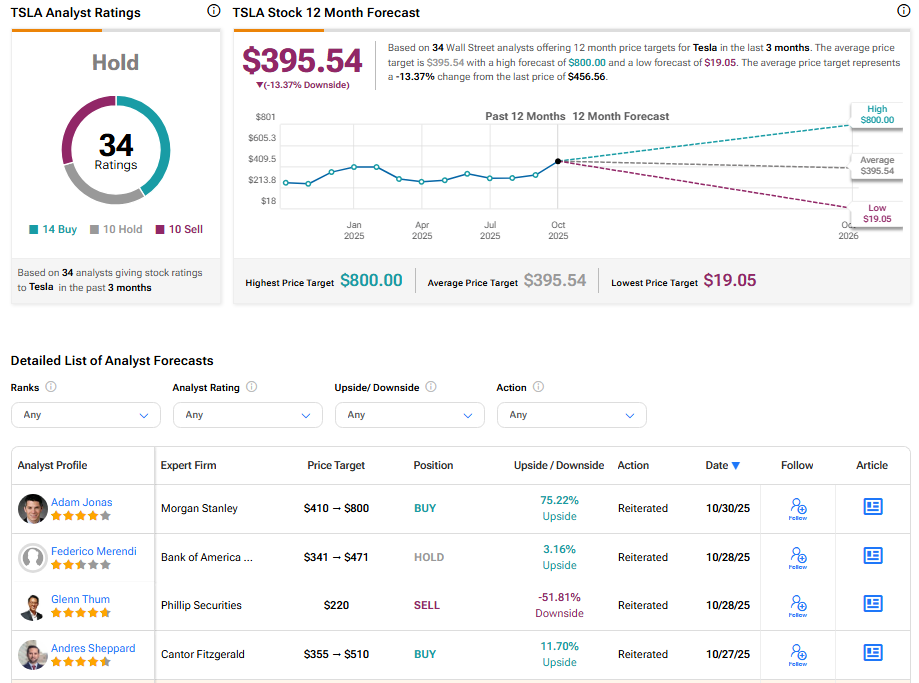

According to TipRanks, TSLA stock has received a Hold consensus rating, with 14 Buys, 10 Holds, and 10 Sells assigned in the last three months. The average price target for Tesla shares is $395.54, suggesting a potential downside of over 13.37% from the current level.