The rally in Tesla (TSLA) shares since the election of Elon Musk ally, Donald Trump, to the White House is truly remarkable. However, I fear the stock is simply overpriced and it has become very hard to justify the valuation given uncertainties around new business, namely robotaxis and the Optimus humanoid robot program. What’s more, the stock is now trading at a huge premium to its average share price target. For these reasons, I’m bearish on TSLA stock.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Tesla’s Outrageous Valuation

The primary reason I’m bearish on Tesla is its valuation, which puts huge pressure on the company to deliver outstanding growth. Tesla’s valuation remains one of the most extreme in the market, supported by incredibly bullish investor sentiment but challenged by underlying fundamentals. Despite a strong market presence in electric vehicles (EVs) and a track record for innovation, Tesla’s valuation data highlights a stark disconnect with traditional financial fundamentals and the broader market.

Tesla’s Non-GAAP trailing 12 months (TTM) price-to-earnings (P/E) stands at 162.2 times, a staggering 945.9% above the sector median of 15.5 times. Even with forward-looking projections, the stock is expensive — the forward Non-GAAP P/E of 156.8 times exceeds the median by 775.2%. Moreover, Tesla’s five-year average P/E reveals a similar disconnect, with the current valuation deviating 18.1% from its historical baseline.

This means that the stock continues to trade far beyond traditional valuation models. Even its forward price-to-earnings-to-growth (PEG) ratio of 19.1 shows Tesla’s forward valuation is extraordinarily high, with no clear path to profitability justifying such multiples. These figures suggest that Tesla’s valuation is driven more by market sentiment, which has gone into overdrive since Donald Trump’s election, than realistic financial performance. As markets recalibrate, Tesla’s valuation likely remains vulnerable.

Tesla’s Robotaxi Delays

In order to justify its valuation, Tesla needs some serious catalysts. But unlike Tesla bulls, I’m bearish because I’m increasingly concerned about the robotaxi project. Tesla’s lofty valuation is heavily anchored in its growth narrative, particularly the anticipated success of its self-driving vehicle program, i.e. the robotaxi. That business plan represents a revolutionary leap — autonomous electric vehicles deployed en masse on a shared, ride-hailing basis — projected to generate enormous revenue streams.

However, production of the robotaxi is not expected until 2026, creating a gap between investor expectations and operational reality. Moreover, despite this promising vision and some unique technological innovation, competition is heating up. This poses risks to Tesla’s dominance. Competitors like Alphabet’s (GOOGL) Waymo autonomous driving unit are advancing their self-driving technology and testing self-driving vehicles in real-world settings. This may result in a narrowing of Tesla’s proposed technological lead in the space.

Additionally, I’m bearish on Tesla’s growth expectations in its core electric vehicle unit with the fall of Biden-era subsidies and competition, especially from China. Companies like Xiaomi (XIACY) are intensifying their presence in the market, leveraging affordable electric vehicle production to capture market share. As a result, Tesla’s market position is eroding both in terms of robotaxi ambition and conventional electric vehicle competition.

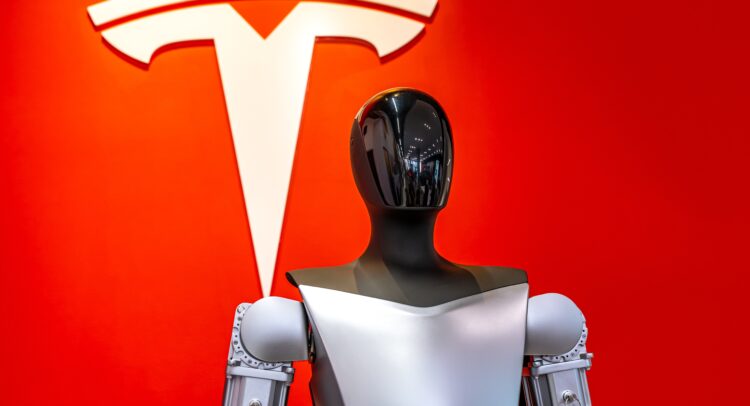

Tesla’s Optimus Robot

Many Tesla shareholders are excited about the prospect of the Optimus humanoid robot, representing one of the company’s most intriguing technological frontiers. But here too I remain skeptical and bearish. Unveiled as part of Elon Musk’s vision for Tesla to extend beyond electric vehicles, Optimus is designed to be a general-purpose humanoid robot capable of performing a variety of physical tasks in homes, factories, and workplaces. Musk has said that the robot could push Tesla’s valuation to $25 trillion, noting a possible 10% share of the world’s future market for domestic robots.

While its potential is vast, the robot remains far from widespread deployment. This once again introduces execution risk and it will be a concern for any investor looking to buy this very expensive stock. Currently, Optimus is still in the prototype phase, and while its capabilities have shown promise, it’s evident that commercial production is still years away. Tesla has talked of production for internal use in 2025 and then rollout to other companies from 2026.

Robotics is a nascent and untested product category for most companies, and Tesla is entering a market with significant technological, ethical, and operational hurdles. This is a concern for me, and I believe the development timeline could prove longer than anticipated, given the complexity of creating a robot that can safely and effectively operate in real-world environments. Nonetheless, I don’t doubt the overall advantage of humanoid robots. I simply don’t have the courage to invest in a stock that is trading with significant multiples for a promise of future robots.

Is Tesla Stock a Buy?

On TipRanks, TSLA stock comes in as a Hold based on 11 Buys, 13 Holds, and nine Sell ratings assigned by analysts in the past three months. The average TSLA price target of $244.88 implies 35% downside risk potential.

Read more analyst ratings on TSLA stock

The Bottom Line on TSLA Stock

I’m bearish on TSLA stock because the valuation seems unsustainable given uncertain future prospects. The company faces significant challenges in justifying its lofty market cap, with delays in robotaxi development and intense competition in the electric vehicle market. While the Optimus robot project shows potential, it remains in early stages and carries substantial execution risks. Finally, with analysts projecting a 35% downside and the stock trading at a premium to targets, investors should exercise caution.