EV maker Tesla (TSLA) delivered a major surprise in the third quarter by reporting a record 497,099 global vehicle deliveries, far above the 439,800 that was expected by analysts and up from 462,890 a year earlier. This surge in demand was likely due to the last-minute push from U.S. buyers looking to take advantage of the soon-to-expire $7,500 federal EV tax credit. In addition to vehicle deliveries, the company also posted global production of 447,450 units and deployed a record 12.5 gigawatt-hours of energy storage.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Interestingly, Tesla wasn’t the only automaker to benefit from the tax credit deadline. Indeed, General Motors (GM), Ford (F), and Rivian (RIVN) also saw strong EV sales during the quarter. However, industry leaders, such as Ford CEO Jim Farley, are already warning that EV sales could be cut in half going forward. Tesla CEO Elon Musk also had similar worries earlier this year when he cautioned that the company could face a “few rough quarters” as it holds off on launching more affordable EVs until after the tax credits are gone.

Tesla Struggles in Europe

While Tesla saw an increase in demand in the U.S., it struggled in Europe. In fact, according to data from the European Automobile Manufacturers’ Association, Tesla’s EV registrations in Europe dropped by 22.5% year-over-year in August, even as the broader EV market grew nearly 27%. Some of this decline may be tied to increased competition and political backlash toward Musk.

Nevertheless, investors are still optimistic, thanks to the excitement around AI and autonomous vehicles, which led to a more than 30% surge in its share price during September.

What Is the Prediction for Tesla Stock?

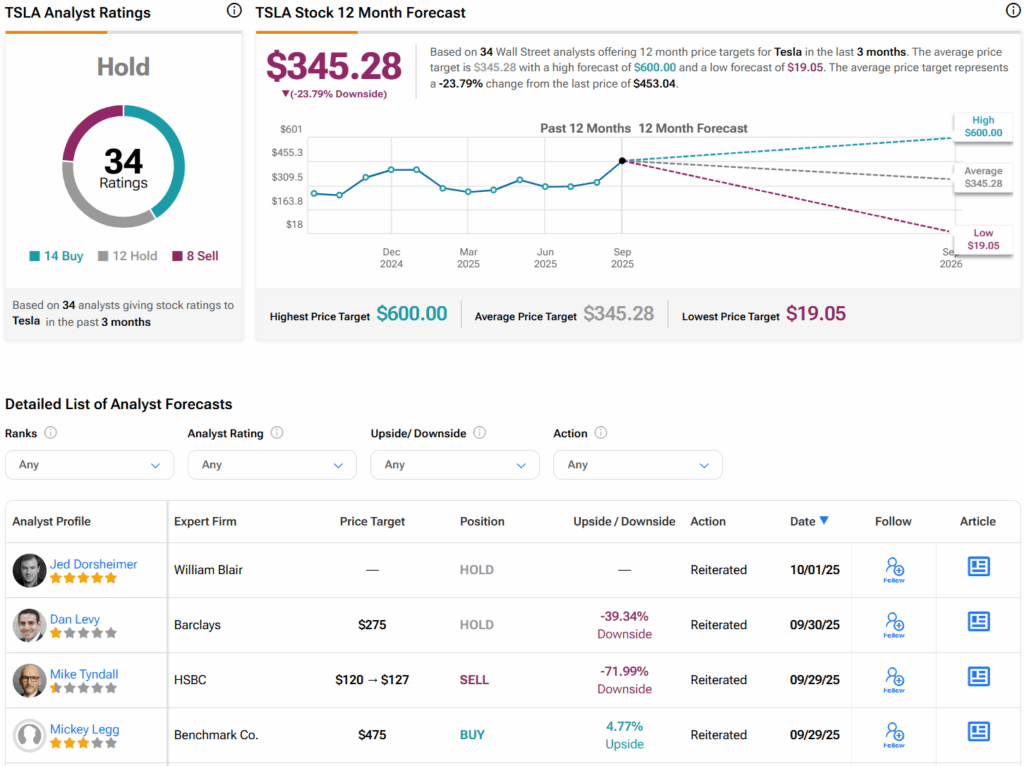

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 14 Buys, 12 Holds, and eight Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average TSLA price target of $345.28 per share implies 23.8% downside risk.