Tesla (NASDAQ:TSLA) CEO Elon Musk opposes tariffs. At a conference, Musk expressed his preference for no tariffs and stated that his company doesn’t require government incentives to compete in China. However, Tesla’s dwindling sales show he needs them, at least in the foreseeable future.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

Before we dig deeper, it’s worth noting that President Biden imposed a 100% tariff on EVs imported from China. This would put substantial barriers in place for leading Chinese EV makers like NIO (NYSE:NIO), BYD (NASDAQ:BYDDF), and Li Auto (NASDAQ:LI) to enter the U.S. market.

Competition Hurting Tesla

Coming back to Tesla, the company is struggling to drive volumes and sales due to multiple headwinds, including heightened competition, especially in the Chinese market. Tesla’s delivery volumes fell 8.5% year-over-year in Q1. Moreover, its total automotive revenue fell 13% year-over-year, reflecting lower volumes and a decline in average selling price.

Musk warned during the Q4 2024 conference call that, without the establishment of trade barriers, Chinese EV manufacturers could severely undermine other car companies globally.

The justification for potentially raising tariffs stems from concerns over China’s dominant position in EV production and the sector’s overcapacity, which pose a threat to jobs and the domestic auto industry in the U.S. Furthermore, BYD has already overtaken Tesla as the top global seller of EVs. Consequently, without tariffs and TSLA’s aging car fleet, Chinese EV manufacturers could give it a run for their money in the U.S. market.

Is Tesla a Buy, Sell, or Hold?

Tesla stock is down about 30% year-to-date due to lower sales and margins. The EV giant is focusing on introducing new models, including more affordable versions, to reaccelerate growth. Additionally, Tesla aims to cut vehicle costs to bolster margins. However, ongoing demand weakness and heightened competition may continue to present challenges in the near term.

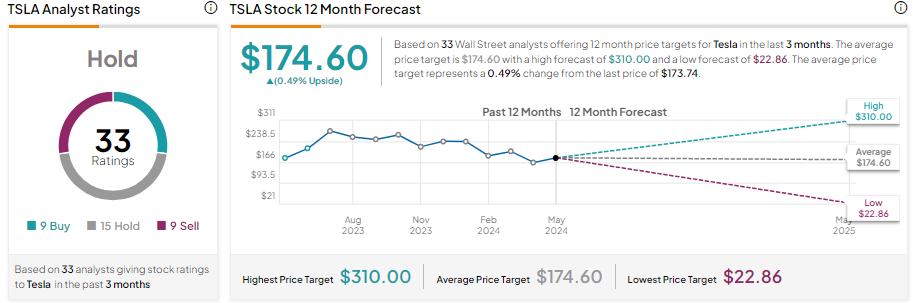

Given the short-term headwinds, Wall Street remains sidelined on TSLA stock. It has nine Buy, 15 Hold, and nine Sell recommendations for a Hold consensus rating. The average TSLA stock price target of $174.60 implies about 0.49% upside potential from current levels.