Tesla’s (TSLA) presence in Europe’s electric vehicle (EV) market is waning. In April, the company’s new car registrations across the European Union, the UK, and the European Free Trade Association (EFTA) countries fell by 49% year-on-year, totaling 7,261 vehicles. This decline marks the fourth consecutive monthly drop, reducing Tesla’s market share to 0.7% from 1.3% a year earlier.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

This sharp drop stands in stark contrast to the EU’s growing electric vehicle market. Electrified vehicles—comprising battery electric vehicles (BEVs), plug-in hybrids (PHEVs), and hybrid electric vehicles (HEVs)—accounted for 59.2% of passenger car registrations in the EU in April, up from 47.7% the previous year. Registrations grew across the board, with BEVs up 26.4%, PHEVs up 7.8%, and HEVs seeing a 20.8% rise.

Yet Tesla, once synonymous with EV innovation, is now trailing as competitors seize the momentum.

Chinese Carmakers Gain Speed as Tesla Stalls

Chinese rivals like BYD (BYDDY) (HK:1211) and SAIC Motor are rapidly expanding their footprint in Europe. SAIC Motor’s registrations grew by 24.5% in April, while Mitsubishi saw a 22.1% increase. In contrast, Mazda experienced a 24.5% decline in registrations. At the same time, BYD, a prominent Chinese EV maker, surpassed Tesla in European sales for the first time in April, registering 7,231 BEVs compared to Tesla’s 7,165.

Competitive pricing and targeted marketing have helped Chinese brands carve out growing market share, even as legacy European automakers race to defend their turf.

Musk’s Political Shadow Adds to Tesla’s EU Troubles

Tesla’s troubles in Europe go beyond pricing and competition. The company is also facing image issues linked to its CEO, Elon Musk. His involvement with the Department of Government Efficiency (DOGE) and rising political profile have sparked criticism in some parts of Europe.

In response to growing worries from investors and buyers, Musk recently said he would cut down on his political activity and spend more time on Tesla’s core operations. While this is seen as a step to win back trust, some doubt whether it will be enough to turn around Tesla’s falling sales in Europe.

What Is the Prediction for Tesla Stock?

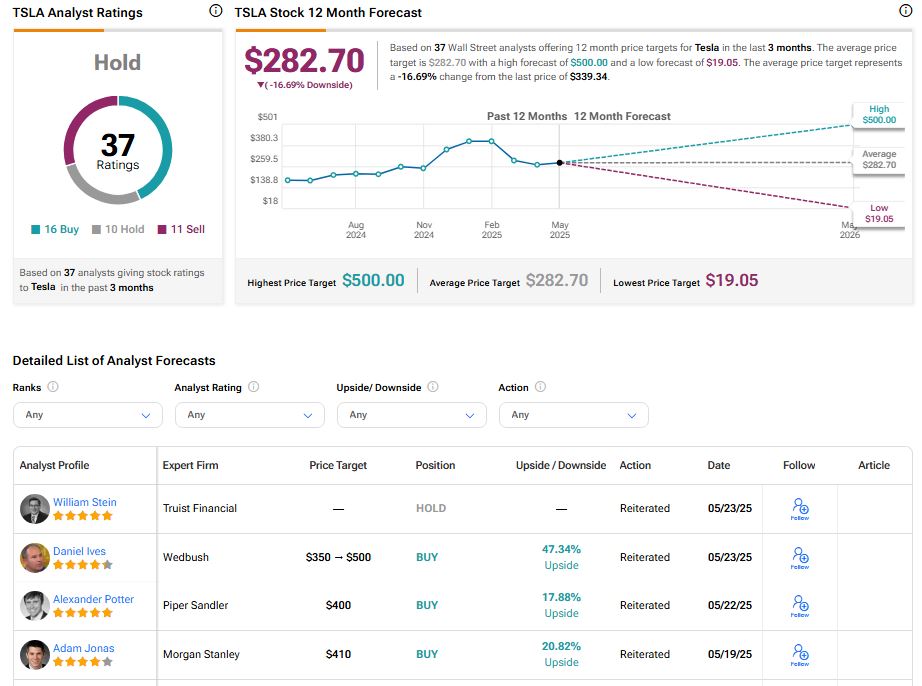

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 16 Buys, 10 Holds, and 11 Sells assigned in the past three months, as indicated by the graphic below. Furthermore, the average TSLA price target of $282.70 per share implies 16.69% downside risk.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue