Tesla (TSLA) investors are on edge as the company prepares to release its third-quarter delivery and production numbers on Thursday. Meanwhile, Chinese rivals XPeng (XPEV), Xiaomi (XIACF), and Nio (NIO) reported record deliveries in September, highlighting intensifying competition in the EV market. Tesla stock rose more than 3% over the past five trading days, bringing its four-week gains to 35%. In pre-market trading on Wednesday, TSLA is down 0.92%.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Chinese EV Players Deliver Record Sales

In September, XPeng delivered 41,581 EVs, up 10.3% from August and 94.7% year-over-year, marking its third consecutive monthly record. Overall, Q3 deliveries surged 149.3% year-over-year to 116,007 EVs. Meanwhile, Xiaomi’s September deliveries surpassed 40,000 units for the first time.

Xiaomi directly competes with Tesla in China, with its SU7 sedan consistently outselling the Model 3, and the new YU7 crossover competing with the Model Y. XPeng, on the other hand, isn’t a direct Tesla rival like Xiaomi. However, it still competes in Tesla’s mainstream EV market.

Additionally, Nio (NIO) set a new monthly record in September 2025, delivering 34,749 vehicles, marking a 64.1% year-over-year increase. For Q3 2025, NIO delivered 87,071 vehicles, marking a 40.8% increase compared to the same quarter last year.

Will Tesla Outperform Q3 Delivery Forecasts?

Analysts and market watchers are optimistic that Tesla will report strong Q3 2025 delivery numbers, potentially surpassing expectations. Estimates range from approximately 447,000 to 475,000 vehicles, driven by factors like the expiration of the $7,500 U.S. EV tax credit and ramped-up production of the refreshed Model Y.

Meanwhile, the Kalshi prediction market projects that Tesla’s Q3 deliveries could reach a record 509,000 vehicles. For context, Kalshi is a regulated prediction market platform where users can trade “event contracts” based on the outcome of future events.

Furthermore, analysts are optimistic that strong Q3 deliveries could boost Tesla’s stock. Over the past two weeks, six analysts have raised their price targets on TSLA.

What Is the Price Target for Tesla Stock?

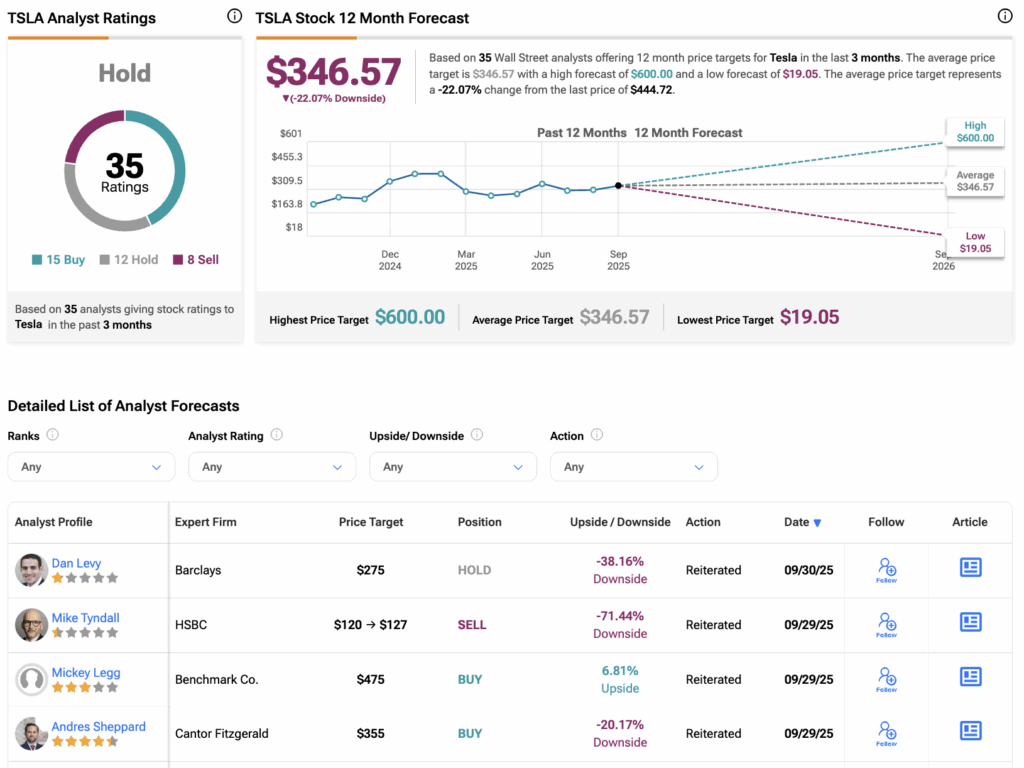

According to TipRanks, TSLA stock has received a Hold consensus rating, with 15 Buys, 12 Holds, and eight Sells assigned in the last three months. The average Tesla stock price target is $346.57, suggesting a potential downside of over 20% from the current level.