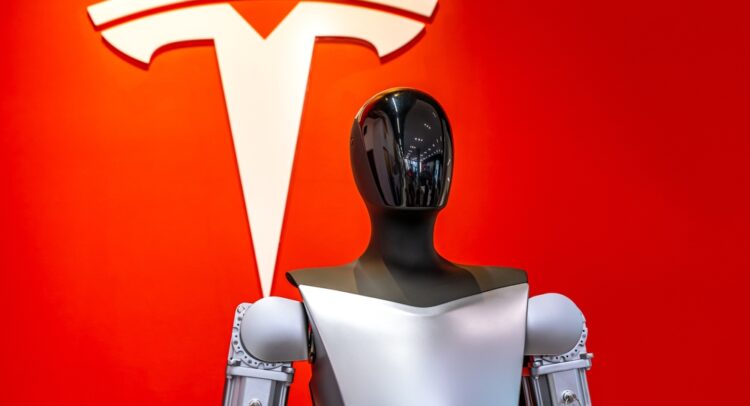

Tesla (TSLA) is facing production delays in its Optimus humanoid robot project. The company had planned to build 5,000 units in 2025, but has only produced a few hundred. According to reports, the main issue is the robot’s hand and arm components, which remain underdeveloped, leaving many units incomplete on factory floors. Tesla stock is down 21% year-to-date.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Optimus Faces Delays Amid Technical and Leadership Setbacks

During the company’s second-quarter earnings call, CEO Elon Musk acknowledged the challenges and scaled back expectations. He now expects production of the updated Optimus 3 model to begin in early 2026. Musk still sees long-term potential, calling the goal of one million units per year within five years “a reasonable aspiration.” He added that he would be “shocked” if Tesla is not producing 100,000 units per month by 2030.

Production was paused in mid-June to address hardware issues. Joint motors have been overheating, and current batteries often fall short in terms of durability. The robot’s hands, a critical piece for dexterity, lack the strength and reliability needed for repetitive tasks. Tesla is testing new materials and working with multiple suppliers to find a solution.

Leadership turnover has also slowed momentum. Milan Kovac, who ran the program, left in June. Ashok Elluswamy, previously head of Tesla’s Full Self-Driving division, is now leading the effort. In related news, earlier in June, Tesla filed a lawsuit against one of its former engineers and his robotics startup, accusing them of stealing trade secrets related to the design of the Optimus hand.

Tesla is counting on new business lines as its core automotive segment faces pressure. The company reported a 12% decline in revenue and a 16% drop in vehicle sales for Q2 2025. U.S. EV tax incentives are fading, and competition from General Motors (GM), Hyundai (HYMLF), and others is growing. Tesla is betting on robotics and AI to drive future growth, but for now, Optimus remains a long-term play.

Is Tesla a Buy, Sell, or Hold?

On the Street, Tesla currently boasts a Hold consensus rating from Wall Street analysts based on 35 reviews. The average price target stands at $314.14, suggesting a potential downside of 0.61%.