It was supposed to be Tesla’s masterstroke. Instead, it has become a master detour. According to an exclusive Reuters report, Elon Musk’s Tesla (TSLA) quietly backtracked on its ambitious plan to repurpose leased cars as the foundation of a future robotaxi fleet. Customers in the U.S. were banned from buying their leased Model 3 vehicles at the end of term.

Confident Investing Starts Here:

- Quickly and easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks straight to you inbox with TipRanks' Smart Value Newsletter

Why? Because Tesla planned to call them home for autonomous service. That grand plan never materialised. Instead, Tesla cashed in and sold many of the cars, often upgraded with premium software, to new buyers.

Musk Plots Robotaxi Takeover then Pivots To Sales

The original plan had all the classic Musk drama. Back in 2019, he declared over a million Teslas would be driving themselves by the following year. Tesla even forced lessees to return cars with the promise they would become the robotic workhorses of a new mobility empire. But that dream hit a brick wall of reality.

With no robotaxi fleet on the horizon, Tesla pivoted fast. It flipped those returned vehicles straight into the resale market. Many came fitted with the pricey “Full Self-Driving” option, which costs up to $15,000. Others had an “acceleration boost” bolted on. The upgrades gave Tesla a tidy profit and kept used car buyers reaching for their wallets.

Tesla Keeps Hype Alive while Regulators Circle

Selling the cars was clever business. It also kept the illusion alive. Investors kept believing Tesla was just inches away from launching the world’s first robotaxi fleet. The dream helped hold up Tesla’s towering stock valuation even as full autonomy remained out of reach.

But the U.S. National Highway Traffic Safety Administration (NHTSA) is not buying the dream so easily. The agency has asked Tesla for more details on its robotaxi plans and specifically how those cars would handle bad weather and unpredictable road conditions.

Tesla’s detour is a classic Silicon Valley story: big ambition, even bigger roadblocks. On paper, a robotaxi army sounded like the next moonshot. In practice, selling the cars straight to buyers proved faster and far less risky.

Is Tesla a Buy, Sell, or Hold?

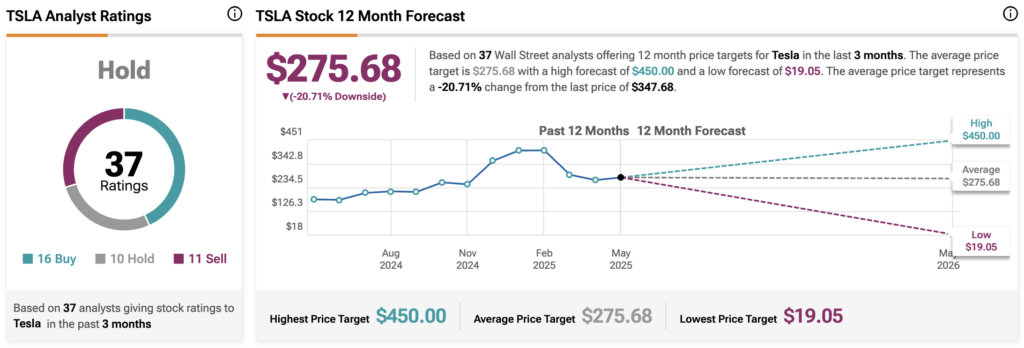

According to the TipRanks, Tesla stock is deemed a Hold from 37 analysts. The split says it all. 16 analysts call it a Buy, 10 sit on Hold, and 11 have slapped it with a Sell recommendation.

The average 12-month TSLA price target sits at $275.68, which implies a worrying 20.71 percent downside from the current price of $347.68. The most optimistic price target stretches to $450.00, while the lowest estimate plunges to just $19.05.

That chasm between bull and bear sums up Tesla’s current predicament. Investors remain torn between believing Musk will still deliver big or fearing the robotaxi dream has already veered wildly off course.