Tesla (NASDAQ:TSLA) has seen its prospects dim in recent months, with global sales tumbling, a trend that appears to have persisted through the second quarter. Tesla’s sales in China for the quarter are running approximately 10,000 units behind the same period last year, even with record incentives and the new Model Y already in full-scale production. In Europe, the latest data has shown that Tesla sales continue to plummet in the region.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

However, Wedbush analyst Daniel Ives is sanguine about all that. He thinks that with Elon Musk having now recommitted to Tesla with the promise to cut back on his controversial government work, the company can move on from the “black cloud” that has hung over the story.

While Ives concedes that challenges remain in reigniting Model Y growth in China and Europe, he believes investors are now primarily focused on the AI revolution at play for Tesla, which makes it “one of the best pure plays on AI over the next decade.”

So, it’s time to look ahead to the future, where the “golden age of autonomous” awaits just around the corner. That’s because the robotaxi service is about to launch in Austin, Texas, next month.

Ives reckons that the AI and autonomous driving opportunity alone could be worth at least $1 trillion for Tesla. Under the Trump administration, the analyst anticipates that these initiatives will be significantly accelerated, as the complex regulatory hurdles that Musk and his team have faced around FSD and autonomy are likely to be substantially reduced. In a bullish scenario, Ives believes Tesla’s market cap could reach $2 trillion by the end of next year.

“The $1 trillion of AI valuation will start to get unlocked in the Tesla story and we believe the march to a $2 trillion valuation for TSLA over the next 12 to 18 months has now begun in our view with FSD and autonomous penetration of Tesla’s installed base and the acceleration of Cybercab in the US representing the golden goose,” Ives opined.

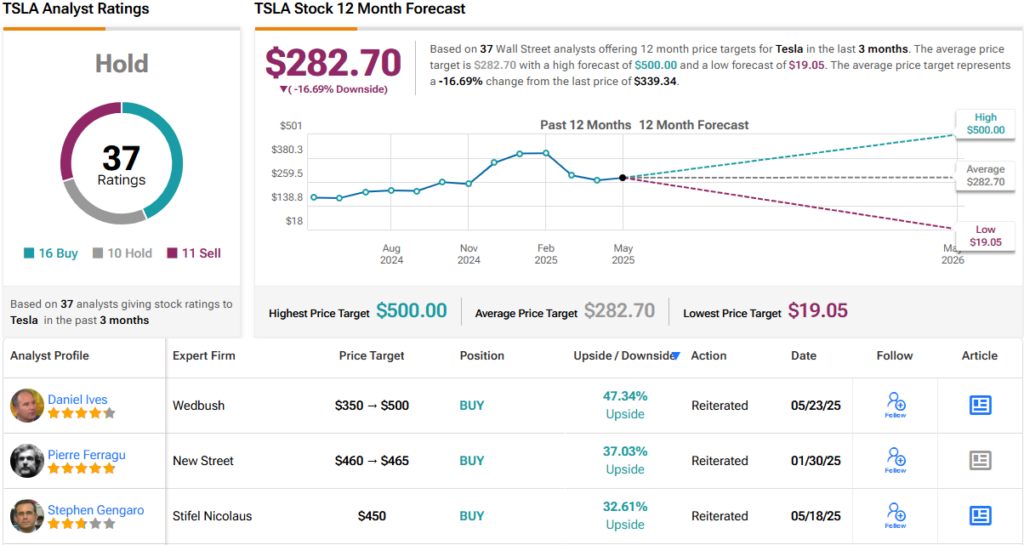

Citing a “massive stage of valuation creation ahead,” Ives has raised his price target from $350 to a Street-high $500, forecasting a potential 47% gain. The analyst keeps his Outperform (i.e., Buy) rating firmly in place. (To watch Ives’ track record, click here)

Of course, not all analysts share his enthusiasm. While 15 others back Tesla with Buy ratings, there are also 10 Holds and 11 Sells on file, all coalescing to a Hold (i.e., Neutral) consensus rating. Going by the $282.70 average price target, the stock will decline by ~17% over the next year. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue