Canaccord Genuity analyst George Gianarikas raised his price target on Tesla (TSLA) by a notable 47%, ahead of the electric vehicle maker’s Q3 delivery update. He maintained a “Buy” rating on TSLA, raising the price target from $333 to $490, implying 10.6% upside potential from current levels.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Gianarikas is a top analyst on TipRanks, ranking #889 out of 10,050 analysts tracked. He has a 48% success rate and an average return per rating of 14.80%.

Gianarikas Expects a ‘Positive Break in Trend’

Tesla is set to release its Q3 auto deliveries this Thursday. According to data from FactSet, Tesla is expected to report Q3 2025 deliveries of around 448,000 vehicles, down about 3% from the 463,000 cars sold in Q3 2024.

Before raising the price target, Gianarikas reassessed Tesla’s delivery trends, new product launches, and energy storage prospects. His recent checks from across 30 countries showed higher delivery estimates, signaling a “positive break in trend” after several quarters of sluggish growth.

He believes management’s commitment to new models could be a catalyst, boosting global sales momentum and helping offset losses from the expiration of U.S. tax credits after Q3. He noted these new models could be “interesting,” urging investors to look forward to their launches.

Energy Storage Unit Is Poised for Higher Momentum

Gianarikas is highly optimistic about Tesla’s energy storage business. He anticipates stronger momentum driven by accelerating demand from utilities and hyperscale data centers. He added that “energy storage will play a meaningful role in behind-the-meter solutions” as reliance on the power grid declines.

He also cited Elon Musk’s recent adoption of alternative on-site power for his xAI facility as a trend, while cautioning about potential environmental risks linked to such projects.

Furthermore, Gianarikas highlighted the importance of Musk’s new compensation package, which sets ambitious long-term targets while ensuring his continued leadership at Tesla. The plan has the potential to deliver substantial shareholder returns if targets are met and could also provide investors with indirect exposure to Musk’s AI venture, xAI.

He concluded that considering Musk’s unique track record of business achievements, his commitment to the company and bold goals are seen as largely positive.

Is Tesla Stock a Buy, Hold, or Sell?

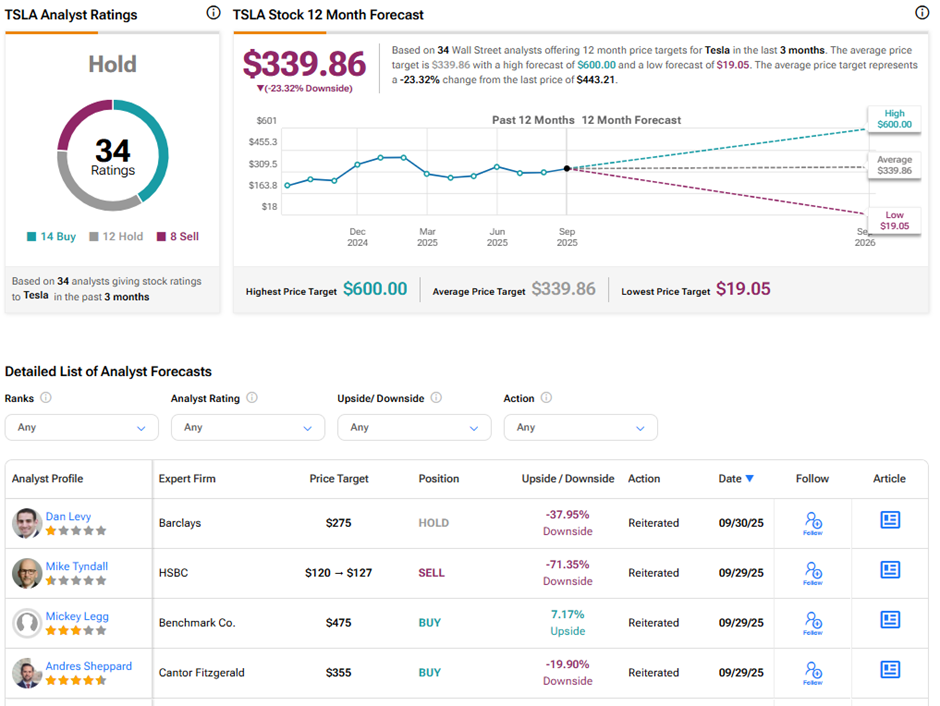

On TipRanks, TSLA stock has a Hold consensus rating based on 14 Buys, 12 Holds, and eight Sell ratings. The average Tesla price target of $339.86 implies 23.3% downside potential from current levels. Year-to-date, TSLA stock has gained 9.8%.