Tesla (TSLA) stock gained 4.1% in yesterday’s after-hours trading session fueled by CEO Elon Musk’s comments that the vehicle business would return to growth in 2025. The electric vehicle maker cited progress in autonomous driving technology and the launch of new models as key drivers of growth. Importantly, Musk’s optimistic remarks helped overshadow Tesla’s weaker-than-expected fourth-quarter results.

Invest with Confidence:

- Follow TipRanks' Top Wall Street Analysts to uncover their success rate and average return.

- Join thousands of data-driven investors – Build your Smart Portfolio for personalized insights.

Musk revealed that Tesla plans to launch new, cheaper EV models in the first half of 2025, built on its existing platforms and production lines. While details on pricing and size remain undisclosed, this move reflects Tesla’s intent to compete more effectively in the mass market segment.

Further, he mentioned that Tesla will begin testing a paid autonomous car service in Austin, Texas, by June 2025. Also, testing of Tesla’s Full Self-Driving (FSD) software without human supervision is planned in other states, including California, throughout the year.

Musk Says TSLA on Path to Being the “Most Valuable Company”

At the Q4 earnings call, Musk highlighted that Tesla’s investments in AI and robotics manufacturing in 2024 are likely to yield benefits in the future. He believes Tesla is on a path to become the “most valuable company” globally.

Musk noted the challenges ahead but stated that Tesla is strengthening its manufacturing lines and will continue to build on this momentum in 2025. He anticipates these efforts will pave the way for an “epic 2026” and “ridiculously good” years in 2027 and 2028.

Is TSLA Stock a Buy?

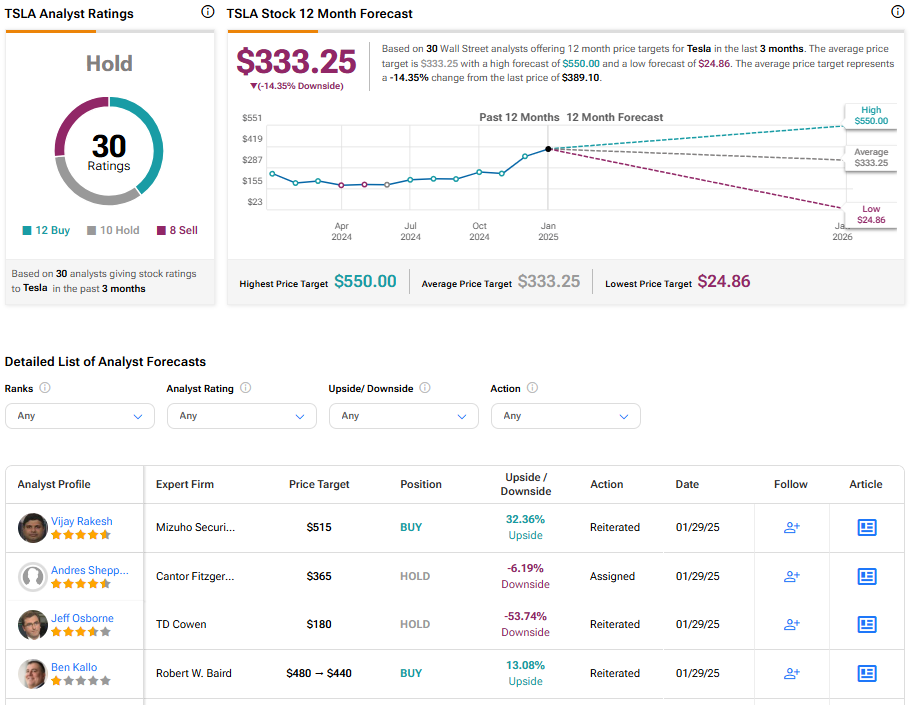

Turning to Wall Street, TSLA has a Hold consensus rating based on 12 Buys, 10 Holds, and eight Sells assigned in the last three months. At $333.25, the average Tesla price target implies a 14.35% downside potential. Shares of the company have gained 74.78% over the past six months.