Tesla (TSLA) stock was down about 2% in pre-market trading. The fall came as the EV giant’s new car sales in the United Kingdom saw a massive year-over-year drop of 62.1% in April. The company sold only 512 vehicles, resulting in a market share of just 0.43%, the lowest in two years. For reference, Tesla had sold 1,352 EVs in April 2024, capturing a 1.01% market share.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

This decline mirrors a wider trend of falling Tesla sales across major European markets. Sales plunged by 80.7% to 203 units in Sweden, the lowest monthly total since October 2022. Also, in the Netherlands, sales were down 73.8%, the biggest drop since 2022. The company further witnessed 67.2% and 59.4% drops in Denmark and France, respectively.

It must also be noted that while Tesla’s UK sales were down, overall battery-electric car registrations in Britain rose 6.9% in April.

What’s Behind the Decline?

Several factors led to Tesla’s sales slump in the region. Firstly, the company is facing rising competition from European and Chinese EV brands, which are offering cheaper alternatives. In April, Volkswagen (DE:VOW) and BYD (BYDDF) witnessed sales jump of 194% and 654%, respectively, in the UK. Also, Stellantis’ (STLA) Peugeot brand sales rose by 37.9%.

More importantly, CEO Elon Musk’s political involvement has sparked protests and vandalism at Tesla showrooms across Europe, further hurting consumer sentiment. In the past few months, some analysts said this backlash has hurt Tesla’s image, causing its market share to drop in the last few months.

Looking ahead, the revamped Model Y is expected to help Tesla regain lost ground, but it depends largely on whether the vehicle can win back customers and drive sales higher. The updated Model Y, set to begin UK deliveries in June 2025, brings new features, better efficiency, and a fresh look to keep Tesla ahead in a competitive EV market.

Is Tesla a Buy, Sell, or Hold?

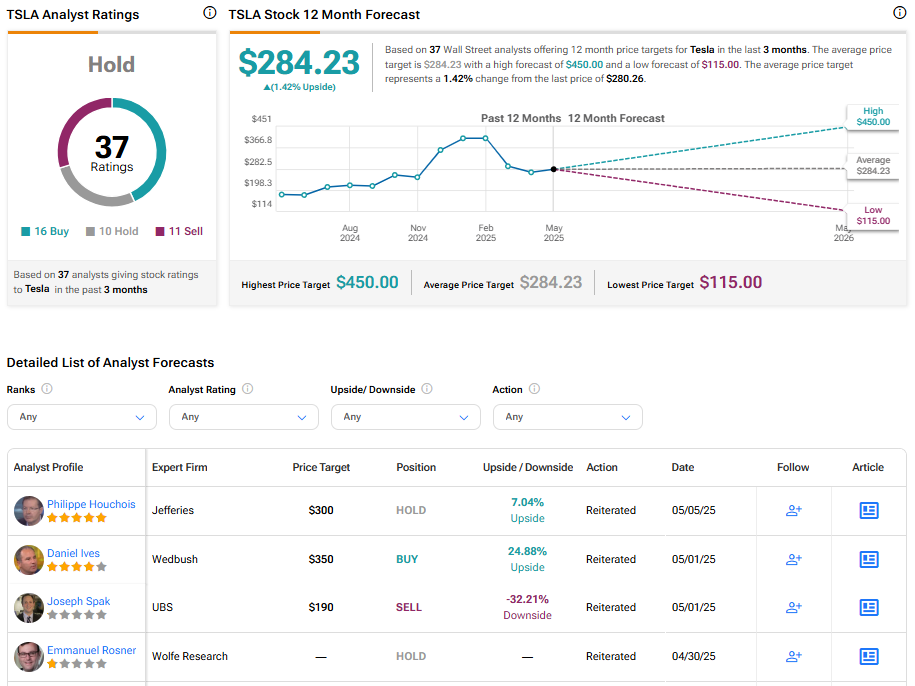

Turning to Wall Street, TSLA stock has a Hold consensus rating based on 16 Buys, 10 Holds, and 11 Sells assigned in the last three months. At $284.23, the average Tesla price target implies a 1.42% upside potential.