Shares in Tesla (TSLA) rose early Monday, although the American electric vehicle maker is expected to have sold about 9% fewer vehicles in 2025. Throughout the year, overall U.S. auto sales defied regulatory uncertainty, including the ending of federal EV credit cuts in September.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

U.S. auto sales rose 2% in 2025 to about 15.6 million units, including gas-powered trucks, sport-utility vehicles and hybrids.

General Motors to Lead U.S. Vehicle Sales in 2025

According to data from automotive services firm Cox Automotive, Tesla’s vehicle sales are anticipated to fall 8.9% in 2025 to reach 577,097 units. In the last quarter of 2025, the automaker is projected to have sold 125,937 vehicles, marking a 22.4% fall from the same period last year.

By contrast, General Motors (GM) is predicted to lead the market by selling about 2.8 million vehicles in the year, marking a 5.1% rise. This is expected to be followed by Toyota (TM) with about 2.5 million units, and then Ford (F) with about 2.07 million. This marks 8.4% and 5.6% rises, respectively, for the latter two.

China’s BYD Overtakes Tesla in Global Vehicle Deliveries

Already, Tesla has reported its second consecutive year of global sales decline, as it delivered 1.64 million autos in 2025. As a result, Chinese top BYD (BYDDY), which sold 2.26 million battery-electric vehicles in 2025, has overtaken Tesla as the best-selling EV brand globally.

In October, Tesla saw record global vehicle deliveries for its third-quarter, as buyers rushed to snap deals before the expiration of the U.S. federal EV tax credit in September. However, the momentum appears to have been short-lived.

General Motors is expected to report higher sales in 2025 despite taking a $1.6 million charge in October due to “strategic realignment” of its electric vehicle manufacturing capacity. Ford in December also announced a $19.5 billion write-down on its balance sheet with plans to shelve several of its planned electric vehicle models, including the F-150 Lightning pickup.

President Donald Trump’s anti-climate campaign, including plans to loosen fuel economy standards, has seen automakers plan a strategic shift towards gas-powered and hybrid vehicles.

What Are the Best EV Stocks to Buy?

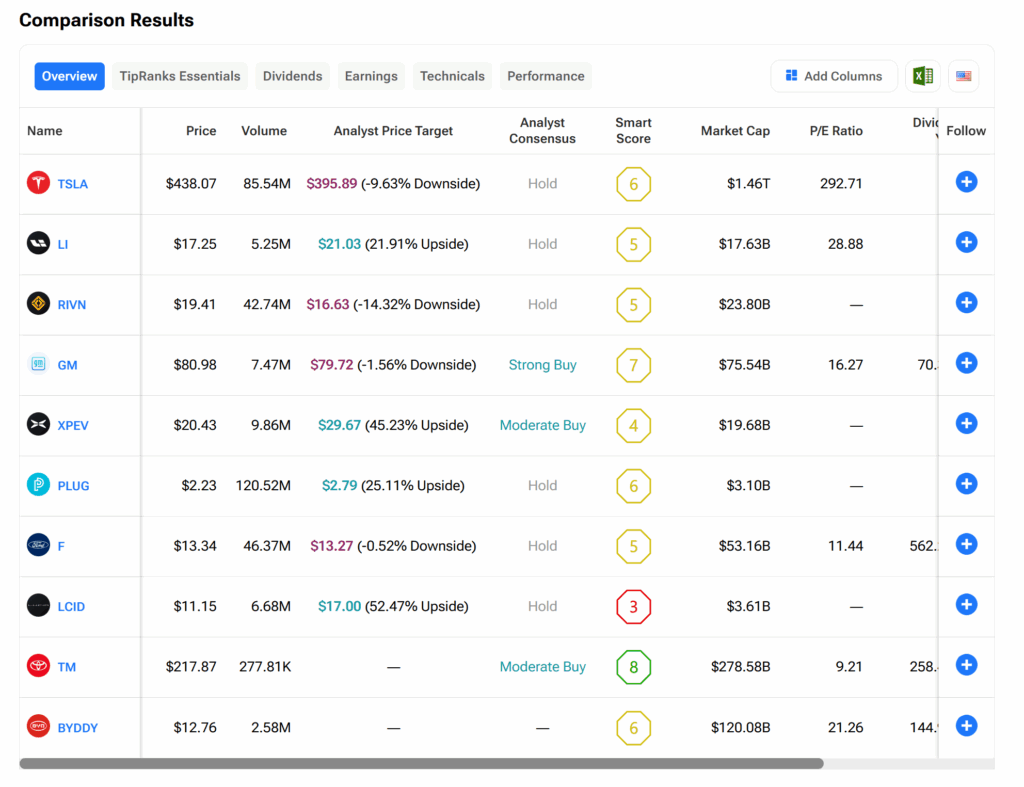

Using the TipRanks Stock Comparison tool, investors can compare the stocks of several electric vehicle makers and other types of automobile manufacturers. Please see the image below.