Tesla’s (TSLA) stock dropped nearly 6% yesterday, following President Donald Trump’s announcement of a 25% tariff on foreign-made vehicles. Meanwhile, Elon Musk, the CEO of the electric vehicle (EV) maker and a close ally of Trump, warned of “significant” impacts from the tariffs. Trump also mentioned that Musk did not express his opinion on the policy because “he may have a conflict” of interest with his own vehicle company. Additionally, Tesla stock took a beating from the news of a 40% year-over-year decline in European sales for February.

Musk Says Tariffs to Have “Significant” Impact

Following Trump’s announcement, Musk said on his social media platform X that Tesla is “NOT unscathed” by the tariffs and that the impact would be significant. He explained that although Tesla domestically manufactures all the autos sold in the U.S., it imports many parts, such as electrical components and batteries from China. Therefore, the tariffs will affect the prices of these parts. In the meantime, Trump noted that the tariffs would be “good for them,” referring to automakers with domestic manufacturing and assembly plants, including Tesla.

Notably, the import taxes could hinder Tesla’s efforts to modify its ageing fleet, as well as its ambitions in the robotaxi and autonomous driving technologies. The tariffs are expected to take effect on April 2, with collections set to begin on April 3. Statistics reveal that nearly 40% of all new vehicles sold in the U.S. are imported, implying that Trump’s tariffs will play an important part in controlling the imports and boosting the domestic automobile industry. However, critics argue that the tariffs on auto imports will drive up the manufacturing costs for some automakers, ultimately increasing the prices of vehicles sold in the U.S.

What is the Prediction for Tesla Stock?

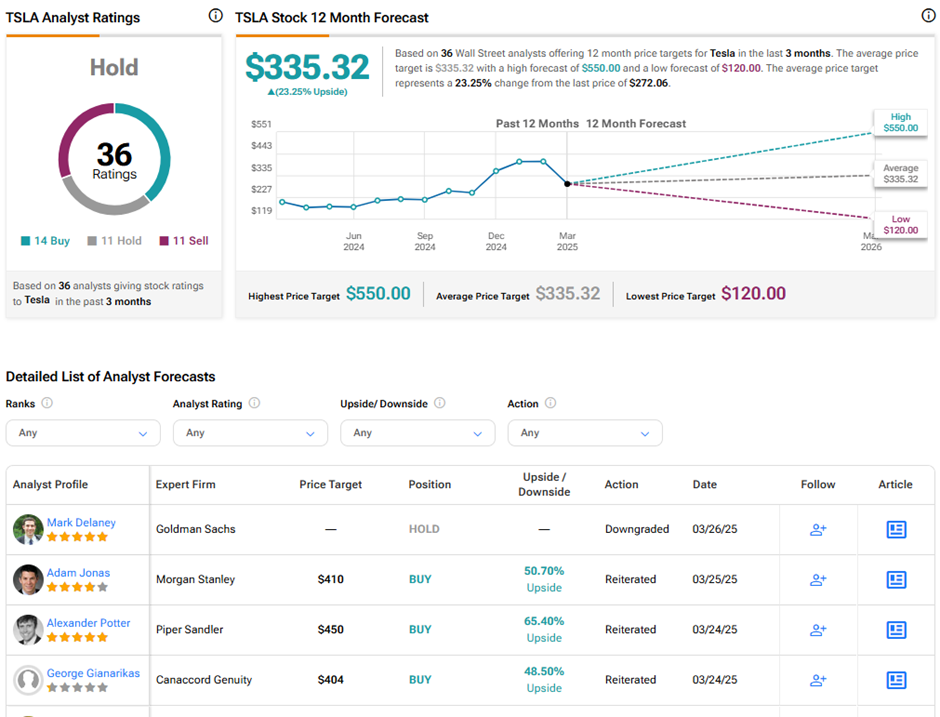

Analysts prefer to remain on the sidelines on Tesla stock currently, owing to the ongoing challenges, including declining sales and severe backlash against the CEO. On TipRanks, TSLA stock has a Hold consensus rating based on 14 Buys, 11 Holds, and 11 Sell ratings. The average Tesla price target of $335.32 implies 23.3% upside potential from current levels. Year-to-date, TSLA stock is down 32.6%.