Tesla Stock (TSLA) is eyeing a critical $500 level as market sentiment remains split between bullish and bearish investors and analysts. Traders are watching closely to see if Tesla can break above this key resistance, which could signal further upside, or if selling pressure will push the stock lower. Currently, TSLA stock is trading at $481.5, with a gain of over 40% in the last six months.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge-fund level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

What’s Happening with TSLA Stock?

Earlier this week, TSLA stock nearly reached $500, hitting $498.83 on Monday, largely boosted by Google’s (GOOGL) Waymo disruptions amid the San Francisco power outage. Additionally, stock rose as investors celebrated after the Delaware Supreme Court approved CEO Elon Musk’s controversial 2018 pay package.

However, the stock slipped on Tuesday, closing at $485.56.

Looking ahead, Tesla is set to report its fourth-quarter delivery numbers in early January 2026, which could serve as a key catalyst for the stock. Most Wall Street analysts are expecting softer results, with the consensus estimate around 440,000 vehicles, down from nearly 500,000 deliveries in Q3.

The Bearish Tone on TSLA

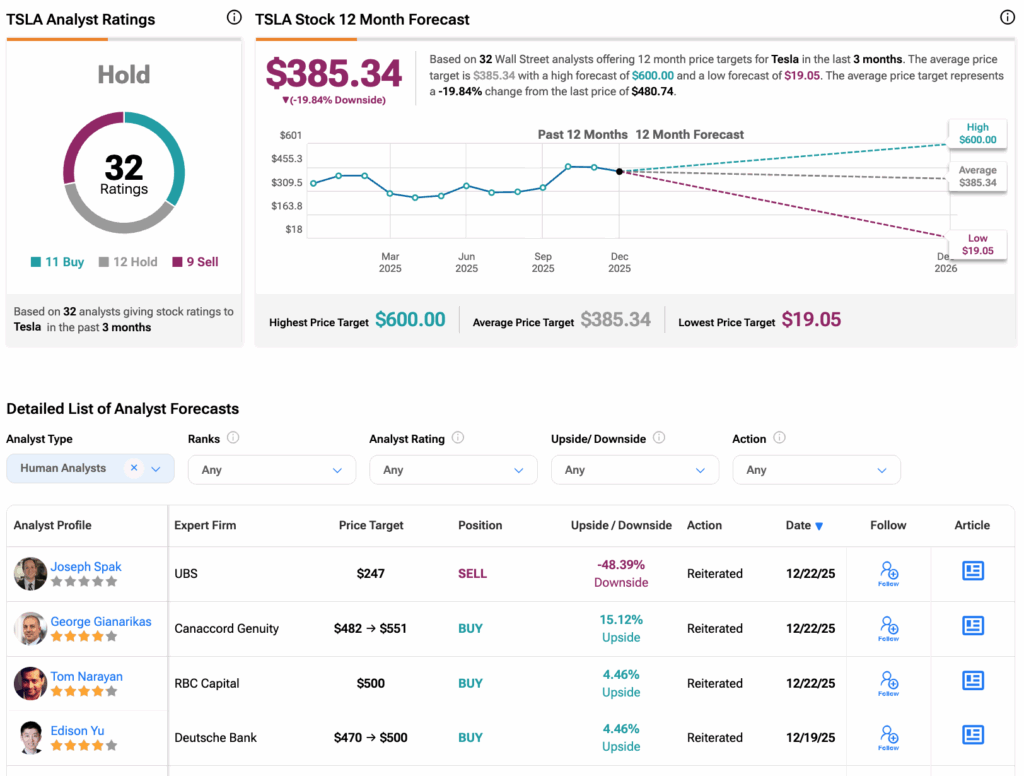

Recently, analyst Joseph Spak at UBS reiterated his Sell rating on TSLA with a price target of $247, implying a downside of 48.5% from current levels. Spark also lowered its Tesla Q4 delivery estimate from 429,000 to 415,000 vehicles. He stated that the revision reflects weaker U.S. deliveries following the expiration of the $7,500 EV consumer tax credit at the end of September.

Likewise, Morgan Stanley’s top-rated analyst Andrew Percoco cautioned that much of Tesla’s expected upside from its artificial intelligence initiatives may already be priced into the stock. Percoco has a Hold rating on TSLA with a price target of $425.

The Bullish Ones on TSLA

Four-star-rated analyst George Gianarikas at Canaccord Genuity also lowered its Tesla Q4 delivery expectations. However, he noted that the reset in the U.S. EV market is setting the stage for stronger, long-term demand. Gianarikas also highlighted that rapid EV adoption in emerging markets could support Tesla’s multi-year growth beyond the domestic market. Gianarikas reiterated his Buy rating on TSLA and raised his price target from $482 to $551.

Gianarikas also believes that any positive developments in Tesla’s Optimus humanoid robot program in 2026 could boost investor sentiment and highlight the company’s earnings potential beyond its EV business.

Meanwhile, Wedbush five-star analyst Daniel Ives has long been bullish on TSLA shares. Earlier this month, he reiterated his Buy rating with a street-high $600 price target. Ives also called 2026 a pivotal year for Tesla, predicting the successful launch of its Robotaxi service in over 30 cities, marking the beginning of the true autonomous era under Musk.

Are Tesla Shares a Good Buy?

According to TipRanks, TSLA stock has received a Hold consensus rating, with 11 Buys, 12 Holds, and nine Sells assigned in the last three months. The average Tesla stock price target is $385.34, suggesting a potential downside of 20% from the current level.