Elon Musk addressed the pay debate directly on X after a user urged shareholders to back the proposal. He said, “It’s not about ‘compensation,’ but about me having enough influence over Tesla to ensure safety if we build millions of robots.” He added, “If I can just get kicked out in the future by activist shareholder advisory firms who don’t even own Tesla shares themselves, I’m not comfortable with that future.”

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The message landed with investors who want him focused on autonomy, robotics, and manufacturing scale. Supporters argue that alignment and continuity matter as Tesla (TSLA) moves from cars to fleets of robotaxis and factory automation. Skeptics counter that the price tag is extreme and that governance safeguards should not hinge on a single executive.

What It Would Take for Musk to Cash In

If approved, Musk’s 2025 performance award could grant about 425 million option-based shares, roughly 12% of Tesla’s outstanding stock. The entire grant vests only if Tesla reaches an $8.5 trillion market capitalization. On rough math that implies a stock price near $2,700 and would make the award worth about $1 trillion.

The hurdle is towering and would require flawless execution across vehicles, energy, software, and full self-driving outcomes that translate into cash flow and margins at unprecedented scale.

Why the Vote Is Important

Tesla’s next chapter depends on capital intensity and technical risk in autonomy and robotics. Bulls see the proposed award as a high bar that pays only if shareholders are already massively wealthier. Bears focus on concentration of power, dilution risk, and whether governance should rest on financial incentives rather than clear oversight structures.

The company’s future mix of car sales, software subscriptions, energy storage, and potential robotaxi networks will determine whether the market even approaches the target embedded in the plan.

Is Tesla a Buy, Sell, or Hold?

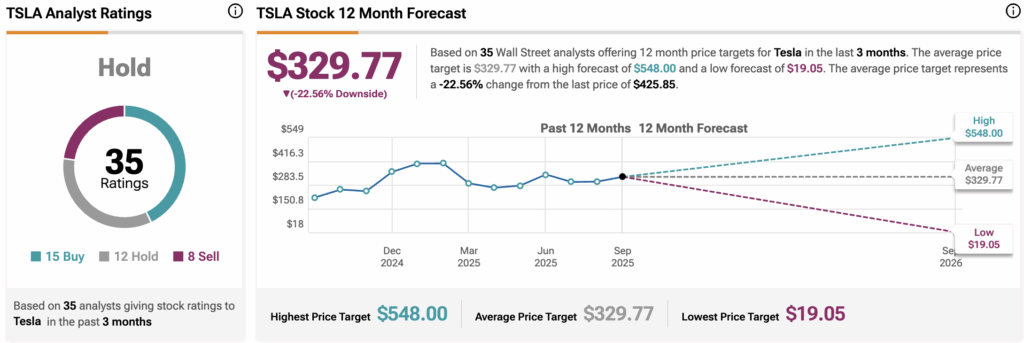

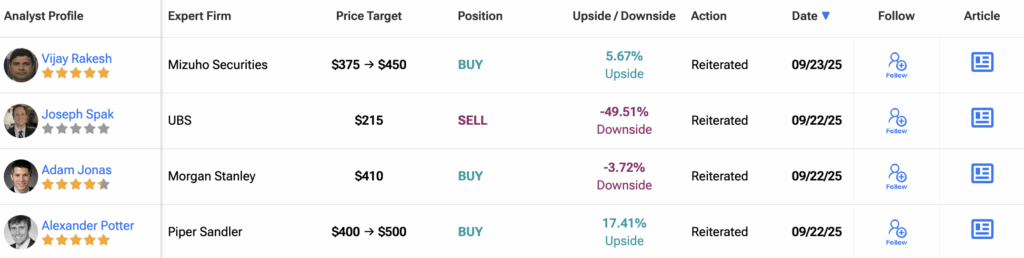

Turning to TipRanks, Tesla is still considered a Hold based on 35 ratings assigned by analysts in the last three months. The average price target for TSLA stock is $329.77, implying a 22.6% downside from the current price.