Tesla (NASDAQ:TSLA) shares plunged 14% today, marking their worst single-day drop since 2020. But the selloff had less to do with electric cars and everything to do with electric egos. What began as a policy disagreement quickly escalated into a high-stakes feud between Elon Musk and President Donald Trump.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The fallout began with the administration’s newly proposed “One Big Beautiful Bill Act,” which aims to slash clean energy incentives, including the $7,500 tax credit for electric vehicles and solar subsidies. Musk called the bill a “disgusting abomination,” warning it would set back American innovation. Trump fired back by threatening to cut off all federal contracts and subsidies for Musk’s companies, including Tesla and SpaceX, claiming the move would save “Billions and Billions of Dollars.”

Musk responded by accusing Trump of betrayal and asserting that his prior support helped Trump win the presidency. He went even further, alleging that Trump’s name appears in classified Epstein-related documents.

But beyond the personal barbs, the proposed legislation poses real financial consequences for Tesla. Analysts estimate that eliminating the $7,500 EV tax credit could shave roughly $1.2 billion from Tesla’s annual profits, nearly 19% of its earnings before interest and taxes (EBIT). On top of that, Tesla’s $2.76 billion in revenue from selling regulatory credits in 2024 is also at risk, as the bill’s rollback of clean energy incentives threatens this income stream.

Wedbush analyst Daniel Ives, who’s been bullish on Tesla for years, chimed in with his take on the situation, and offered a glimpse of where he thinks the stock could be headed next.

“The quickly deteriorating friendship and now ‘major beef’ between Musk and Trump is jaw dropping and a shock to the market and putting major fear for Tesla investors on what is ahead. This situation between Musk and Trump could start to settle down and the friendship continues but this must start to be calmed down on the Musk and Trump fronts and it’s not good for either side. This feud does not change our bullish view of Tesla and the autonomous view but clearly does put a fly in the ointment of the Trump regulatory framework going forward. It’s another Twilight Zone moment in this Musk/Trump relationship which now is quickly moving downhill,” Ives noted.

That “bullish view” comes with an Outperform (i.e., Buy) rating, and a $500 price target, which implies about 76% upside from TSLA’s current levels. (To watch Ives’ track record, click here)

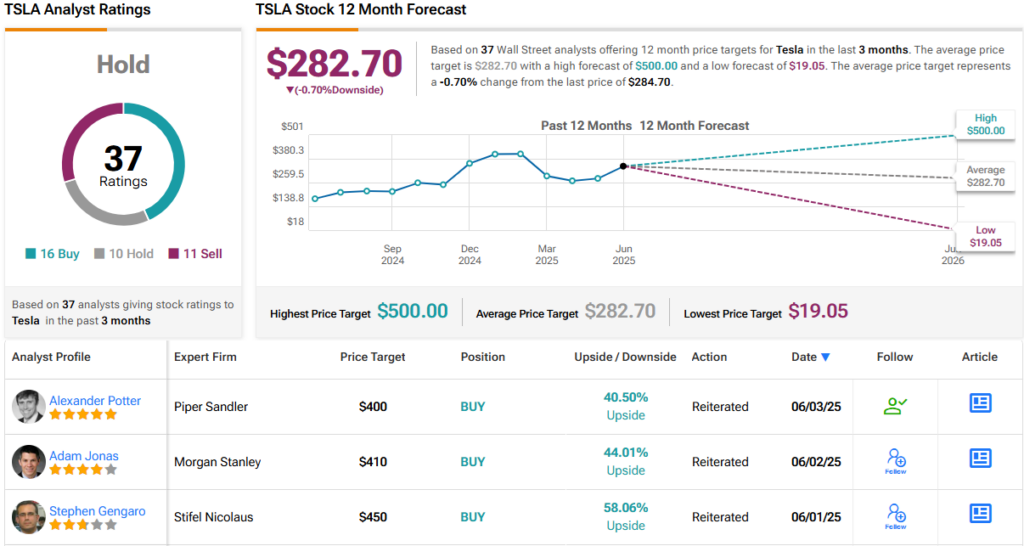

Generally speaking, however, the Wall Street analysts have a different idea. TSLA stock only claims a Hold (i.e. neutral) consensus rating, based on 16 Buy recommendations, 10 Holds and 11 Sells. Going by the $282.70 average price target, the shares will stay rangebound for the time being. (See TSLA stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.