Elon Musk used Tesla’s latest earnings call to defend his proposed $1 trillion compensation plan. He clashed with proxy advisors who urged shareholders to reject it.

Tesla Stock Plunges as Elon Musk Turns Earnings Call into a Pitch for His $1 Trillion Pay Plan

Story Highlights

Tesla stock (TSLA) plunged in early trading as Elon Musk spent the final minutes of Tesla’s third-quarter earnings call on Wednesday doing something few expected: he defended his own pay package. The Tesla CEO cut off his chief financial officer to make an impassioned plea for shareholders to approve his $1 trillion compensation plan.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

“There needs to be enough voting control to give a strong influence, but not so much that I can’t be fired if I go insane,” Musk said, as he interrupted CFO Vaibhav Taneja’s closing remarks.

The comments came after a challenging quarter for Tesla. While the company achieved record vehicle deliveries, profits fell short of Wall Street estimates. Operating income dropped 40%, and costs surged as tariffs added more than $400 million in expenses. Tesla’s operating costs rose 50% to $3.4 billion, underlining the growing pressure on its electric vehicle margins. Shares slid 3.8% in premarket trading, trimming their year-to-date gain to about 9%, behind the S&P 500’s (SPX) 14% rise.

Musk Sends Tesla’s Earnings Call Off Course

The first half of the call focused on Tesla’s push into artificial intelligence, humanoid robots, and self-driving technology. But Musk’s attention turned quickly toward his own compensation as he blasted the two influential proxy advisory firms, Institutional Shareholder Services (ISS) and Glass Lewis, both of which have recommended that investors vote against the proposal at the company’s upcoming November 6 meeting in Austin.

ISS raised “unmitigated concerns” about the “magnitude and design” of the award, while Glass Lewis warned that it could significantly dilute existing shareholders. Musk, visibly irritated, said the firms “have no freaking clue.”

“I just don’t feel comfortable building a robot army here, and then being ousted because of some asinine recommendations from ISS and Glass Lewis,” Musk said.

Tesla’s CFO Tries to Bring It Back

After Musk’s remarks, CFO Taneja tried to steer the conversation back to business, praising the special board committee that drafted the pay plan. “There’s nothing which gets passed on until shareholders make substantial returns,” he said, calling the structure “aligned with long-term value creation.” He ended by urging investors twice to support the proposal.

Musk’s influence on Tesla remains unmatched. At 54 years old, the world’s richest person, with a net worth of roughly $455 billion, according to the Bloomberg Billionaires Index, has tied much of his fortune to the company’s success.

Whether shareholders see the package as deserved or excessive will become clear in two weeks, when they cast their votes on a plan that could change up executive compensation and perhaps, once again, Musk’s own legend.

Is Tesla Stock a Buy, Hold, or Sell?

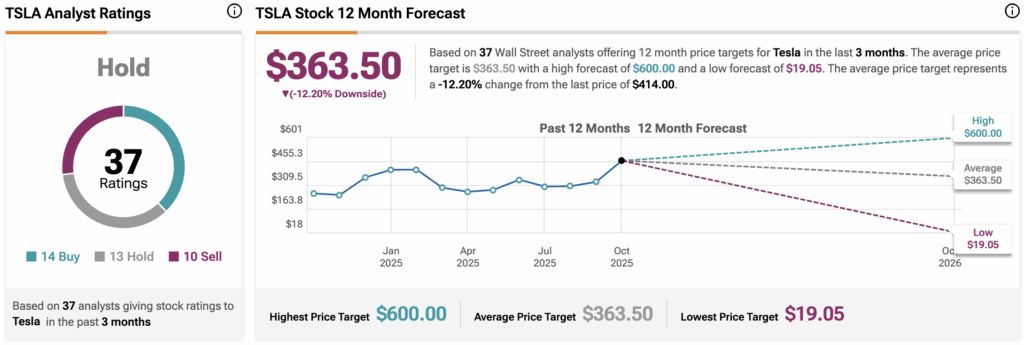

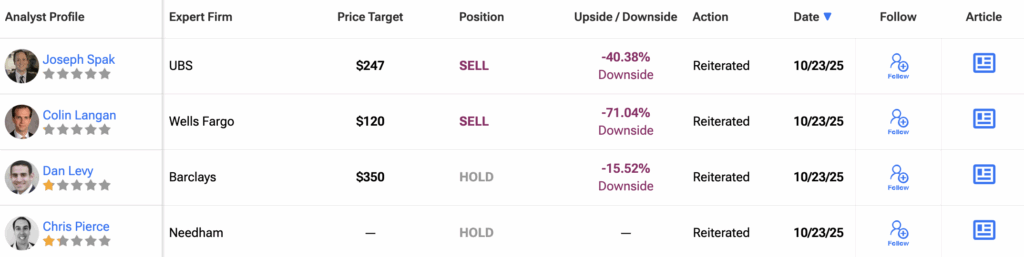

Turning to Wall Street, TSLA stock has a Hold consensus rating based on 14 Buys, 13 Holds, and 10 Sells assigned in the last three months. The average 12-month Tesla price target is $363.50, implying a 12.20% downside potential.

Analyst ratings are likely to change post the earnings call.

1