There has been an odd new complaint coming out of late about electric vehicle giant Tesla (TSLA) and its car line: its door handles. While the complaints have been oddly valid—in some cases they can prevent someone from exiting a vehicle in an emergency—it is still strange that a door handle would prompt this level of concern. The news was apparently enough to balk investors, though, as Tesla shares dropped over 2% in Monday afternoon’s trading.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The retractable door handles that Tesla made popular have since spread to other carmakers. But there are signs that these door handles simply may not be allowed much longer by law in several of Tesla’s biggest markets. New draft rules from the Chinese Ministry of Industry and Information Technology say that all door handles must now come with a mechanical emergency release. This includes interior and exterior handles.

The draft rules go live January 1, 2027, reports note. So regardless of how Tesla feels about the matter, mechanical door handles will be required. There are even some reports saying that the United States is looking at similar rules.

The Story of Las Vegas’ Free Cybertruck Fleet

November was a big month for Las Vegas, which used to be known for free goodies. Now, Las Vegas got some freebies of its own, as donors handed out 10 Cybertrucks to the Las Vegas police department. Reports noted that the fleet was supplied by “…an anonymous supporter.”

Reports also suggested that the supporter in question supplied the entire 10 Cybertruck fleet single-handedly, which was an even bigger surprise. The series of surprises was capped off by the revelation of who the supporter actually was: Ben Horowitz, co-founder of Andreessen Horowitz.

Is Tesla a Buy, Hold or Sell?

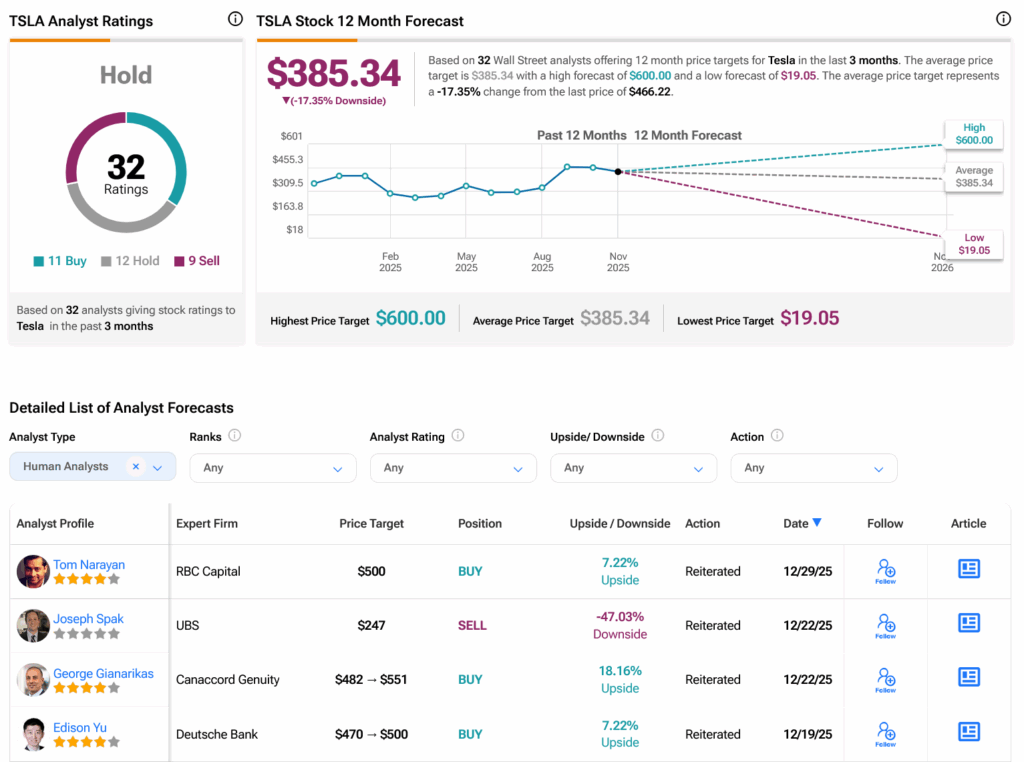

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 11 Buys, 12 Holds, and nine Sells assigned in the past three months, as indicated by the graphic below. After a 13.84% rally in its share price over the past year, the average TSLA price target of $385.34 per share implies 17.35% downside risk.