Electric vehicle giant Tesla (TSLA) has an ambitious schedule afoot for 2026. With some referring to it as Tesla’s “Prove-It Year,” it has plans to roll out everything from robotics to Roadsters. And as more information emerges about 2025, we discover just how vital those plans really are. Tesla’s Cybertruck is not selling well. This left investors cautiously optimistic, as Tesla shares gained fractionally in Tuesday afternoon’s trading.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The numbers that emerged are troubling. Cox Automotive data says that Tesla sold just 20,237 Cybertrucks in the United States in all of 2025. That is about half of what Tesla sold back in 2024, and the numbers only got worse the farther they went. The fourth quarter of 2025 saw sales drop 68%. And given that Elon Musk was out to sell over 10 times that number at 250,000 a year, it is clear the Cybertruck is not the sales powerhouse some had hoped for.

While there were plenty of reservations for the Cybertruck, they did not pan out into sales. It did not help that the original price for a Cybertruck was supposed to be $40,000, but ballooned to nearly double that before launch. Throw in 10 different recalls in two years—including one nightmarish possibility of an accelerator pedal that could get stuck at full—and the strange-looking, occasionally dangerous almost-pickup just did not work.

Who Can Dethrone Tesla?

Thus, some are looking to who could ultimately take Tesla’s place in the market. Some companies are clear possibilities. Other electric vehicle makers might qualify, like XPeng (XPEV) or even Ford (F), who recently rolled out plans for electric vehicles with the least expensive motors around.

But one report suggests the real Tesla dethroner is none other than Nvidia (NVDA). The launch of Alpamayo represents a significant threat to Tesla’s Full Self-Driving (FSD) concept. It has the potential, reports note, to become the Android to Tesla’s iOS. If businesses are willing to license Alpamayo over FSD, then Nvidia could indeed become a Tesla-killer, on at least one front.

Is Tesla a Buy, Hold or Sell?

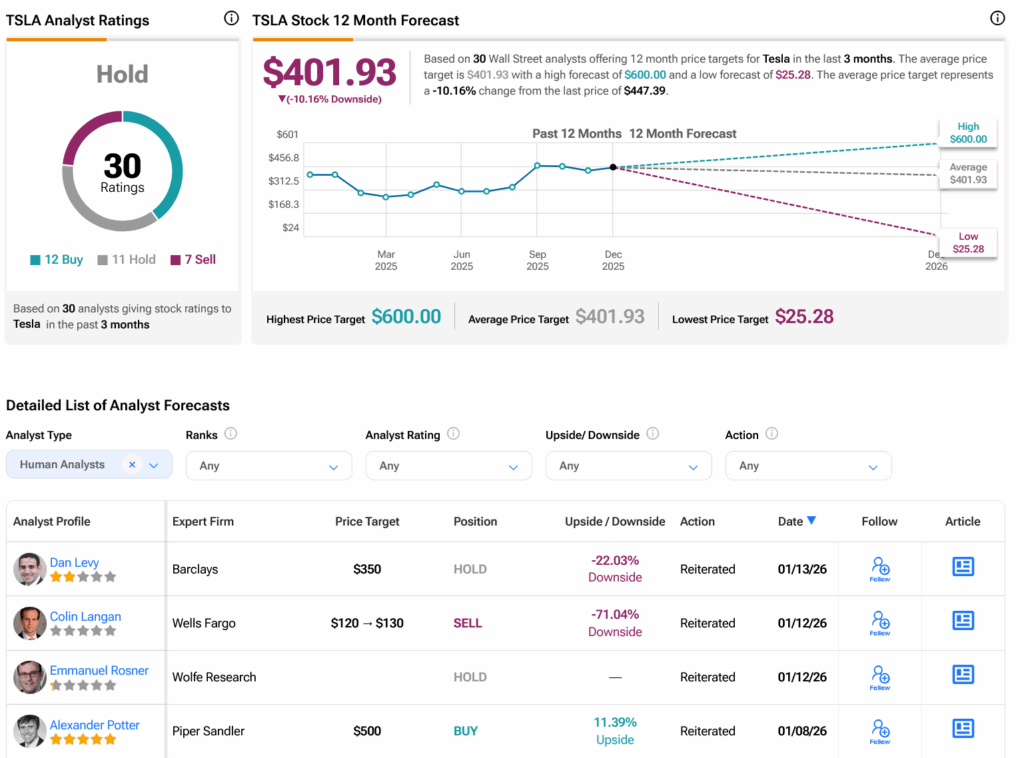

Turning to Wall Street, analysts have a Hold consensus rating on TSLA stock based on 12 Buys, 11 Holds, and seven Sells assigned in the past three months, as indicated by the graphic below. After a 13.27% rally in its share price over the past year, the average TSLA price target of $401.93 per share implies 10.16% downside risk.